Construction of Sempra Infrastructure’s Energía Costa Azul (ECA) LNG Phase 1 in Mexico has hit a snag due to what the San Diego, CA-based company called labor and productivity challenges.

The 3 million metric tons/year (mmty) export project, which would source U.S. natural gas, would now see the start of commercial operations pushed back from next year to the spring of 2026, management said during a second quarter earnings call on Tuesday. The company said work would be finished next year, when the plant is now expected to produce first liquefied natural gas.

Construction at the project in Ensenada in Mexico’s Baja California is approximately 85% complete. “However, our contractor has experienced labor retention and productivity issues in recent months,” CFO Karen Sedgwick said.

“As a result, our commercial operation date will be delayed until the spring of 2026. We are actively engaged with our contractor to advance the project, and we'll see increased features for the project in the form of additional carrying costs and lower estimated commissioning rent based on forward price curves,” she said.

“Despite the delay and potential changes in capital, we still expect to maintain strong integrated financial returns,” Sedgwick added.

CEO Jeffrey Martin said, “We’re disappointed in the change of schedule at ECA. As has been our practice, where we work with our contractors, we expect our projects to be built on time and on budget. That is the standard and in this case, that standard has not been met. But I'm confident that just this team will get it corrected.”

The CEO said that the cost overruns would add up to about $300 million with the delay.

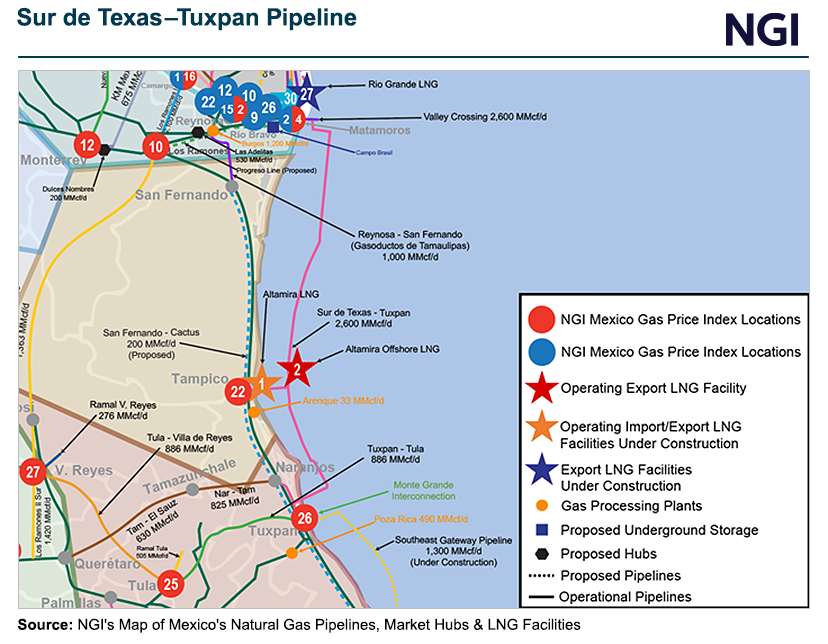

He said the company would continue to “optimize its transport position” with natural gas positions connecting the project to production regions in both Texas and New Mexico. This capacity would allow Sempra “to serve what is increasingly been a constrained market,” Martin said.

In Baja California, natural gas demand has risen 30% in 10 years, Martin said.

Other Projects

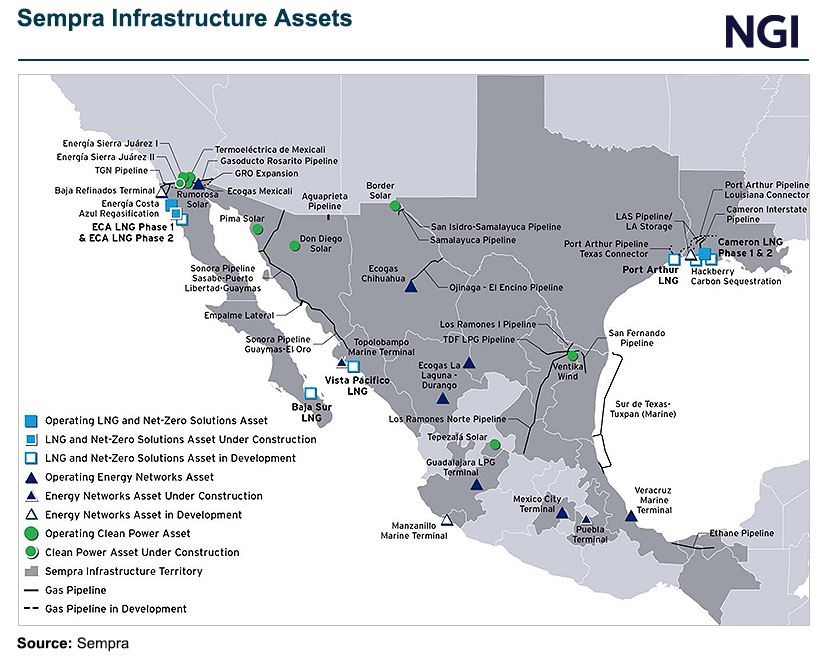

Through its Sempra Infrastructure unit, the company has nearly 40 mmty of LNG export projects under development, including on the U.S. Gulf Coast and Mexico’s Pacific Coast.

Construction of the 13 mmty Port Arthur LNG Phase 1 in South Texas remains both on budget and on schedule. Trains 1 and 2 of Port Arthur LNG Phase 1 would start in 2027 and 2028, respectively.

At Cameron Phase 2, “we continue to work with our partners to enhance capacity through value engineering. Mechanical completion and first LNG are expected to occur in 2025, with timing of commercial operations under the sales and purchase agreements targeted for spring 2026,” management said.

In July, Sempra selected Bechtel Energy as its engineering, procurement and construction (EPC) contractor for Port Arthur Phase 2. The companies signed a fixed price EPC contract.

Bechtel would also conduct the commissioning, start up, performance testing and operator training work for the second phase. The contract also allowed for pre-final investment decision work to help with costs and the schedule.

Bechtel is currently working on the first phase of the project, which was sanctioned last year. State-owned Saudi Arabian Oil Co., better known as Aramco, also is working to finalize an agreement to take a 25% equity stake in the second phase.

In Mexico, Sempra also has plans to expand ECA beyond the initial first phase, and to sanction the Vista Pacifico terminal in partnership with state power utility Comisión Federal de Electricidad.

Sempra reported net income of $713 million ($1.12/share) for the second quarter of 2024, compared with $603 million (95 cents) in 1Q2023.