Regional natural gas forwards continued to soar during the May 16-22 trading period in parallel to the recent bullish momentum lifting summer Nymex futures to new heights, data from NGI’s Forward Look show.

Fixed prices at Henry Hub rallied 42.3 cents week/week to finish at $2.845/MMBtu for June delivery. Gains at the benchmark were strongest toward the front of the curve. January 2025 prices at Henry rose 20.9 cents for the period to $4.037, Forward Look data show.

Fixed price gains across the curve were the norm for much of the Lower 48 during the May 16-22 period, with increases especially pronounced in the Southeast and Mid-Atlantic.

Futures Rally Finally Done?

The gains for regional forwards coincided with another bullish week for Nymex futures, though the rally that has dominated this month’s trading showed signs of faltering Thursday.

After entering the month below $2, the June Nymex contract probed as high as $2.924 Thursday before pulling back.

The steady ascent for Nymex futures this month suggests a growing sense of optimism around the potential for summer power burns to help bring down inventory surpluses that had reached unmanageable levels after a no-show 2023/24 winter.

“While staggering storage surpluses are set to whittle away, higher natural gas prices incentivizing the return of withheld production and narrowing price-induced demand via gas-to-coal switching in the power sector may slow the pace of decline,” EBW Analytics Group analyst Eli Rubin said.

However, even at higher prices, surpluses would remain poised to decline into midsummer, a potential source of “ongoing fundamental price support,” according to Rubin.

There’s also the possibility that the move higher will entice producers to bring volumes back into the market, the analyst said.

“The historic price-driven production declines over the past three months open questions of a substantial supply response to higher prices,” Rubin said. “While altering supply plans on the fly is difficult in practice…and we continue to expect the majority of producers to return volumes into 4Q2024, higher production over the next 30 to 60 days into midsummer appears possible.”

Of course, even with hefty price increases for the balance of 2024, forward curves during the May 16-22 period continued to suggest producers will capture better returns on volumes deferred until next year, when new U.S. export demand hits the market.

One source of incremental export demand, the Golden Pass LNG project currently under development on the Texas coast, is facing setbacks, however.

Markets took notice after a contractor on the project recently announced that it is filing for bankruptcy and moving to exit the project.

Still, the recent Golden Pass developments did not do much to dampen the market’s outlook on natural gas pricing into early 2025. Henry Hub fixed prices for April 2025 delivery surged 16.7 cents for the May 16-22 period to reach $3.173.

Southeast Premiums

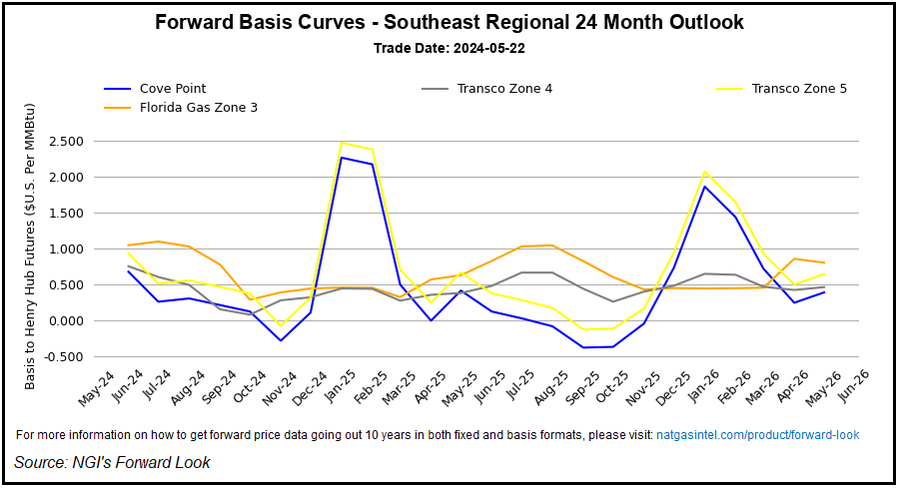

A combination of early season cooling demand and pipeline congestion continued to propel Southeast natural gas forwards higher in recent trading.

Maxar’s Weather Desk was calling for highs to reach the mid-90s for Houston and Dallas over the Memorial Day weekend, with above-normal temperatures also expected to blanket Southeast and Mid-Atlantic population centers.

Transco Zone 5 June fixed prices rallied more than $1 week/week to exit at $3.773, with Transco Zone 4 up 66.7 cents to $3.596, Forward Look data show.

Spot prices in the Southeast have been trading at a hefty premium to other regions recently, coinciding with a constraint on the Transcontinental Gas Pipe Line (Transco).

Earlier this month, Transco notified shippers that it “experienced an unplanned incident” during maintenance at Station 60 in East Feliciana Parish, LA.

Since May 6, Station 60 has been flowing at a reduced rate of around 775,000 MMBtu, down from a previous operating capacity of 1,600,000 MMBtu, Wood Mackenzie flow data show.

The reduction has crimped south-to-north flows on the pipeline and appears to have exacerbated upward pressure on Southeast pricing. Those spot market dynamics carried over into forwards trading during the May 16-22 period.