There is a growing movement of organizations working to improve financial inclusion for refugees and Kiva and its partners have been leading the charge since 2016. With six years of data and over 30,000 loans behind us, we believe that the notion that refugees are a riskier group to lend to is largely based on myths.

UNHCR estimates that global forced displacement reached 103 million as of mid-2022—over one percent of the total global population. Of this, 32.5 million are refugees and 53.2 million are internally displaced people (IDPs). While not a homogenous group, refugees often face distinct financial needs and challenges. In the initial stages of their displacement, they may require immediate support to help them access food, shelter, and medical care. As these basic needs are stabilized, displaced people need more sustainable solutions to support their economic independence. Many refugees decide to open businesses in their new countries, often due to a lack of other available career options, and access to financial services can help them get the capital they need to get started. However, despite their need for financial access and the fact that the majority of refugee populations appear to be as eligible for access to financial services as any other market segment, financial service providers (FSPs) have largely overlooked refugees as a viable market.

A report by UNHCR and SPTF suggests there are three key reasons for this financial exclusion:

Reputational risk: Societal fears, prejudices, or stereotypes reflected in public policy and media cause FSPs to be concerned about their reputation.

Legal barriers: In addition to several barriers to financial inclusion that refugees share with poor citizens, refugees often face uncertain legal status, limited rights to work or to move, and inadequate identification papers and documentation of residence.

Ignorance: Lack of information, contact, and attention, or misinformation about refugees fuel the perception of refugees as high-risk clients who represent a “flight risk.”

