Mexico’s power demand is growing faster than forecast, and its infrastructure is falling behind, according to analysts at Fitch Ratings.

“Mexico’s energy sector is grappling with the need to enhance energy capacity and dependability,” the analyst team, led by Velia Patricia Valdes Venegas, said.

They cited challenges that included fostering a regulatory environment that encouraged private investment in the electricity industry, particularly in light of preliminary election outcomes.

“Significant investment is required, with private sector participation being crucial for the development of new power stations, ensuring the financial structure of Comisión Federal de Electricidad (CFE),” they said.

Their views echoed those of many in the industry. Last week, the Instituto Mexicano para la Competitividad (IMCO) think tank sounded a similar warning. IMCO researchers broke down the latest Prodesen electricity sector planning document from energy ministry Sener. Sener’s projections for demand growth during the 2024-2038 period are “potentially conservative,” according to the IMCO team.

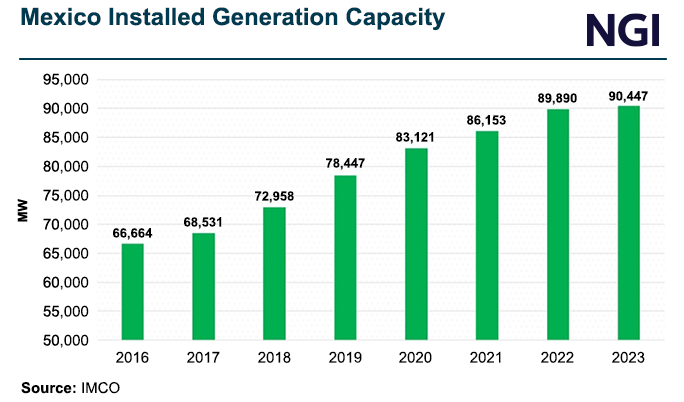

IMCO researchers noted that while last year’s Prodesen forecast average annual demand growth of 2.6% for the 2023-2037 period, Mexico’s actual power demand rose by 3.5% year/year in 2023. The country’s installed generation capacity, meanwhile, only grew by 0.6%.

Fitch analysts also pointed out Mexico’s growing dependence on natural gas. In 2023, gas-generated electricity accounted for 70% of Mexico’s power matrix, while hydro, wind and solar each represented 6%. The remaining 12% was generated by nuclear, carbon and diesel sources.

“The country’s reliance on natural gas for over 60% of its energy installed capacity makes it vulnerable to shortages and fluctuations in natural gas prices” and exchange rates, analysts said.

“Additionally, there is a pressing need to establish infrastructure for the storage and transportation of natural gas, given the country's heavy reliance on imports and the significant proportion of energy generated from this source.

“The expansion and modernization of Mexico's power grid are also imperative to improve the flexibility and stabilization of the electrical system, to accommodate new plants, to increase the mix of energy sources and to allow the entrance of renewable energy projects, while managing the intermittence they introduce to the system,” analysts said.

Wood Mackenzie has Mexico imports from the United States averaging 7.2 Bcf/d so far in June, an all-time high.

System Failure

Throughout early May, Mexico experienced a nationwide heatwave that drove a surge in electricity demand across the country.

The national electricity grid was unable to support the increased demand, leading the power system operator, known as Cenace, to issue critical alerts for inadequate supply on 11 of the first 18 days of the month. The grid’s inability to meet national power needs led to blackouts in 21 of Mexico’s 32 states on May 7.

The natural gas system held up during the heatwave, but a lack of sufficient power generation supply crippled the electric grid.

If Mexico were to continue to delay its development of natural gas storage and energy generation projects, the country could become increasingly vulnerable to further blackouts in the short- and mid-term. This could negatively impact investment opportunities driven by the relocation of companies to the country, known as nearshoring, according to a recent report from ratings agency Moody’s.

Fitch analysts, meanwhile, said they expected Mexico energy demand to continue growing, “given the economic acceleration in Mexico, mainly due to nearshoring, and higher temperatures during the summer.”

“Fitch believes the trend of rising energy demand and insufficient investment strains the system's reserve margin and exposes it to vulnerabilities,” the analysts said.