Baseload natural gas prices continued to move higher in Texas and Southeast in the second day of June bidweek trading Tuesday, supported by expected summer power demand and ebbing pipeline maintenance.

NGI’s Bidweek Alert (BWA) showed price gains in Texas, Rockies and Southeast. Prices in the Northeast, Midwest and California weakened from the previous month.

In fixed trade, Waha in West Texas averaged at 58.0 cents/MMBtu, up from 29.0 cents on day 1 of June bidweek trading. This reflected a shift to the positive after the hub averaged at minus 39.5 cents for May bidweek. In East Texas, NGPL TexOk fixed prices averaged $2.055, up from $1.315 for the previous month.

Pipeline maintenance and a slower pace of LNG exports in the spring had added to a glut of Permian Basin supplies to weigh on West Texas prices.

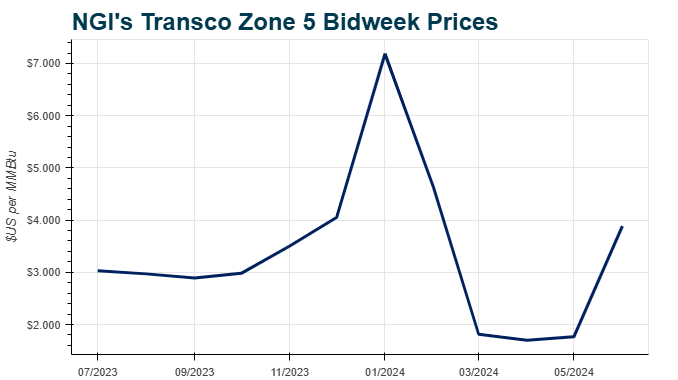

Basis price premiums in the Southeast widened sharply, untamed by the expected completion this week of the Mountain Valley Pipeline LLC (MVP) after years of delays. The pipeline would connect Appalachian Basin gas supply to the Southeast via the Transcontinental Gas Pipe Line Co. (Transco) system.

Transco Zone 5 saw June basis deals between plus $1.305 and $1.365 for an average of plus $1.348, BWA data show. That’s up from an average of plus 15.25 cents for May.

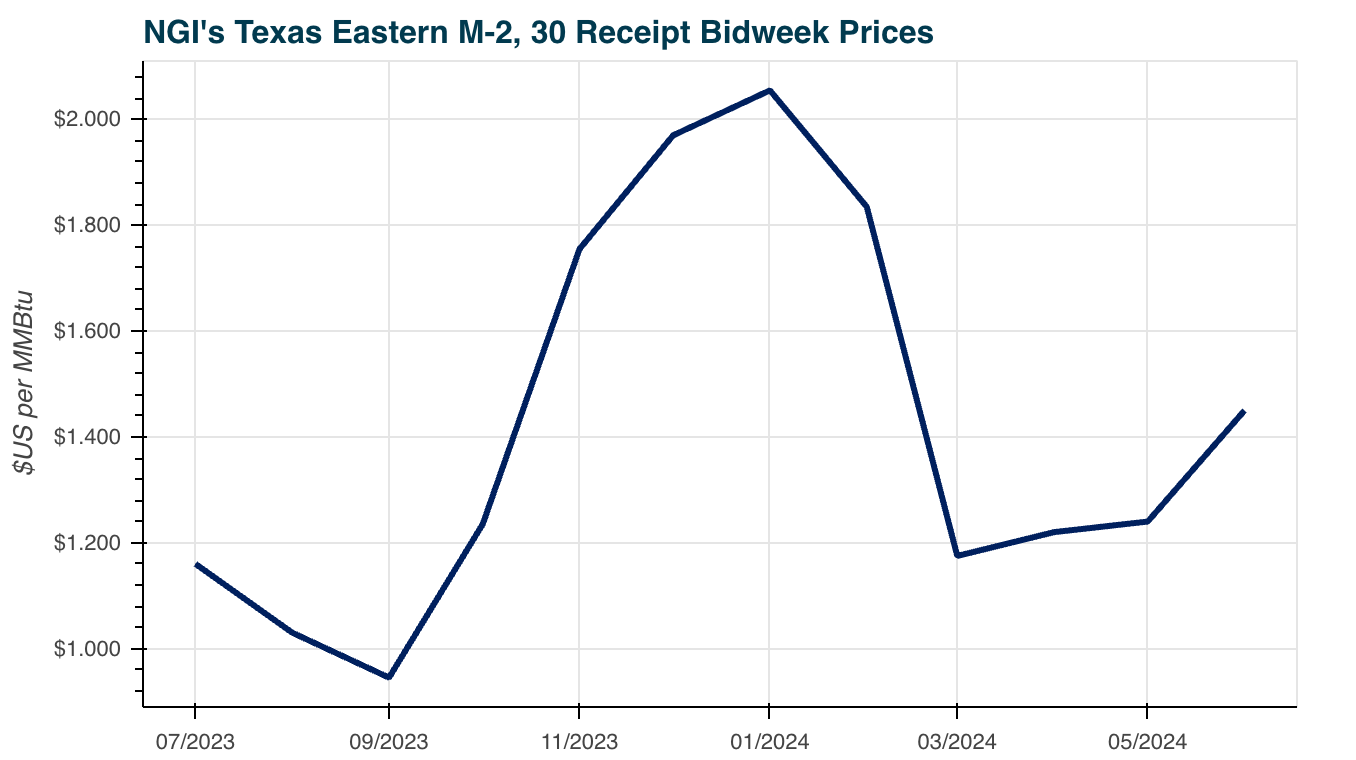

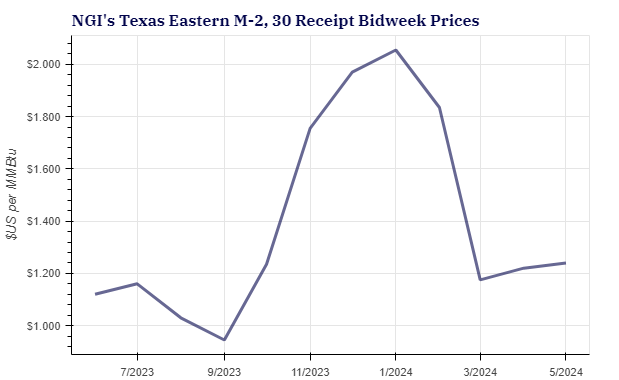

However, Transco bottlenecks could limit MVP’s outbound flows into the Southeast. Possibly reflecting that continued outbound capacity constraint, Appalachia basis discounts widened from May to similar levels as June 2023. Texas Eastern M-2, 30 Receipt averaged at minus $1.055 Tuesday. That compared with May average of minus 37.5 cents and June 2023 average of minus $1.060, data from BWA and NGI’s Bidweek Survey showed.

Basis deals for Algonquin Citygate in the Northeast averaged at minus 63.8 cents. That compared with an average of minus 18.75 cents for May.

Futures offered some support on the second day of June bidweek trading. The June contract, set to roll off the board Wednesday, rose 7.0 cents to settle at $2.590 Tuesday. Meanwhile, July climbed 5.2 cents at $2.825.