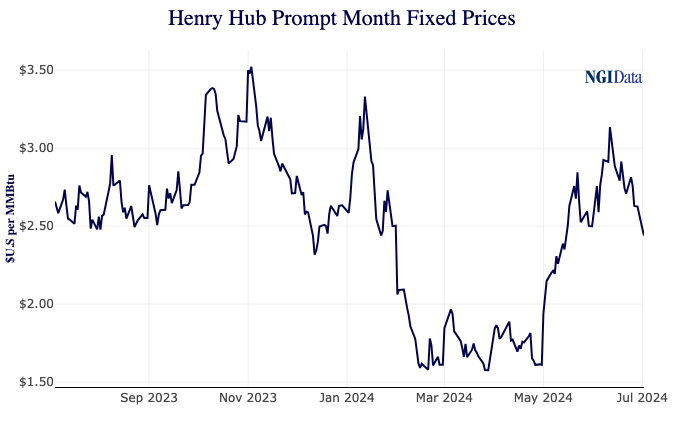

Modest and directionally mixed forward prices during the July 18-24 trading period hinted at impending strength in natural gas markets amidst ongoing supply concerns and changing weather patterns.

August forward prices averaged about 1.54 cents higher through the period, supported by large gains in the heat-baked California region. PG&E Citygate led the advance, adding 18.2 cents at the front of the curve, NGI’s Forward Look data showed.

Prices at PG&E Citygate further out the forward curve were mixed. The balance of summer (August-October) was up 15.8 cents to $3.379/MMBtu, while winter 2024-2025 dipped a scant 2.4 cents to $5.627.

Elsewhere in the region, August prices averaged $3.133 at SoCal Citygate on Wednesday, up 8.2 cents. Further out the curve, the balance of summer fell 2.5 cents to $2.839. Winter tumbled 14.6 cents to $5.689.

California’s unrelenting hot weather has driven demand for power generation and supported natural gas prices. Temperatures fluctuated briefly between sweltering and near normal in other parts of the country, but forecasts showed intense heat returning.

The National Weather Service long-range forecast showed widespread excessive heat over much of the country into early August.

EBW Analytics Group senior analyst Eli Rubin said blistering August heat may reset power burns. That in turn could result in the smallest recorded monthly July natural gas storage injection, followed by the smallest August injection into storage.

Stubbornly high natural gas inventories remain a concern for the market, reflected in the decision by EQT Corp., the largest natural gas producer in the United States, to curtail production through 2024. EQT anticipates 90 Bcfe of curtailments in the second half of the year.

Only moderate shut ins are likely after the heating season arrives to lift regional demand in November-December. Curtailed volumes are likely to reach or exceed 1.25-1.75 Bcf/d in September and early October from EQT alone, Rubin said. “Still, we caution that strategic production curtailments in a soft environment help defend against overbearing weakness more than an overtly bullish market development.”

Meanwhile, a boost in demand from liquefied natural gas exports and pipeline startups, including Equitrans Midstream Corp.-sponsored Mountain Valley Pipeline LLC, may offer support. Transcontinental Gas Pipe Line Co. LLC’s Regional Energy Access expansion and Matterhorn Express Pipeline in-service dates also are looming.

Rubin said a small storage build could be on tap in August because of the blistering heat, which could “ignite” a speculator short-covering rally. He said if storage containment concerns could be abated, natural gas prices had room to move higher.