At the halfway point for 2024, U.S. natural gas demand is pacing for another record year, driven by increased demand from the power sector amid record-breaking weather trends, according to the American Gas Association (AGA).

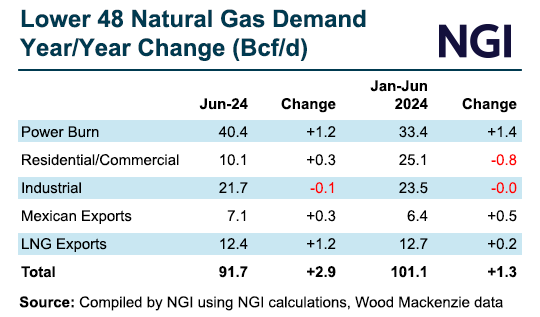

Lower 48 natural gas demand rose by 1.3 Bcf/d to a record average of 101.1 Bcf/d in the first six months of the year, according to Wood Mackenzie data. The figure, which includes exports, was boosted by a 1.4 Bcf/d gain, or 4.3%, to 33.4 Bcf/d in gas-fired power burns, the data show.

“Natural gas demand for electric power is likely going to set another record in 2024 or will be close to the record set in 2023,” said AGA’s Richard Meyer, vice president of Energy Markets, Analysis & Standards, citing similar data.

That growth is being seen in nearly all states across residential, commercial and industrial sectors, Meyer told NGI. “It's a blue state and a red state issue. This is happening even in California, Colorado and Massachusetts, where there's maybe been some focus on policies that might limit or restrict the use of natural gas.”

Gas also has benefited from coal plant retirements, but that tailwind is seen fading in the second half of 2024 as a wave of renewable capacity additions could flatten gas power burn growth this summer, according to analysts at Enverus and Wood Mackenzie.

Meyer is aware of these predictions, which for the past several years have also forecast the peak was imminent for gas-fired generation. “That peak just keeps getting pushed out,” he said.

Accelerating load growth “is new, and I think upsetting some of the other expectations in a lot of these prior forecasts that were made in that kind of old world where we weren't really growing electric power demand,” Meyer said. In addition, the rapid increase in variable renewable generation is calling on gas-fired units as a balancing tool, he said.

New England Gas Need

In its latest market indicators update, AGA said record-breaking heat in the midsection of the country and in the East sent electricity demand surging in late June, straining portions of the electric grid.

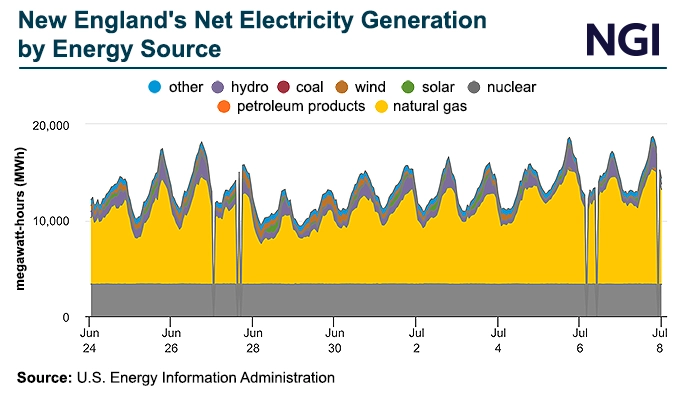

New England saw the biggest year/year surge in power demand of any region, increasing its natural gas consumption to 2.0 Bcf/d from 1.2 Bcf/d, AGA said. The region’s power grid operator issued an alert after power producers were unable to come online during a peak demand time.

Yet even with the retirement of the 1,400 MW gas-fired Mystic Generating Station at the end of May, U.S. Energy Information Administration data showed that natural gas remained the dominant fuel for New England electricity during the heat wave.

“The role of natural gas in terms of meeting New England or even the Northeast’s electricity requirements – that is not yet diminished,” Meyer said.

New England was one of several regions that the North American Electric Reliability Corp. (NERC) said was at risk of potential power shortages during severe heat this summer in its 2024 summer reliability assessment released in May. The others are California, the Southwest, Texas and the Midcontinent Independent System Operator (MISO) region.

The Electricity Reliability Council of Texas (ERCOT) forecast in its monthly outlook for resource adequacy report for August a 16% chance of an electric grid emergency and a 12% chance of rolling blackouts during the month. Those risks are for between 8-9 p.m. CT, when daily loads are typically near their highest levels and solar production is ramping down, ERCOT said.

Citing 2023 data, AGA said coal-fired power plants have suffered more outages than other types of power generation because of their age and increased cycling to support intermittent renewable sources.

“This expected increase in the frequency of outages, as well as scheduled retirements of coal plants in the next several years, could cause natural gas reliance to spike from the need for alternative fuel,” AGA said.