July baseload natural gas prices for Canadian hubs weakened further during the final day of bidweek trading on Wednesday, while Lower 48 hubs maintained an overall upward trajectory from June, according to NGI’s Bidweek Alert.

The onset of summer cooling demand has helped drive gains for Lower 48 baseload prices. Record heat in mid-June was expected to further draw down storage surpluses in the next government storage report on Thursday. The heat was forecast to return in force over the July 4 holiday.

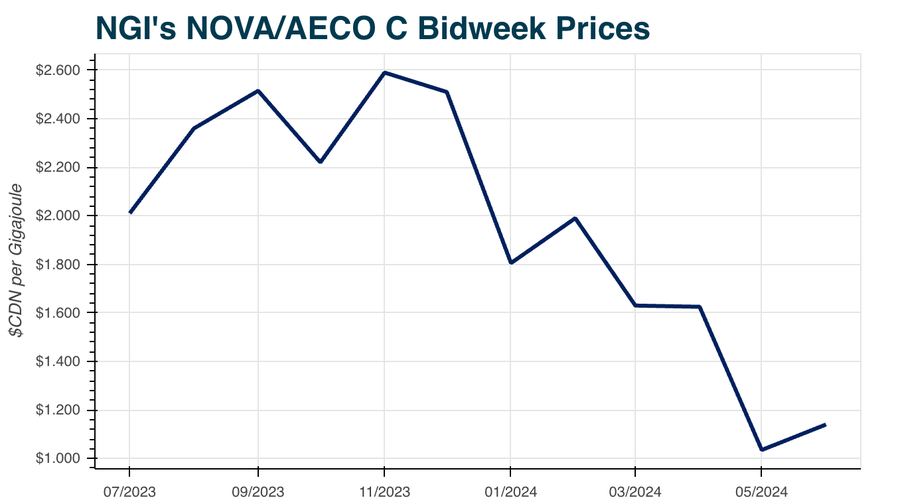

However, that strength in prices did not carry over into Canada, which saw baseload prices for another two of its hubs fall below C$1.000/GJ for the first time since 2019.

On Wednesday, NOVA/AECO C was the most actively traded hub with 92 deals. It traded at an average fixed price of C70.0 cents, down from C74.5 cents on day 1 and C78.0 cents on day 2 of July bidweek trading. It was also down from C$1.140 for June bidweek.

Empress has traded the highest of the country’s three hubs this week. It averaged at a fixed price of C75.5 cents in day 3 trading, down from C86.5 cents on day 2. Westcoast Station 2 averaged at a fixed price of C46.5 cents on day 3.

Baseload prices for Canadian hubs have been on a generally downward trend in 2024, pressured by abundant supply that has weighed on its cash prices.

Canadian gas storage levels are 254 Bcf, or 64% above their five-year average, according to EBW Analytics Group analyst Eli Rubin. Tha overhang is almost three times the magnitude of the Lower 48’s surplus of 23% above its five-year average in the week ended June 21.

“Inflated Canadian gas storage surpluses are an incremental source of supply,” Rubin said. “The risk of rising imports is often discounted by U.S.-based traders and analysts, and could present a modest bearish surprise.”

Canada’s supply overhang likely had mixed effects on its two biggest U.S. import markets, the Rockies and Midcontinent, as tallied by NGI’s Canada Border Tracker. Last week, U.S. imports of Canadian gas rose to five-month highs around 6.8 Bcf/d, according to Wood Mackenzie.

In the Rockies, Northwest Sumas traded at an average fixed price of $2.100/MMBtu on day 3 of July bidweek trading. That price was up from $1.800 averaged on day 1 and up from an average $1.120 for June Bidweek. The hub did not trade on day 2 of July bidweek trading.

Conversely, Emerson, among the recipients for flows via the Midcontinent, averaged near minus $1.815 in basis trade on day 1. That was a wider discount than the minus $1.325 averaged for June Bidweek. Emerson did not trade on day 2 or 3 of July bidweek trading.

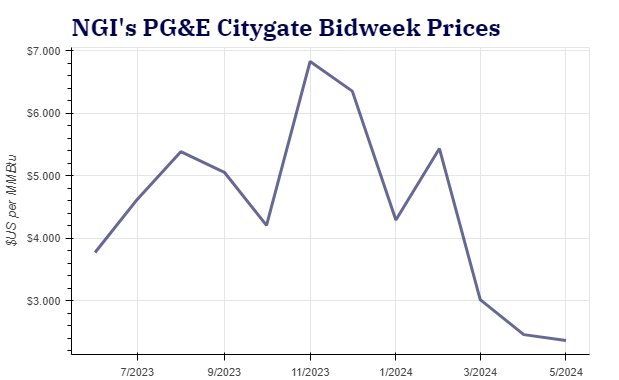

Elsewhere on Wednesday, trading in California was its most active of the July bidweek period. Prices at hubs firmed modestly from the first two days of trade. PG&E Citygate traded at an average fixed price of $3.275, up from $2.775 on day 1 and $3.200 on day 2. SoCal Citygate averaged at $3.150 on day 3, up from $2.965 on day 1 and $3.050 on day 2.

Those gains came despite futures lending little support for a second day. July futures settled down 12.8 cents at $2.628 on their last day of trading Wednesday. August, which took over as the front month, fell 11.8 cents to $2.745.