Weekly natural gas cash prices retreated amid seasonally mild temperatures in key sections of the Lower 48 and strong national production.

NGI’s Weekly Spot Gas National Avg. for the July 22-26 period slid 3.0 cents to $1.775/MMBtu.

As trading for the week culminated, decliners in the nation’s midsection and the Northeast proved the weak points.

El Paso Permian in Texas was down 18.5 cents to 5.5 cents, while Tenn Zone 5 200L in New York was off $1.085 to $1.605, and Algonquin Citygate near Boston was down 75.0 cents to $1.670.

The July Nymex contract, meanwhile, kicked off the covered period in rally mode on Monday but lost momentum as the week wore on because of simmering supply worries. It settled at $2.006 on Friday, down 3.5 cents on the day and down 6% from the prior week’s finish.

The past week’s relatively mild weather in the central and eastern United States was forecast to shift toward near-record heat across those regions and most of the Lower 48 by early August. LNG volumes also recovered from recent lows near 10 Bcf/d to above 12 Bcf/d during the past week. The rebound has proven choppy, owing to a gradual and uneven restart at the liquefied natural gas facility in Freeport, TX, after it was damaged earlier this month by the former Hurricane Beryl.

“Weather appears to be ready to heat up again in the Midwest and in the East, which combined with higher LNG feed gas flows could keep the market supported” in coming sessions, Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI.

However, production levels remained consistently above 100 Bcf/d during the week, according to Wood Mackenzie, and supplies in storage stayed well above historical norms.

This pointed to supply/demand balance uncertainty and kept many buyers on the sidelines, Andy Huenefeld, managing partner at Pinebrook Energy Advisors, told NGI. “People are watching production really closely, but volumes have been pretty steady, and that’s affecting the market’s psychology,” he said.

Natural gas supplies in storage held 16% above the five-year average, according to the latest federal data. This included a 15% surplus in the densely populated East.

“One of the big factors in this whole picture is going to be what the market foresees the overhang to be as we end the injection season” in the fall, Blair said.

On Wednesday of the past week, EQT Corp., the Lower 48’s top natural gas producer, weighed in with a bearish view on that front, saying it expected a surplus as the market enters the shoulder season. Its executives said that, following spring production curtailments, they expect to implement more in the fall.

“While the pace of eastern storage builds has moderated, absolute storage levels remain high on the back of warm winter weather last year,” CFO Jeremy Knop said Wednesday during EQT’s quarterly conference call. “In response to market fundamentals, we continue to tactically curtail production, including over the past weeks, and expect to continue this tactical curtailment program during the upcoming fall shoulder season.”

Futures fell in the wake of his commentary.

Stout Storage

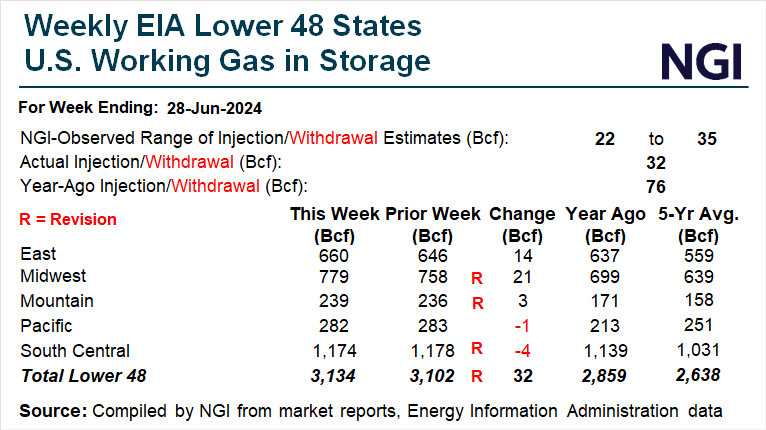

The prompt month dropped again Thursday after the latest U.S. Energy Information Administration (EIA) storage result proved bearish relative to expectations.

