Global natural gas prices fell on Monday amid broader panic across global financial markets over concerns the U.S. economy is slowing.

European natural gas prices declined 3%, following a selloff in oil and stock markets that started last week. A weak U.S. jobs report, higher unemployment and fears that the Federal Reserve Bank has waited too long to cut interest rates appeared to have spooked the market.

Strong Norwegian LNG exports, which were flowing near capacity at 12 Bcf on Monday, along with milder temperatures across much of continental Europe, pressured prices lower.

Prices in Europe and Asia gained last week, when the prompt Title Transfer Facility (TTF) contract finished 6% higher and the Japan-Korea Marker picked up 8 cents. Geopolitical unrest and hotter weather have supported prices.

Asian prices are about $1 above TTF, incentivizing more liquefied natural gas to flow to the region. The risk of retaliatory strikes against Israel, after it killed Hamas and Hezbollah leaders, still has the market on edge. However, prices weakened after the threat of an imminent attack passed over the weekend.

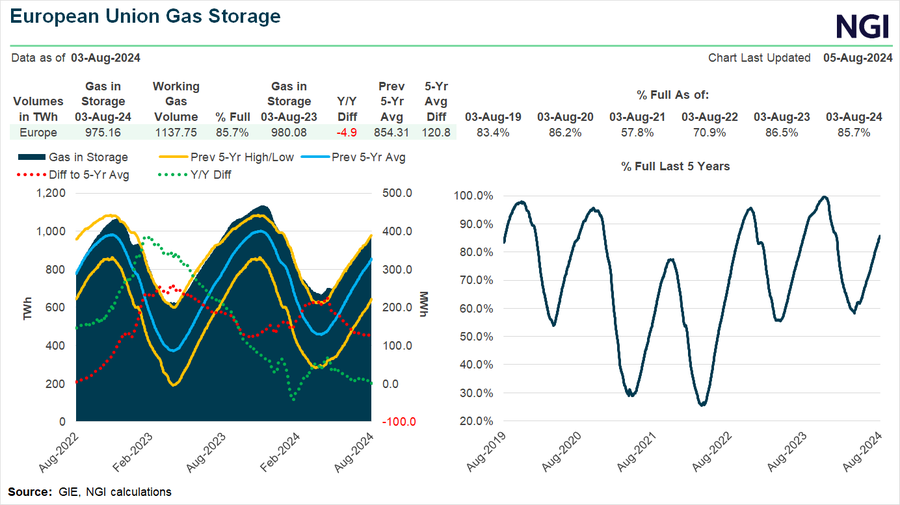

Hot weather was still expected for most of Asia and southern Europe over the next two weeks, according to Maxar’s Weather Desk. European storage inventories are at about 86% of capacity, compared to an average of 77% over the previous five years. Cooling demand in Europe is slowing the pace of storage injections.

Hotter weather also has buyers across Asia in the spot market for LNG cargoes for later this month and next, including those in India, Japan and South Korea, according to Kpler data.

In the United States, natural gas futures declined as a powerful storm barreled into the Southeast cutting into demand. Cooler northern weather also arrived and supplies in storage have held at stout levels.

Hurricane Debby made landfall in western Florida as a Category 1 storm early Monday before it weakened into a tropical storm. It delivered powerful, cooling winds and drenching rains. The heavy rains were forecast to affect Georgia and the Carolinas as well, according to the National Hurricane Center (NHC).

Feed gas deliveries to the Elba Island LNG export terminal in Georgia were unscathed Monday at about 351 MMcf, filling roughly 89% of the pipeline capacity serving the facility, according to NGI data.

“We continue to monitor the storm’s progress and have implemented our hurricane preparedness plans,” an Elba spokesperson told NGI Monday afternoon. “At this point, our Elba terminal remains operational, and our facilities are manned and secured.”

Prices were under pressure most of July and into the start of August because of strong production and robust amounts of gas in storage.

Wood Mackenzie on Monday pegged U.S. gas production at 102.6 Bcf/d, in line with the prior seven-day average and up from spring lows in the 90s Bcf/d.

Meanwhile, feed gas deliveries to U.S. LNG export terminals were at 12.5 Bcf on Monday, in line with levels over the last week.

Elsewhere in the United States, Cheniere Energy Inc. said Monday it signed a deal to supply Galp Energia SGPS SA with 0.5 million metric tons/year of LNG for a 20-year term at prices linked to Henry Hub. Cheniere’s deal with the Portuguese company is expected to start in the early 2030s if it sanctions a planned expansion at its Sabine Pass LNG terminal in Louisiana.

Farther north, LNG Canada said last week that a cargo of refrigerants was expected to arrive at its site in British Columbia as the project moves ahead with start-up activities. The cargo is expected to arrive early this month to help cool natural gas delivered to the facility.

Once operational, LNG Canada would produce its refrigerants. The first phase of the Shell plc-led project is still on track to start shipping LNG cargoes by the middle of next year.

In other news as the week got underway, Venture Global LNG Inc. has sued construction contractor Kiewit Corp. for allegedly sharing confidential documents about the Calcasieu Pass LNG terminal being commissioned in Louisiana with Shell.

The documents included design and other detailed information about the facility, Venture Global said in a filing with the New York Supreme Court.

Calcasieu Pass has been selling LNG into the spot market for more than two years. Management has argued that it doesn’t need to supply contracted customers with volumes until the facility enters commercial operations.

Equipment issues, Venture Global has said, have prolonged commissioning. The extended start up has prompted regulatory fights and arbitration proceedings. Federal regulators in June ordered Venture Global to provide its customers with more information about the equipment issues and its start-up process at Calcasieu Pass.