Natural gas forward basis prices slumped during the July 25-31 trading period, weighed down by a cooling August forecast, robust production and stubbornly high storage inventories. September basis dropped by an average 7.5 cents through the period, with the western United States leading the declines, according to NGI’s Forward Look.

Recent weather model runs have trimmed the number of cooling degrees days (CDD) from the long-term outlooks thanks to cooler weather moving into the Midwest. NatGasWeather said weather systems were expected to send temperatures there falling back to the 70s and 80s, which is near normal for this time of year.

Until then, scorching temperatures were set to continue through the early part of August. The National Weather Service (NWS) said high temperatures in the West could soar as much as 20 degrees above normal in the coming days. Highs may reach the upper 90s and low 100s for the inland Pacific Northwest/northern Great Basin and into the mid- to upper 90s for the northern Rockies/High Plains.

“Temperatures will get even hotter on Friday, with highs into the low to mid-100s for most locations,” NWS forecasters said. “Many near record-tying/breaking highs are possible.”

Meanwhile, California continued to battle the Park Fire that has scorched more than 391,000 acres in the northern part of the state. The fire began July 24 and is now the fifth-largest in state history, according to the California Department of Forestry and Fire Protection.

Other wildfires were raging across Colorado, Idaho and Oregon, as well as Western Canada.

AccuWeather noted, however, that relief is likely on the way. The Pacific Northwest could see an early arrival of fall-like weather, including some early-season storms. The arrival of cooler, wetter weather may help to put an early end to the short but intense wildfire season across parts of the Northwest, forecasters said.

The potential cooldown led to stout basis decreases across the front of the forward curve. Malin September basis plunged 28.7 cents from July 25-31, according to Forward Look. Further out, fixed prices for the balance of summer (September-October) picked up 4.0 cents to reach $1.882. The winter 2024/2025 strip lost 8.2 cents to hit $4.828.

Basis prices also were weak at the PG&E Citygate. Fixed prices, though, managed some gains as a result of planned maintenance scheduled this month in the region. Pacific Gas & Electric Corp. was set to conduct maintenance to its Redwood path through Aug. 12. The work would limit southbound flows from Oregon to San Francisco to 1.81 Bcf/d from 2.2 Bcf/d.

Prices in Southern California, meanwhile, were down across the board. SoCal Citygate September basis tumbled 64.3 cents through the period. Fixed prices also were lower, with the balance of summer shedding 11.3 cent to $2.545 and the prompt winter losing 7.5 cents to $5.568.

Storage Dragging On Prices

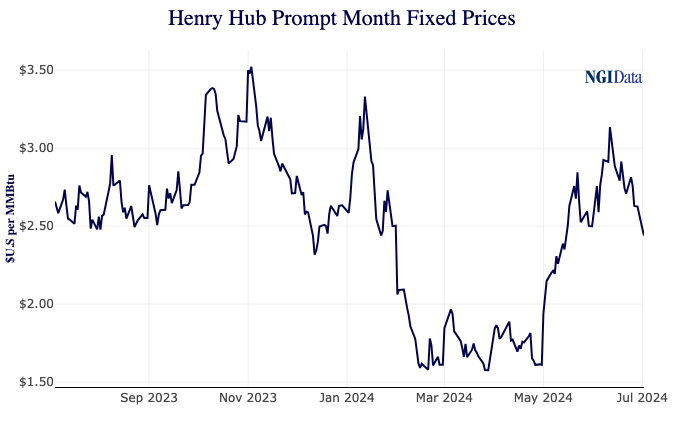

The weakness in the West compared bearishly with benchmark Henry Hub forward prices, which fell only a few pennies at the front of the curve to $2.040, Forward Look showed. Henry Hub balance of summer prices were down 3.1 cents to $2.103, while the upcoming winter gained less than a penny to reach $3.128.

NatGasWeather noted that several parts of the country could still see above-average temperatures late in August, which likely kept Henry Hub prices in check through the period. However, it’s normal for the number of CDDs to fade as the days become noticeably shorter. This means the rate at which storage surpluses decline could slow through the second half of August, according to the forecaster.

“That could be a problem,” NatGasWeather said. The natural gas markets “have become quite frustrated over the past one to two months that one of the hottest summers on record is failing to decrease surpluses as fast as what would normally be expected.”

The U.S. Energy Information Administration’s (EIA) latest data offered some support. EIA said stocks for the week ending July 26 rose by 18 Bcf, which shrunk the surplus to the five-year average by 15 Bcf.

