Regional natural gas forwards sold off heavily during the May 23-29 trading period as the unofficial start of summer — and the ramp up in prices during the month of May — brought a shift in the production outlook.

June fixed prices at benchmark at Henry Hub tumbled 34.4 cents for the period to finish at $2.501/MMBtu, paralleling the sell-off in Nymex futures over the same time frame, according to NGI’s Forward Look.

Most other Lower 48 hubs followed the national benchmark lower, with fixed price discounts across the balance of 2024 widespread during the period, Forward Look data show.

EQT Bringing Production Back?

The May 23-29 trading period brought with it rumblings of a bump in output from EQT Corp. The largest U.S. natural gas producer began curtailing 1 Bcf/d in late February, but analysts recently pointed to signs that the withheld supply was being reintroduced into the market in time for summer.

Wood Mackenzie estimates as of Thursday showed total domestic production averaging 99.6 Bcf/d over the past week, notably higher than the recent 30-day average of 98.5 Bcf/d.

Analysts at East Daley Analytics said they observed a recent increase in volumes in pipeline samples linked to EQT.

The Appalachian Basin heavyweight could be preparing to meet higher summer demand, and the timing also syncs up with the imminent addition of new capacity on the Mountain Valley Pipeline (MVP), the East Daley analysts said in a recent note.

EQT owns 1.2 Bcf/d of capacity on MVP, which will be operated by acquisition target Equitrans Midstream Corp.

“The timeline would line up with our prediction for EQT to return its gas production in June, based on the expected start of MVP and higher seasonal demand,” the East Daley analysts said. “Flows rose on systems in the Southwest Pennsylvania region of the Marcellus, the same systems that took a hit when EQT curtailed its production.”

Analysts at Tudor, Pickering, Holt & Co. (TPH) similarly noted recent pipeline samples indicating previously shut-in volumes were being brought back in time for summer.

“From a macro perspective, we expect another 1 Bcf/d of supply to return to the market in June, with our model averaging 101.3 Bcf/d,” TPH analyst Matt Portillo said. “We consider the industry’s decision to defer completions and shut in production over the last few months as the correct course, avoiding selling gas at poor economic levels…and helping clean up the excess storage overhang.”

This year “remains a transition year, but due to the industry’s focus on reining in capital given weak returns and accelerating LNG demand” in the second half of 2024, “our model has settled out at 3.82 Tcf for October, with storage dropping below the five-year average in 2025,” Portillo added.

Basis differentials at Appalachian Basin hubs came under downward pressure during the May 23-29 trading period, Forward Look data show.

Eastern Gas South June basis fell to minus-$1.000, increasing its negative differential to Henry Hub by 7.9 cents week/week. Trading pointed to additional selling pressure there at the end of the injection season; October basis slid 10.3 cents to minus-$1.302.

Southeast Premiums Persist

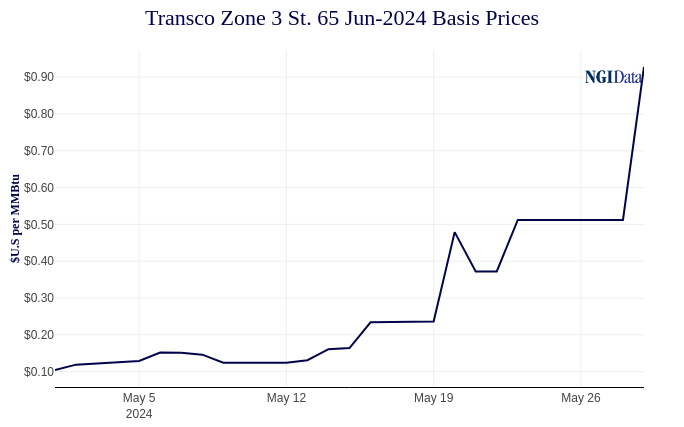

Southeast basis differentials, meanwhile, moved in the opposite direction during the May 23-29 period. Pipeline constraints coincided with widening premiums at hubs like Transco Zone St. 65, Florida Gas Zone 3 and Transco Zone 4, among others.

Wood Mackenzie flow data as of Thursday continued to show a restriction on south-to-north flows through Station 60 on the Transcontinental Gas Pipe Line.

Transco Zone St. 65 basis climbed sharply at the front of the curve, exiting the period at a 92.8-cent premium to Henry Hub, a 55.6-cent swing higher. July basis increased 17.4 cents to plus-61.3 cents, Forward Look data show. Further along the curve, basis at the hub was flat to lower week/week.

Also potentially impacting flows in the Southeast, Southern Natural Gas (SONAT) declared a force majeure Wednesday that was expected to remain in effect through Friday tied to maintenance on the Southeast Supply Header system, according to Wood Mackenzie analyst Inigo Guerra.

SONAT expected reduced capacity at several locations during the event, according to a notice posted by the operator.