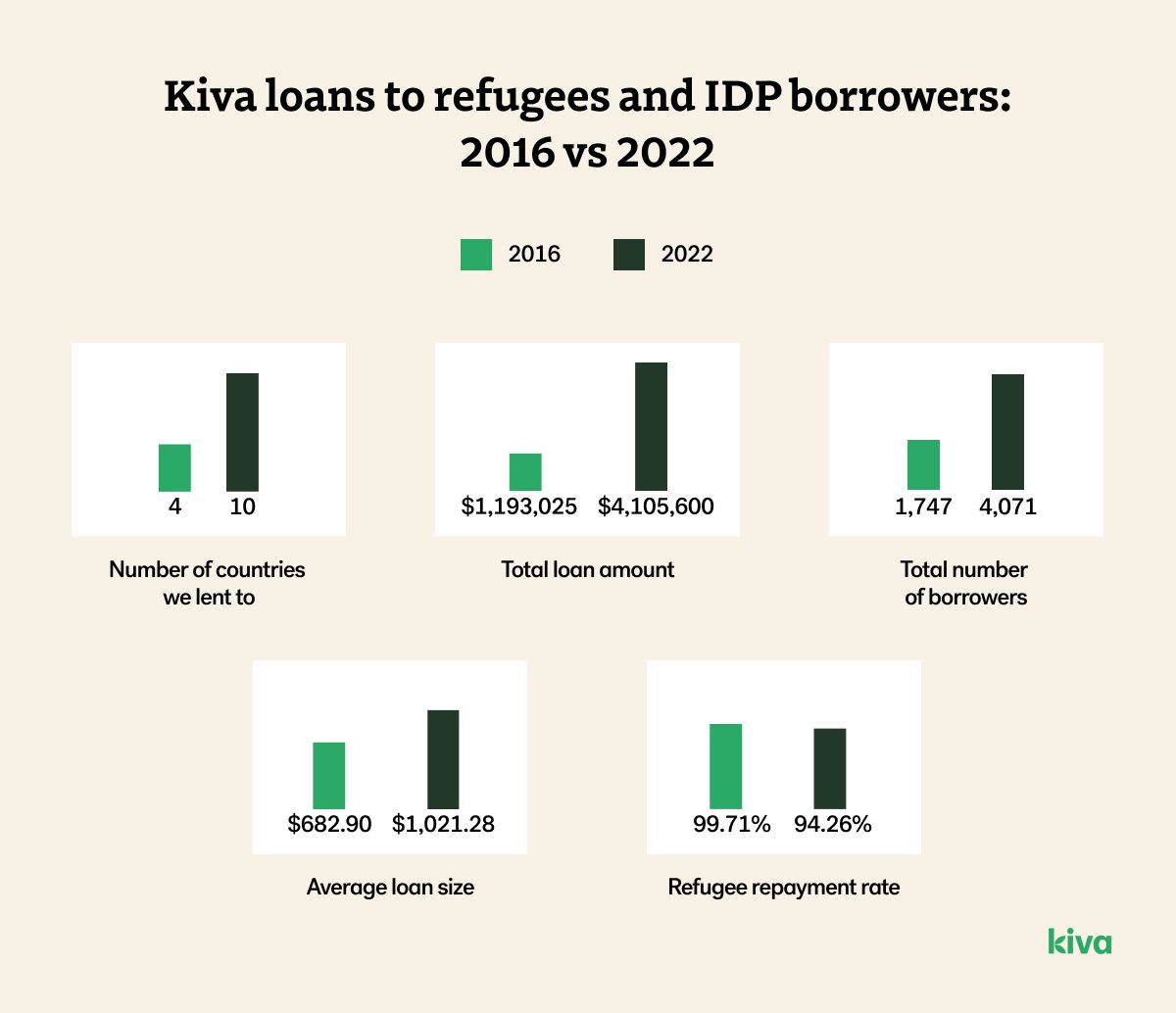

Kiva and its partners have been working to change this perception and improve financial inclusion for refugees since 2016. That year, with the support of our lenders and Lending Partners, we were able to lend to 1,762 refugees and IDPs, across four countries.

The program was so successful that by the end of 2022, we had scaled to lend to over 30,000 refugees and IDPs in 22 host countries. Kiva is now one of the biggest funders for this market across the globe, through not only our crowdfunded, individual loans, but also larger loans direct to social enterprises working with refugees, and institutional investment via Kiva Capital, our impact-first asset manager.

Here we share some of what we have learned through lending to refugees.

Refugee repayment rates are comparable to those of non-refugee clients

In 2016, of the 466 clients we lent to who were refugees, our data showed a 99.71 percent repayment rate — far exceeding the expectations of those who believe that refugees represent a riskier market segment.

With this indication that refugees were just as creditworthy as non-refugee microfinance clients, we grew our lending to refugees 5 times over in 2017, and continued to see repayment rates of over 99 percent.

Between 2016 and 2022, the average repayment rate of refugee clients has been 97.2 percent, almost identical to the average repayment rate across Kiva loans to non-refugee clients.

As they are successful in integrating with local economies, refugees often grow their capacity to take on additional loans, and we often see borrowers coming back for a second loan.

We have comfortably increased our average loan size to refugees and IDPs by 71 percent from 2016 to 2022 ($682.90 vs $1,168.17). This increase in loan size has not affected repayment rates.

For Saffa, a refugee who fled Syria for Turkey, there was never a question of settling her Kiva loans as she grew her business.

“Debts should be paid,” she says. “I repay it with thanks.”

Most refugees do not present a ‘flight risk’

FSPs often mention a concern of ‘flight risk’ when it comes to considering refugees as a potential target market. But this isn’t supported by Kiva repayment data, nor by data from others who have researched the market.

In fact, refugees are less transitory than most people imagine, and they do not usually plan to go back to their home countries. A market study which assessed refugees' financial needs in Jordan and Uganda found that the vast majority of respondents did not have any plans, even vague ones, to return to their countries or to relocate to another country. Between 2014 and the end of April 2018, only five percent of the registered refugee population in Jordan and one percent in Uganda had resettled in another country.

A study by UNHCR and SPTF found that resettlements are also rare within countries, but when they do occur, they are first and foremost associated with economic opportunities — refugees will consider moving if their current location doesn’t offer opportunities that allow them to fulfill their financial needs and support their families.

The study in Jordan and Uganda echoed this, finding that refugees’ aspirations were more related to gaining economic independence than to moving on to a new location. In Jordan, it found that most refugees prefer to start their own business rather than seek employment in the limited available sectors for non-Jordanians. In Uganda, 78 percent of respondents had plans to start or develop their own businesses, and 60 percent had already taken the first steps towards doing so.

Mbazimutima and Beata, a couple who escaped from the Democratic Republic of Congo (DRC) to Nakivale, had such aspirations to start their own business in their new home. Arriving in Uganda with almost nothing, Mbazimutima and Beata quickly began looking for opportunities to support themselves beyond the aid programs administered by the UN and other organizations.

“When I got here, I started to hustle for ways to start a business so that I could sustain myself,” recalls Mbazimutima.

They used their first loan to buy a motorized scooter to transport water throughout the settlement. They were soon selling a thousand jerry cans of water a day, which enabled them to repay their loan and secure another to expand their shop and buy more stock to serve the growing community. They plan to keep expanding the venture to help the people of Nakivale.

“I… plan to buy more stock and have a store that sells groceries because that’s what is really needed in this community,” says Mbazimutima.

Experience and research can help other funders take the leap to lend to refugees

“The financing from Kiva gave us the initial push to take the risk and start lending to refugees. We wouldn’t have seen this expansion without Kiva.”

In 2016, Kiva worked with four Lending Partners who lent to refugees and IDPs. In some cases, the support and financial backing of Kiva allowed Lending Partners to take the leap to start funding refugee loans. As one Lending Partner said, “The financing from Kiva gave us the initial push to take the risk and start lending to refugees. We wouldn’t have seen this expansion without Kiva.”

Six years on, we’ve now partnered with 26 Lending Partners who lend to refugees and IDPs.