The EIA report compared bullishly with analyst expectations ahead of the weekly inventory report. Estimates ranged widely from a 22 Bcf injection to as much as 45 Bcf. NGI modeled a 29 Bcf increase.

The modest injection compares with the year-ago 15 Bcf build and the 33 Bcf five-year average increase.

Wood Mackenzie analyst Eric McGuire said, similar to the bullish miss for the EIA report covering the week ending July 12, the latest miss could be attributed to a large decline in wind generation. The impact of these declines were not fully captured in gas nominations to power plants or storage facilities, according to McGuire.

“Our power generation-based model forecasted a 15 Bcf injection for this week and a 7 Bcf injection for storage week ending July 12,” he said. “Wind generation has rebounded for the current week. If wind is the driving factor, there is less risk of it presenting such a large bullish surprise in next week’s report.”

Broken down by region, the South Central region reported a 10 Bcf withdrawal from stocks, according to EIA. This included a 6 Bcf decline in nonsalt facilities and a 3 Bcf draw from salts. The Midwest led all injections with 15 Bcf added to stocks. East inventories increased by 14 Bcf. The Pacific and Mountain regions each added less than 5 Bcf. However, storage levels in the Mountain region are around 45% above the five-year average.

Total working gas in storage stood July 26 at 3,249 Bcf, which is 252 Bcf above last year and 441 Bcf above the five-year average, EIA said.

To Curtail Or Not Curtail?

With storage inventories remaining stubbornly lofty, the question of whether producers may initiate curtailments this fall has resurfaced after exploration and companies responded to low prices this spring.

So far, the message is mixed.

Chesapeake Energy Corp., active in the Haynesville Shale and Appalachia Basin, said Tuesday it would continue to curb output until prices improve. Management, though, touted the company’s flexibility to bring as much as 1 Bcf/d of spare production online as prices increase.

However, a look at forward prices at Eastern Gas South – a key Appalachian benchmark – shows prices remaining well below $2.50 even through the winter season.

Range Resources Corp. executives said they planned to hold production steady through the end of the year, but noted the company could “adapt to near-term commodity prices and resulting economics.” The company operates primarily in the Marcellus Shale.

EQT Corp., the largest natural gas producer in the United States, said it would continue to curtail Appalachian volumes to combat the hefty storage levels in the region. EQT began curtailing about 1 Bcf/d in late February, or around 180 Bcfe. Through the second half of this year, EQT expects to hold back an average of 90 Bcfe, or around 500 MMcf/d.

“At a high level, producer willingness to shut in supply helps strengthen a soft floor under Nymex prices that, all else equal, biases market risks higher,” said EBW Analytics Group’s Eli Rubin, senior analyst. “Still, the market will remain dependent on low prices to narrow a North American storage surplus” that remains well above the five-year average.

To that end, Rubin pointed out that plunging natural gas prices have stimulated an incremental 2.0 Bcf/d of price-driven coal-to-gas switching since late June. Should prices rise, though, fundamentals could slacken rapidly, maintaining the centrality of the storage surplus in weighing upon the natural gas market.

LNG To The Rescue!

It’s not all doom and gloom for the natural gas market, however.

[Actionable Insight: NGI is one of only two Price Reporting Agencies that include trade data from the Intercontinental Exchange. Explore our data services.]

LNG demand has recovered after the Freeport liquefied natural gas facility returned all three trains to service following Hurricane Beryl. What’s more, new LNG terminals are expected to come online later this year and into 2025.

Plaquemines LNG in Louisiana appeared to be gaining momentum and could see feed gas introduced at the 2 Bcf/d facility by year’s end. Cheniere Energy Inc.’s Corpus Christi Stage 3 expansion project also was on track to produce first LNG by the end of this year. The third stage includes seven trains and would add 10 million metric tons/year (mmty) of capacity to the existing 15 mmty facility in South Texas.

Meanwhile, construction on the Texas coast at Golden Pass LNG is underway again following a settlement in July with its primary contractors, including Zachry Industrial Inc. Zachry had filed for bankruptcy in May. In June, Golden Pass estimated the first train was 83% complete and, with a full workforce, it could be ready by mid-2025.

Each of the three trains at Golden Pass could add around 700 MMcf/d in feed gas demand, according to NGI calculations.

“By 2025, total LNG sendout capacity could potentially reach over 6.6 Bcf/d with Plaquamines, Corpus Christi Stage 3 and Golden Pass coming online,” NGI senior energy analyst Josten Mavez said. “That’s not including both the Port Arther and Rio Grande projects, which would add an additional 4.1 Bcf/d.”