With summer heat falling short of record forecasts and natural gas storage levels still well above historical levels, gas forwards slipped at the front of the curve during the June 20-26 trading period, according to NGI’s Forward Look.

Fixed prices at benchmark Henry Hub finished the period at $2.629/MMBtu for July delivery, down 11.4 cents week/week, Forward Look data showed. On average, July fixed price forwards fell 5.8 cents.

July fixed prices fell sharply in West Texas and in the Northeast, followed by other hubs across the South Central and East regions during the period. Leading on gains were hubs in the Rockies and California.

Thursday’s government storage report showed a seasonally light 52 Bcf injection of gas into storage for the week ended June 21, putting Lower 48 stocks at 3,097 Bcf. Overall gas demand levels were strong during the report week.

However, much of the strength was driven by severe heat in the eastern half of the country, away from the gas-heavy South Central region that saw some of the sharpest declines for forward prices during the June 20-26 trading period. Instead, tropical systems draped Texas in cooling rains, limiting its gas demand.

Triple-digit temperatures returned to Texas this week. For Thursday, National Weather Service (NWS) data pointed to severe heat across most non-coastal areas of the state. That heat was expected to continue into mid-July.

“Much of the southern two-thirds of the U.S. will be hot the next 15 days with highs mostly in the upper 80s to 100s, hottest California to Texas, for strong to very strong national demand,” NatGasWeather said.

With the injection season’s continued lag to previous years, the surpluses of gas in storage have fallen from 37% above the five-year average in April to about 21% in the week ended June 21.

Even with storage surpluses diminished, EBW Analytics Group analyst Eli Rubin warned the trajectory of storage injections could still lead to price weakness later this year.

“Although record July heat, falling surpluses and very low weekly injections into mid-July may offer near-to-medium term upside for” gas futures, storage levels reaching near 3,100 Bcf in late June and 3,200 in early July “increases risks of lower gas prices this fall,” Rubin said.

Permian Pain

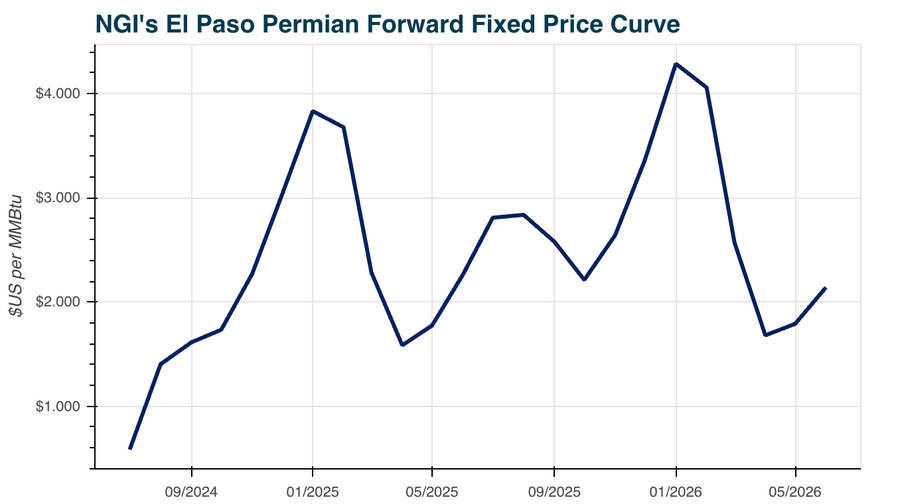

Fixed prices at El Paso Permian, Waha and Transwestern all sold off sharply for July and August peak summer contracts during the latest trading period, Forward Look data show.

Amid a spate of maintenance work backing up supplies across the South Central region, daily spot prices in the Permian Basin sank back into negative territory this week for the first time since late May, NGI’s Daily Historical Data show.

The negative pricing could prove temporary. Waha spot prices averaged as low as negative $1.040 on Monday. But by Wednesday, the hub averaged at a positive 1.5 cents.

The cash market pain spilled over into summer fixed price forwards. Natural gas for July delivery at Waha ended the latest trading period at 55.7 cents, down 67.0 cents week/week. August delivery for Waha fell by 38.9 cents to $1.391.

Basis prices for the Permian also weakened. For example, El Paso Permian July basis prices fell 51.0 cents week/week to minus $2.044.

Permian dry gas production began the trading period at around a one-month high near 16.9 Bcf/d, according to Bloomberg data. The region’s output had marched higher from near 16.1 Bcf/d at the start of the month, the data showed. Over the trading period, Permian production fell by about 0.4 Bcf.

For the South Central region, summer’s boost to gas demand comes with a counterisk of potential hurricanes unexpectedly shutting off demand quickly.

An expected active hurricane season has increased the risk of storms idling liquefied natural gas exports and industrial power demand along the Gulf Coast. A hurricane strike of the region could strand as much as 23 Bcf/d of gas.

The near-term tropical weather outlook continued to show potential storms forming. A tropical wave in the Caribbean Sea had a relatively low chance of becoming a storm over the next seven days, the National Hurricane Center (NHC) said. Another wave well off the west coast of Africa had a 70% chance of forming into a storm over the week, NHC said.

Firmer California Basis

Downstream of Permian supply, prices in the Rockies and California markets moved higher during the trading period. Above-normal temperatures were expected in the near term in California and across the Rockies into late July, NWS data showed.

SoCal Citygate July basis jumped 49.5 cents through the period to flip positive at plus 42.1 cents, according to Forward Look. In Northern California, PG&E Citygate July basis added 58.0 cents to reach plus 36.1 cents.

El Paso San Juan July basis gained 45.0 cents to reach minus 31.7 cents.

Elsewhere in the East, basis prices were modestly mixed. In the Southeast, Transco Zone 5 July basis added 2.4 cents to reach plus 35.4 cents. In Appalachia, Columbia Gas July basis shed 6.0 cents to finish at minus 68.1 cents.

In the previous trading period for forward prices, the startup of the Mountain Valley Pipeline LLC (MVP) helped boost fixed prices for Appalachian Basin hubs. MVP expanded the reach of Appalachian supply into the Southeast, though flows were not expected to reach the pipeline’s full 2 Bcf/d capacity until pipeline expansions clear bottlenecks by 2027.

July fixed prices for Texas Eastern M-2, 30 Receipt shed 15.8 cents to $1.827 over June 20-26, more than offsetting the gains during the June 13-18 period when MVP came online.