Inkomoko, which is the largest lender to refugees in Africa, has raised over USD $5M through Kiva. They do incredible work in refugee camps and with host communities, and offer low interest rates far below the national average. They also offer business training prior to providing loans to refugees. After starting their work in Rwanda and since expanding to Kenya and Ethiopia, Inkomoko is developing new ways to engage communities, including creating meaningful market linkages and advocating for economic inclusion.

While many FSPs still avoid lending to refugees, several Kiva Lending Partners are seeing the potential of this market and working to change perceptions. A 2018 study by VisionFund Uganda, a Kiva Lending Partner, called for “a strategic shift from humanitarian response to self-reliance, which includes improving access to financial services and boosting livelihoods and income of families.” The study assessed 6,700 refugee members of existing savings groups, and revealed that despite the challenges that refugees face, these communities had enough financial capacity to merit the presence of FSPs, especially in areas where there was limited access.

Individuals around the world want ways to directly support refugees

Over 250,000 lenders have supported loans to refugees and IDPs through Kiva.

Kiva lenders have been supporters of lending to refugees for as long as we have. In 2016, an impressive 23,311 lenders supported loans to refugees and IDPs, and since then, over 250,000 lenders have supported loans to refugees and IDPs through Kiva. These lenders come from far and wide — representing 165 different countries (that’s 85 percent of all the countries in the world!).

In addition to lending to individual refugee borrowers, lenders have funded both refugee founders who are scaling social impact-driven businesses, and innovative social enterprises that are working to help large populations of refugees through our direct to social enterprise program.

These organizations often fall in the ‘missing middle’, meaning they are too small to receive funding from traditional banks, but too big for microfinance providers.

One such loan went to Grupo R5, which specifically works with Venezuelan refugees in Colombia. The political and economic circumstances in Venezuela have profoundly deteriorated, and over 1.7 million Venezualans are now based in Colombia. Unfortunately, these refugees lack access to work, education, health, and financial services. Access to bank loans is difficult due to a lack of financial history and they are pushed towards loan sharks that charge extremely high interest rates.

A Kiva loan of $50,000 enabled Grupo R5 to finance motorbikes for Venezuelans in Colombia, enabling them to work for the Mensajeros Urbanos (Urban Messengers) delivery app, earn steady income, establish a credit history, and use the vehicle as collateral to cover unplanned life events like medical expenses or education costs.

Institutional investors want to support refugees

Building on the success that we’ve seen on the Kiva marketplace, we’re now demonstrating that refugees are a viable market to invest in through the Kiva Refugee Investment Fund, managed by Kiva Capital. Since its launch in 2021, KRIF has deployed over USD $36M, in 17 institutions across 11 different countries, reaching a total of 24,530 end borrowers. More than 59 percent of KRIF’s total deployed capital has been lent to refugees and host communities.

The rest of the deployed capital has been invested in populations at risk of forced migration. KRIF has invested in microfinance institutions (MFIs) based in Central America and Mexico that are providing increased economic opportunities to their communities. KRIF seeks to work with organizations operating in poor, rural areas, whose populations are typically prone to forced migration. The lack of job opportunities for local youth, frequent hurricane onslaughts which negatively affect farmers’ yields, and omnipresent gang-related violence are all contributing factors that have pushed many to seek better opportunities elsewhere.

To prevent forced migration and build a sense of community that makes borrowers feel supported and empowered, MFIs like VisionFund Guatemala are providing products such as agricultural loans, crop insurance, financial training, and health services to support their borrowers and increase their resiliency in the face of adverse events. Since 2021, KRIF investees provided loans to over 17,000 borrowers at risk of forced migration.

Supporting financial inclusion for refugees is good for everyone

Just like others in their host communities, refugees can benefit from financial inclusion. But not only that, supporting financial inclusion for refugees is good for the community — evidence suggests that a refugee community that is nationally and transnationally integrated contributes in positive ways to the national economy, is economically diverse, and is far from dependent on international aid.

Refugee entrepreneurs demonstrate that they have a positive and significant impact on the economic development of their host country. In 2017, Inkomoko contributed to creating more than 2,600 jobs in Rwanda, both within camps and in urban centers. Of the new jobs created by refugee entrepreneurs, approximately 900 went to other refugees, while 1,700 jobs went to Rwandans in host communities.

While we’ve come a long way since we first started lending to refugees in 2016, there is still so much to do, and the need is only growing. By the end of 2025, we aim to provide an additional USD $40M in loans to at least 65,000 refugees, IDPs, impacted host communities, and those at risk of forced migration. Our goal is to continue building the foundation to make financial inclusion for displaced peoples a reality.

Join us in our work to improve financial inclusion for refugees — you can lend to a refugee or IDP here.

Donate to help us expand our work

Your donations enable us to cover the costs of expanding access to life-changing loans across the globe.