Natural gas forwards rallied during the May 9-15 trading period as the market keyed in on the upside potential of summer power burns.

Front month fixed prices at Henry Hub climbed 22.8 cents to finish the period at $2.422/MMBtu, Forward Look data show.

Interestingly, near-month basis differentials weakened at numerous other Lower 48 trading points during the period as they failed to keep pace with the gains at Henry Hub.

Chicago Citygate, for instance, traded higher for June delivery in fixed price terms; however, June basis there fell to minus-33.7 cents, down 6.4 cents week/week.

Summer Powering Bullish Sentiment

The week/week gains for natural gas forwards mirrored the recent bullish momentum observed in Nymex futures.

As of Thursday, June Nymex futures were on a tear, rallying roughly 50 cents month-to-date.

Speculators as a group still had a substantial net short position as of May 7, according to an analysis of Commodities Futures Trading Commission data conducted by StoneX Financial Inc.’s Thomas Saal, senior vice president of energy.

Looking at positioning data for select Nymex natural gas products, speculators were net short by 133,775 contracts as of May 7, a reduction of 16,804 contracts week/week amid short covering, according to Saal.

Recent futures gains appeared to be “powered by supportive technicals and substantial short-covering,” EBW Analytics Group analyst Eli Rubin said in a recent note.

Looking ahead, bulls have plenty of reason for optimism as the ramp up in summer cooling demand looms, according to the analyst.

“Rapidly increasing power sector gas burns remain a stalwart bullish indicator heading into early summer,” Rubin said. “While electricity loads have expanded over the past two years — particularly with population growth and economic expansion in Texas and the Southeast — loads have been generally repressed by weak weather, and the seasonality of demand likely remains underestimated by the market.

“Hot summer weather may remain a bullish tailwind for the market — reversing nearly four months of stubbornly bearish weather headwinds from mid-January through early May.”

Sweating In The Southeast

Regional forward trends during the May 9-15 trading period appeared to take into account the concentration of early-season heat over southern portions of the country.

Select Southeast hubs, in particular, saw pronounced buying pressure for summer delivery, Forward Look data show.

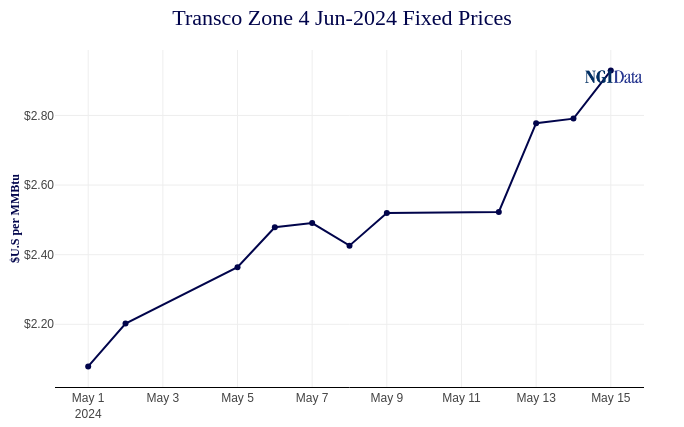

Transco Zone 4 June fixed prices surged to $2.929, up 50.3 cents week/week. Florida Gas Zone 3 rallied 60.7 cents to exit the period at $3.313.

The National Weather Service (NWS) was predicting a strong chance for unseasonably warm temperatures from Texas to Florida heading into the final third of May.

“Subtropical ridging favors above-normal temperatures for much of the southern and eastern contiguous U.S.” during the six- to 10-day time frame, the forecaster said.

According to the NWS, southern regions east of the Rockies were expected to continue seeing unusually hot temperatures later in the month.

NatGasWeather similarly pointed to “very warm to hot conditions” ahead for the southern third of the Lower 48, including highs in the mid-80s to 90s.

“The natural gas markets have had the option of focusing on the very comfortable northern two-thirds of the U.S. or the hotter southern third of the U.S., and clearly they have preferred the latter, evidenced by impressive price gains the past few weeks,” NatGasWeather said.

Recent pipeline maintenance events also appear to have pinched flows into the Southeast and contributed to upward price pressures regionally.

In a recent note, Wood Mackenzie analysts highlighted maintenance on the Southeast Supply Header (SESH) system. That was expected to restrict volumes flowing toward the Southeast this month.

Southern Natural Gas Co. (SONAT) subsequently declared a force majeure because of maintenance at the Gwinville Compressor Station. The event was expected to restrict flows through an interconnect with SESH for several days this past week, according to Wood Mackenzie analyst Inigo Guerra.

“Nominations for the interconnection between SESH and SONAT have been near or at max operational capacity for almost all days this past month,” Guerra said.