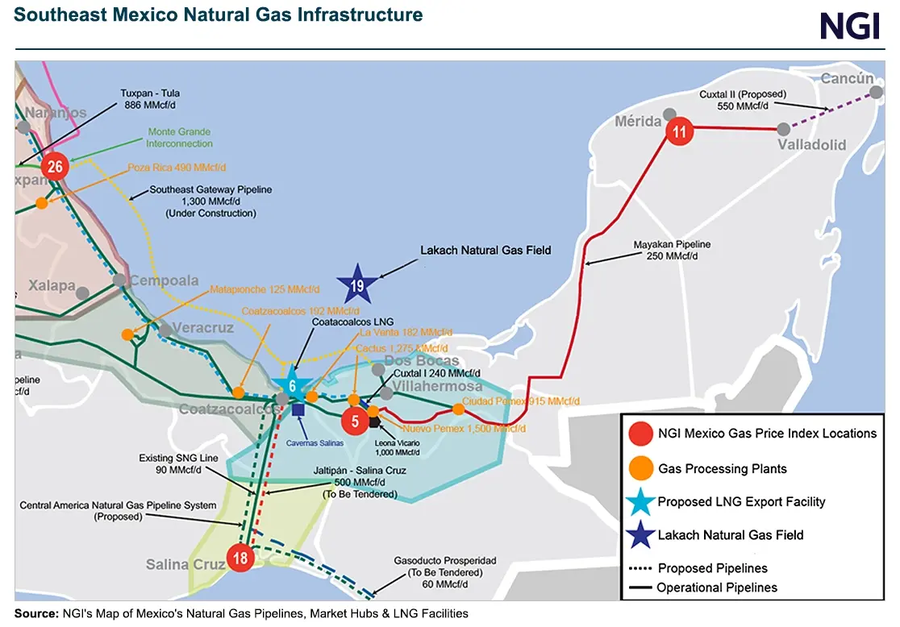

Mexico’s Grupo Carso, SAB de CV, a conglomerate owned by billionaire Carlos Slim, signed a services contract with state oil company Petróleos Mexicanos (Pemex) to help develop the Lakach deepwater natural gas field off Mexico’s southeastern coast.

First gas production from Lakach is expected in about two-and-a-half years, Grupo Carso said in a filing to the Mexican stock exchange.

Under the integrated exploration and extraction services contract, known by the Spanish initials CSIEE, Grupo Carso plans to invest about $1.2 billion in the project, which would supply natural gas to Mexico’s internal market. Grupo Carso would be responsible for building an onshore gas treatment plant.

Other strategic partners in the project include Houston-based oil and gas producer Talos Energy, as well as FCC Construcción, a Mexico-based civil engineering and construction firm.

Pemex had previously planned to develop Lakach in partnership with New Fortress Energy Inc., in an arrangement that would have included a floating LNG export platform. The latest announcement by Grupo Carso makes no mention of liquefied natural gas.

Grupo Carso has been steadily expanding its investments in Mexico’s upstream and midstream oil and gas segments.

The company last month finalized its $530 million acquisition of PetroBal Operaciones Upstream, SA de CV, which holds a 50% stake in the Ichalkil and Pokoch offshore oil and gas fields.

Last September, Grupo Carso completed its acquisition of a 49.9% stake in Talos’ Mexico subsidiary, which discovered the Zama offshore oil deposit in 2017. Mexico’s energy ministry subsequently revoked operatorship of Zama from Talos and awarded it to Pemex.

Grupo Carso also is developing a roughly 280-mile natural gas pipeline in partnership with CFE in Sonora and Baja California states. The pipeline would link Grupo Carso’s existing 472 MMcf/d Samalayuca-Sásabe pipeline and Sempra’s 700 MMcf/d Sásabe-Guaymas pipeline. CFE is Mexico’s primary importer and marketer of U.S. natural gas, which supplies about 72% of Mexico’s internal needs.

The Lakach announcement comes amid stagnating natural gas production in Mexico. Nationwide output averaged 3.85 Bcf/d in May, down 11% year/year. The onshore Ixachi and Quesqui gas fields have partially offset a steep decline in associated gas production from Pemex’s legacy shallow water oil fields.

Outgoing president Andrés Manuel López Obrador in 2018 halted bid rounds, farmout tenders, and service contract modifications, all of which would have allowed private sector firms to develop oil and gas assets and shore up production.

It remains unclear whether his successor and ally, Claudia Sheinbaum, will revive any of these mechanisms.

Congressman-elect Alfonso Ramírez Cuellar, part of Sheinbaum’s inner circle, indicated in recent comments to the Mexican press that new bid rounds and public-private joint ventures in the oil and gas sector could resume under Sheinbaum.