Weather forecasts that called for a sweltering August in California supported baseload natural gas prices in the region on the third day of bidweek trading (July 29), NGI’s Bidweek Alert (BWA) showed.

In fixed trade, SoCal Citygate pulled back to an average of $3.085/MMBtu on day 3 of bidweek trading, down from $3.255 on day 2 and $3.205 on day 1, but still higher than the July bidweek average of $3.055.

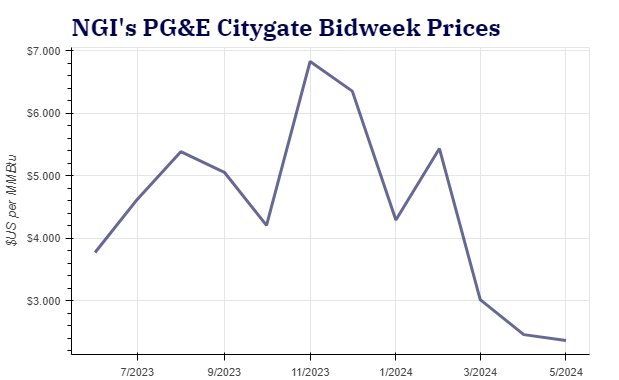

To its north, PG&E Citygate held the highest baseload price in North America after climbing to an average trade level of $4.015 on day 2, just a tick above the day 1 average, and well above the $3.040 average for July bidweek, BWA data show. No trades were reported at the hub on day 3 of bidweek trading.

The Golden State’s grid operator, the California Independent System Operator (CAISO), reported the average daily load was extremely strong in the final full week of July. “That might not be the peak for the summer,” said Criterion Research vice president of Research James Bevan on the online energy platform Enelyst. “CAISO can have high load into early September,” he said.

National Weather Service (NWS) forecasts showed temperatures pulling back from recent highs in the 100s to finish July in a range from the upper 80s to low 90s across most of the state before climbing back into the 100s in August.

Help meeting elevated weather-driven demand with solar generation would likely be lessened by shortened days as summer wanes, and hydro generation from federal hydroelectric dams on the Columbia River and its tributaries continues to decline, Bevan said. That could result in more robust demand for natural gas-fired generation.

Meanwhile, futures were of no support Monday as the August contract crumbled into expiration, and September natural gas posted its fifth consecutive lower close. The August New York Mercantile Exchange gas futures contract shed 9.9 cents to settle at $1.907/MMBtu before rolling off the books. The September contract, which moves to the front month position, fell 1.5 cents to $2.036.

“Selling might have been aided by August futures expiring at the close, but more likely due to hefty surpluses of 456 Bcf that just aren’t being reduced this summer as fast as many participants were expecting,” NatGasWeather meteorologist Rhett Milne said.

According to U.S. Energy Information Administration (EIA) estimates, working gas in storage was 3,231 Bcf as of July 19. This reflected a net increase of 22 Bcf from the previous week. Stocks were left 249 Bcf higher than the prior year and 456 Bcf above the five-year average of 2,775 Bcf.

NGI modeled a 29 Bcf build to stocks for the EIA data covering the week ended July 26. That would compare with the year-earlier 15 Bcf injection and the five-year average build of 33 Bcf.

Some analysts warned that the current supply conditions could warrant production cutbacks to prevent total end-of-season natural gas supplies from exceeding storage capacity limits. If the first slate of producer earnings was any indication, that could be a tall order. Last week, CNX Resources Corp. and Range Resources Corp. indicated they were “unlikely to make further production concessions,” while EQT Corp. baked in more curtailments, Tudor, Pickering, Holt & Co. LLC analyst Matt Portillo said.