Weekly natural gas cash prices drifted lower despite sizzling summer temperatures across much of the Lower 48 and maintenance work in the Permian Basin that temporarily lowered production below the century mark.

NGI’s Weekly Spot Gas National Avg. for the July 15-19 period shed 13.5 cents to $1.805/MMBtu.

As the trading week closed, Houston Ship Channel was down 18.0 cents to $1.555, while Waha in West Texas was off 45.0 cents to 28.5 cents, and Chicago Citygate was down 15.0 cents to $1.695.

Meanwhile, the August Nymex futures contract gave up ground during the week – as it has throughout July. It settled Friday at $2.128, up three-tenths of a cent on the day but down 9% from the prior week’s finish.

“Natty trends – and the trend is now down” this month, Snapper Creek Energy analyst Kyle Cooper told NGI.

During the past trading week, high temperatures soared above historical averages across vast swaths of the country, from the Southwest to the Northeast. Heat waves galvanized air conditioner use and powered natural gas demand.

However, temperatures did ease in the Midwest during the period, and National Weather Service forecasts called for rains and seasonally mild conditions in the nation’s midsection and the Northeast during the week ahead. Still, forecasts advertised hot conditions to endure in other parts of the country and then spread again in late July and early August

At the same time, production fell below 100 Bcf/d at one point during the week in Wood Mackenzie estimates – down from recent highs above 102 Bcf/d. Wood Mackenzie analyst Emma Weng noted an El Paso Natural Gas Co. LLC maintenance project on Line 1300 that spanned much of the week and restricted Permian gas flows.

However, she added, the work was expected to culminate before the coming week and upward revisions to production estimates were made. On Friday, production was pegged at 101 Bcf/d.

Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI that repair projects can impact prices on any given day, but the influence can prove modest if the work is short-lived.

“Anything more than a near-term effect would certainly depend upon what pipeline and for how long the problem is expected to last,” Blair said.

The export front also proved bearish during the week, Blair noted. LNG demand held below 11 Bcf/d and off about 2 Bcf/d from recent highs, owing to the aftershocks of the former Hurricane Beryl. In particular, the Freeport liquefied natural gas terminal in Texas, damaged by the storm, continued to work on repairs as it prepared to gradually restart its three trains.

Blair said that, for the week ahead, weather could prove a wildcard, with near-term heat likely not as pervasive as it was in the first half of July but forecasts showing strong cooling demand later in the summer.

Carley Garner, senior broker and analyst at DeCarley Trading, noted that the latest slump in futures extended a downward trend that developed over the first two weeks of July. While fundamental factors played roles, she also said that aggressive short-covering by money managers helped to ignite a June rally that was overextended. So an increase in short positions and a futures pullback was not a surprise this month.

That noted, Garner said if futures fall further, “I doubt the August contract trades much under $2.00.”

Mixed Storage Picture

Futures did get a 9.0-cent bump on Thursday, marking a brief, but notable, rally following the latest government inventory data.

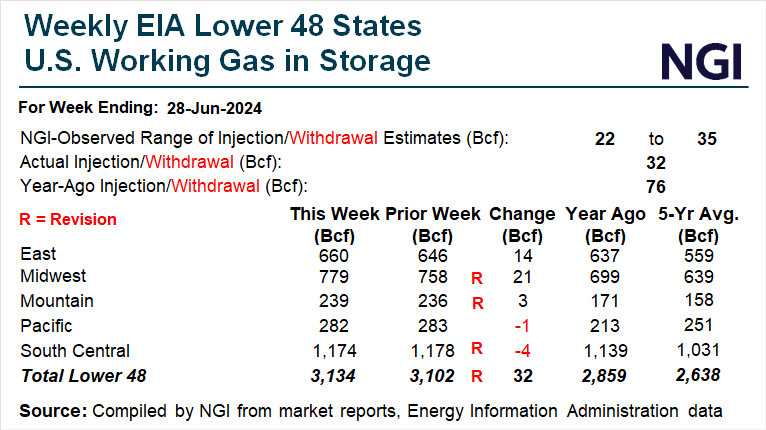

The U.S. Energy Information Administration (EIA) on Thursday reported an injection of 10 Bcf natural gas into storage for the week ended July 12. The print was bullish relative to expectations for a high 20s Bcf build found by major polls. NGI modeled a 12 Bcf injection.

From a price bulls’ perspective, the actual result also compared favorably to the five-year average increase of 49 Bcf.

Near-record temperatures cooked much of the Lower 48 during the EIA period, trumping Beryl’s impacts on LNG as well as the power outages the storm caused in southern areas of Texas.

The Midwest and East regions posted seasonally small builds of 14 Bcf and 4 Bcf, respectively, according to EIA. Mountain region stocks increased by just 3 Bcf. Pacific inventories were flat and the South Central reported a draw of 10 Bcf.

Still, the latest increase boosted inventories to 3,209 Bcf, keeping stocks well above the five-year average of 2,744 Bcf.

“On a medium-to-long term basis, the recent wash-out in Nymex gas pricing will bring the projected storage trajectory to manageable levels in the most-likely scenario – implying fundamental support near the $2.00/MMBtu mark,” said EBW Analytics Group’s Eli Rubin, senior analyst. Yet “bearish risks dominate near-term momentum” and there is “no reason low natural gas prices in an oversupplied market cannot linger for weeks.”

Looking ahead to the next EIA report, covering the week ended July 19, analysts were generally expecting a result roughly in line with historical averages. Early injection estimates submitted to Reuters ranged from 15 Bcf to 66 Bcf, with an average of 24 Bcf. The estimates compare with an increase of 23 Bcf a year earlier and a five-year average build of 31 Bcf.

Friday Cash Prices

Cash prices for gas delivered through the weekend and Monday slipped across most of the Lower 48, with bears seizing upon forecasts for a stretch of mild weather. NGI’s Spot Gas National Avg. fell 10.5 cents on Friday to $1.570.

Henry Hub shed 11.5 cents on Friday to average $1.885, while Florida Gas Zone 3 fell 10.5 cents to $2.385, and Michigan Consolidated lost 4.0 cents to $1.525.

Out West, SoCal Border Avg. dropped 25.0 cents to $2.345.

Hubs in the Pacific Northwest, where a weekend heat blast was forecast, proved an exception on Friday. Malin in Oregon, for example, jumped 21.5 cents to $2.295.

The lower prices in the nation’s midsection and portions of the South and East developed against the backdrop of expected seasonal to relatively mild conditions through the weekend and into the trading week ahead, as NatGasWeather noted.

Still, forecasts advertised more widespread heat returning by the middle of the coming week and enduring through the end of the month and into August, though with sporadic exceptions in the Midwest and parts of the South because of rainy conditions.

“The long-range weather data maintain a hotter than normal pattern over most of the U.S. for the end of July through the first half of August for strong to very strong national demand,” NatGasWeather said. It cautioned that tropical systems could track into the Lower 48, as Beryl did, and cause demand destruction.

Near term, forecasts for moderating conditions include Texas, with highs falling from the 100s in some markets to the 80s. “Widespread rain and thunderstorms will be the forecast for much of” the coming week in Greater Houston, “with locally heavy rain, some flooding, gusty winds at times, but also cooler temperatures,” said Space City Weather meteorologist Matt Lanza.

AccuWeather on Friday said the Atlantic was quiet to close out the week. But it said a tropical system could deliver heavy rains and possible power outages to Florida early in the coming week.

"While we do not expect this system to organize and strengthen, it will bring locally heavy rain to Florida from as early as Sunday to perhaps as long as Tuesday in some areas," AccuWeather meteorologist Alex DaSilva said.