Baseload natural gas prices continued to move higher in Texas on Tuesday, the second day of July bidweek trading, while in the Southeast, new supply from the startup of a long-awaited pipeline appeared to weigh on prices.

NGI’s Bidweek Alert (BWA) showed price gains continued in Texas from June levels as the market recovered from an about three-month routing. Elsewhere, prices mostly weakened from the previous month.

In fixed trade, Waha in West Texas averaged at 60.0 cents/MMBtu, up from 56.0 cents on day 1 of July bidweek trading. The sustained upward moves keeps it on track to trade in positive for a second month after falling below zero in March.

The Waha hub averaged at 30.5 cents for June bidweek. At El Paso Permian, fixed prices averaged $1.150, up from 34.5 cents the previous month.

Pipeline maintenance season was drawing to a close, and demand for feed gas to export facilities, including Freeport LNG, operating smoothly after a sporadic restart from planned and unplanned outages, contributed to a tightening of the South Central supply/demand balance.

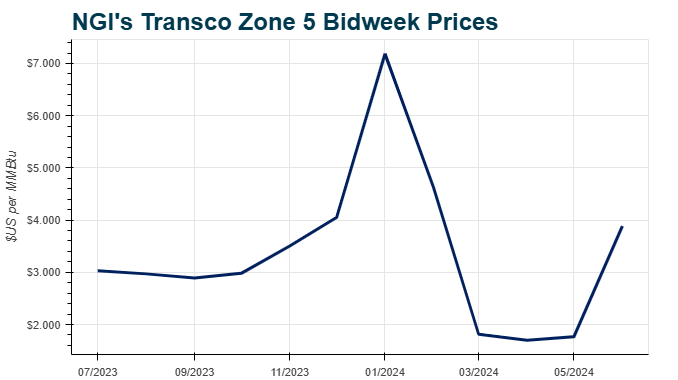

Basis pricing for the Southeast region have slumped alongside the start-up of the long-awaited Mountain Valley Pipeline LLC (MVP).

After years of delays, this pipeline connected Appalachian Basin gas supply to the Southeast via the Transcontinental Gas Pipe Line Co. (Transco) system, marking a significant shift in supply dynamics.

MVP ramped up flows to slightly over 0.5 Bcf/d in the final week of June, with most of the gas sent to Transco, analysts said.

Transco Zone 5 saw July basis deals between plus 56.0 cents and 59.5 cents for an average of plus 57.5 cents, BWA data show. That’s down from an average of plus $1.390 for June.

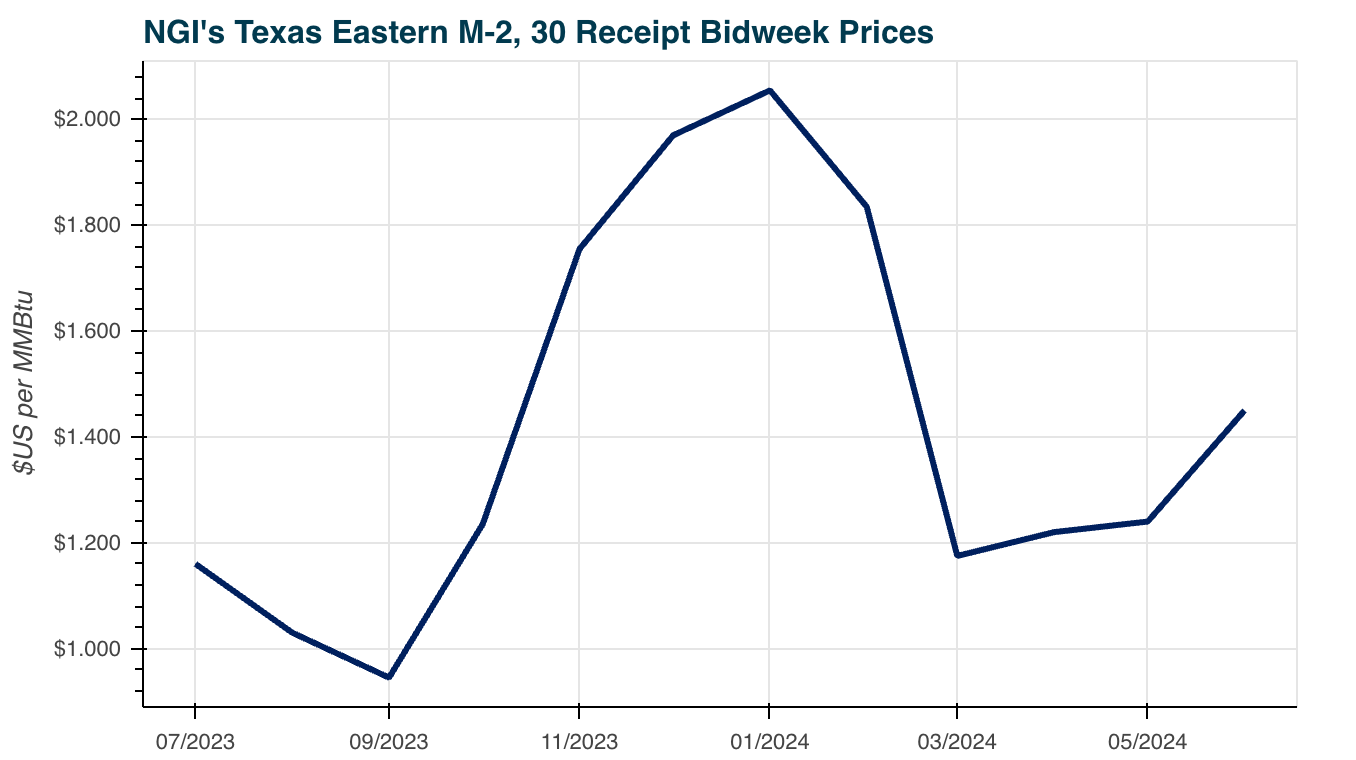

With MVP still not at full capacity and ongoing pipeline maintenance, including on Transco, bottlenecks apparently limited outbound flows into the Southeast. Appalachia basis discounts still tightened from June. Texas Eastern M-2, 30 Receipt averaged at minus 81 cents Tuesday. That compared with the June average of minus $1.040.

Basis deals for Algonquin Citygate in the Northeast averaged at plus 11 cents. That compared with an average of plus $1.850 for June. Iroquois Zone 2 averaged plus 47 cents. That compared with an average of plus $1.920 the prior month.

Futures offered little support on day two of July bidweek trading. The July contract continued searching for direction ahead of its expiration on Wednesday. The soon-to-expire contract rose to a $2.844/MMBtu intraday high and settled down 5.5 cents at $2.756 on Tuesday. Meanwhile, August slumped 8.5 cents to $2.863.