Polls showed analysts’ expectations coalescing around a build of 11-15 Bcf for the week ended July 19. EIA posted an injection of 22 Bcf. The Midwest and East regions led with injections of 13 Bcf and 11 Bcf, respectively, while Mountain region stocks increased by 3 Bcf. Pacific inventories were flat. The South Central printed a pull of 6 Bcf.

The overall increase lifted inventories to 3,231 Bcf, keeping stocks at a hefty surplus to the five-year average of 2,775 Bcf. The surfeit has been more than cut in half since the spring, but analysts remain concerned about excess supply.

Futures have been under pressure “partly due to surpluses just not decreasing as fast this summer as the natural gas markets were expecting,” meteorologist Rhett Milne of NatGasWeather said.

Looking ahead to the next EIA print, covering the week ended July 26, preliminary estimates submitted to Reuters ranged from additions of 15 Bcf to 51 Bcf, with an average increase of 39 Bcf. The estimates compared with an increase of 15 Bcf during the comparable week last year and a five-year average increase of 33 Bcf.

Forecasts for intense heat in August, however, could eat into the storage surplus, said EBW Analytics Group’s Eli Rubin, senior analyst.

“While natural gas remains oversupplied on a longer-term basis and susceptible to lower prices, modest upside is possible into early next month,” he said.

“Blistering August heat may reset power burns,” and “tiny storage builds in early August could ignite a sizable speculator short-covering event,” Rubin added. “While bearish risks abound, including swelling supply and renewed tropical threats, if storage containment concerns can be abated, Nymex gas futures appear to have moderate room to the upside.”

Friday Cash Prices

Spot gas traded Friday for delivery over the weekend and Monday lost ground across most of the Lower 48, with West Texas proving a particular weak spot. NGI’s Spot Gas National Avg. dropped 19.5 cents to $1.550.

A spate of relatively small but cumulatively disruptive maintenance events over the past week in the Permian Basin backed up supplies and flipped prices in West Texas into negative territory. It has become a common occurrence this year in the region, where an abundance of associated gas often outstrips takeaway capacity.

Additionally, the U.S. Geological Survey on Friday reported a 5.1-magnitude earthquake in West Texas. Friday’s quake was not immediately linked to pipeline issues, but it occurred only a few miles from a 4.9-magnitude rumbling earlier in the week that interrupted travel.

Permian Basin benchmark Waha dropped $1.540 on Friday to average negative $1.210.

Elsewhere, notable decliners included Florida Gas Zone 3, down 18.0 cents to $2.430, and El Paso San Juan, off 54.0 cents to $1.710.

NatGasWeather said Friday that thunderstorms and rainy conditions would track through the eastern third of the Lower 48 as well as Texas over the weekend to keep high temperatures at seasonal levels. However, parts of the Southeast, central and western United States were forecast to bake under highs in the 90s and 100s.

Then, in the week ahead, the firm said, “most of the U.S. will warm above normal with highs of upper 80s to 100s for strong demand.”

Looking at the first third of August, the forecaster added, “hot upper high pressure will rule most of the U.S.,” extending highs from near 90 to well into the triple digits for “very strong national demand.” The hottest conditions were expected in the deserts of California and the Southwest.

Prices were nevertheless under pressure Friday in the West. SoCal Citygate slumped 52.0 cents to $2.390, and KRGT Del Pool in Nevada fell 39.0 cents to $2.335.

On the tropical storm front, AccuWeather meteorologists said conditions over the past week were calm. However, the firm’s forecast on Friday noted that “an area of low pressure recently pushed off the coast of Africa and into the eastern tropical Atlantic…There is the potential for development” and “a surge of tropical activity in August.”

The firm noted that record warm ocean temperatures created conditions ripe for an active hurricane season, particularly from August into October.

"We are expecting a significant uptick in Atlantic tropical activity beginning in August, regardless of whether the wave near Africa develops later on or not," AccuWeather’s lead hurricane forecaster Alex DaSilva said.

This would follow the former Hurricane Beryl, which made landfall along the Texas coast in early July, causing disruptions at export facilities and dampening LNG demand for weeks.