Natural gas-fired power generation in Europe declined 16% year/year during the first half of 2024, driven partly by a sluggish recovery in industrial demand across the continent, according to the European Union (EU) energy watchdog.

Gas-fired power generation also declined amid mild weather, stronger renewable output and household energy efficiency, according to the EU Agency for the Cooperation of Energy Regulators (Acer). Overall, natural gas demand has fallen since Russia invaded Ukraine in 2022, cut off exports to the continent and sent prices soaring.

Supplies have steadily recovered and storage inventories are filling fast. Acer said in its latest quarterly market monitoring review that both LNG and pipeline supplies are stable.

As demand has declined, however, liquefied natural gas imports fell 11% year/year between January and June.

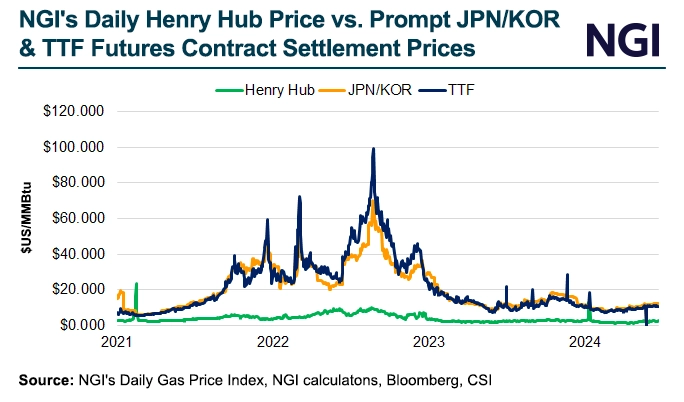

Prices have continued to moderate as well since record highs of 2022 when the war broke out in Ukraine. The Dutch Title Transfer Facility fell 33% during the first half of the year, compared with the same time in 2023.

Acer warned that the market would remain fragile and face a number of challenges moving forward.

Among them would be the transit contract that allows Russia to move natural gas supplies to Europe through Ukraine. It is expected to expire at the end of this year and “renewal is unlikely,” Acer said.

[Check out a Special Edition of NGI's Daily Gas Price Index, 'Ports Unknown,' to delve into the price impacts of new LNG supplies, and where those supplies will be needed most later this decade and beyond. Download now.]

“Landlocked Central European countries will need alternative supply routes, making cross-border trade essential for affordable gas,” the agency said.

Rystad Energy released an analysis earlier this month that estimated 7.2 billion cubic meters, or about 254 Bcf, of natural gas would be needed to replace Russian supplies currently transiting Ukraine.

Acer also warned that the Atlantic Hurricane season, which stretches from June until November, could also continue disrupting global LNG supplies. Former Hurricane Beryl made landfall earlier this month and knocked Freeport LNG Development LP offline, which is slowly ramping back up.

Acer said any delays finishing scheduled maintenance offshore Norway and excess storage withdrawals could “threaten the market balance” heading into the winter, as well.

The agency noted, however, that a series of liquefaction projects under development across the world, particularly in the United States, are expected to start coming online next year. The U.S. is Europe’s top LNG supplier, accounting for about 40% of the continent’s imports. More supplies would likely further stabilize the global gas market, Acer said.