Baseload natural gas prices held onto gains in southern and western portions of the country on the final day of June bidweek trading Wednesday, while abundant supply and a slow start to summer heat kept most prices in other areas under pressure.

NGI’s Bidweek Alert (BWA) showed overall trade slowed on the third and last day of bidweek trading for June.

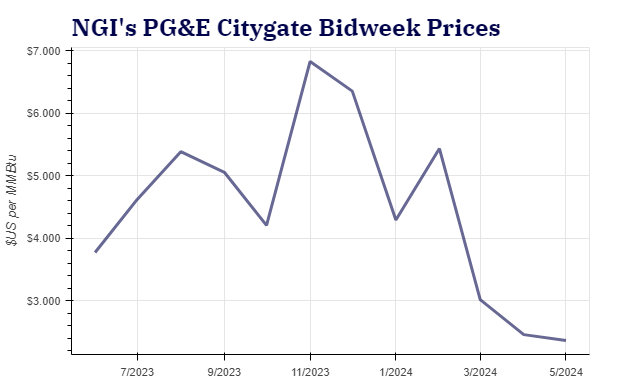

In fixed trade, PG&E Citygate held onto the highest baseload price in North America at an average trade level of $2.200/MMBtu, higher than its average on day 1 June bidweek trading but 1.0 cent lower than day 2, BWA data show. The prices compared with an average of $2.360 for May bidweek.

To its south, SoCal Citygate averaged $1.810 to maintain a trend higher over the course of June bidweek but still lower than the May bidweek average of $1.955.

One of the most actively traded hubs, Dawn in the Midwest saw basis deals average at minus 66.8 cents, a slightly wider discount to its first two days of June bidweek trade and its May bidweek average of minus 18.25 cents. Dawn also traded at an average fixed price of $1.795 on Wednesday.

Prices in West Texas, Southeast and Rockies continued to trade above May bidweek levels on Wednesday.

The mixed bag for June baseload prices has come as May’s early appearance of summer heat fizzled across large swaths of the country and forecasts for eastern states turned cooler for early June.

Forecasters are calling for a scorching summer, and indeed Texas already has seen its share of heat and storms. A strong summer burn would help draw down hefty natural gas storage levels that were 606 Bcf, or 29%, above the five-year average in the week ended May 17.

However, this month’s strong rebound in natural gas prices could entice producers to reverse some of the output cuts put in place in winter. “Production may turn higher as pipeline maintenance concludes and producers restore curtailed output alongside higher prices, limiting upside,” EBW Analytics Group analyst Eli Rubin said.

June futures rolled off the board Wednesday at $2.493. The contract catapulted as much as 51% higher in May before shedding some of the gains to end its run up 29% since May 1.

The benchmark Henry Hub made a similar move higher in the spot market, rising as much as 60% to $2.605 in May. The hub has since drifted lower and averaged $2.210 Wednesday, up 36% since May 1.