Italy’s Eni SpA, one of Mexico’s leading private sector producers, has found more oil and associated natural gas in shallow waters offshore Mexico.

The Yopaat-1 EXP exploration well in Block 9 of the Cuenca Salina in the Sureste Basin could hold 300-400 million boe, the company said.

Eni is the operator on Block 9 with a 50% interest, and Spain’s Repsol SA holds the remaining 50%.

The find adds to a series of Mexico offshore successes for the Italian company.

Eni is currently producing 26,000 boe/d from the Area 1 phased development project, which is expected to be completed by 2025. In 2022, a floating production, storage and offloading vessel arrived offshore Tabasco, allowing for production to ramp up in the development. Output could hit 100,000 boe/d.

Eni has been working in Mexico since 2006. Currently, the firm holds rights in eight exploration and production blocks, six as the operator. All are in the Sureste Basin in the Gulf of Mexico.

Despite discoveries by privately led firms, Mexico’s natural gas production remains firmly led by state oil company Petróleos Mexicanos (Pemex).

Pemex produced 3.65 Bcf/d, or 95% of total gas output in May, with private sector operators accounting for the remainder, according to upstream regulator Comisión Nacional de Hidrocarburos (CNH).

It is unclear whether the private sector could play a greater role under the upcoming administration of President-Elect Claudia Sheinbaum.

Congressman-elect Alfonso Ramírez Cuellar indicated recently that new bid rounds and public-private joint ventures in the oil and gas sector could resume under Sheinbaum.

Rising Investment, Prices

The news from Eni comes with optimism on the rise among oil and natural gas executives. New research by risk management consultancy DNV showed that the mood in the industry was the most upbeat since 2018.

The firm’s latest Energy Industry Insights survey found that 68% of respondents have a positive outlook for the year ahead.

“Worldwide capital investments in oil and gas exploration and production rose by 11% in 2023 and are projected to climb an additional 5% in 2024,” DNV researchers said, citing Evercore ISI projections.

The International Energy Agency (IEA) also said recently that global investment in fossil fuels this year should rise for a fourth straight year.

Natural gas prices are also poised for an uptick after over a year of bearish sentiment.

In the July release of the U.S. Energy Information Administration’s Short-Term Energy Outlook Henry Hub natural gas spot prices are projected to average of $2.90/MMBtu for the final six months of 2024, up 80.0 cents from the first half of the year.

Energy executives in Texas are also forecasting Henry Hub prices will rise this year, according to the Federal Reserve Bank of Dallas. Meanwhile, the executives see Henry Hub averaging $3.58 in two years and $4.28 in five years.

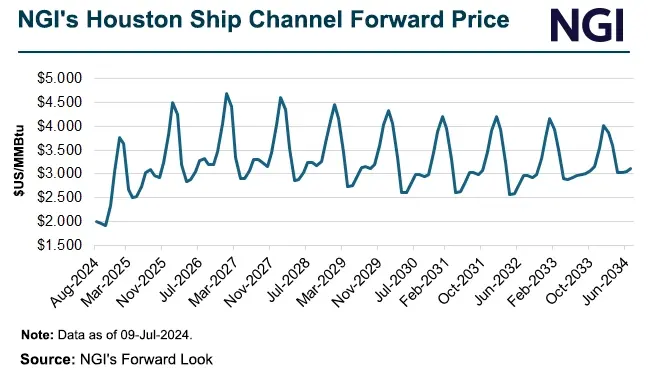

NGI’s Forward Look has Houston Ship Channel (HSC) prices rising to $4.497 in January 2026 as demand from export projects ramps up. HSC is a key benchmark for many Mexico natural gas contracts.