Weekly natural gas cash prices slipped lower in the week as abundant Lower 48 supply undercut support from strong cooling demand and LNG feed gas flows.

NGI’s Weekly Spot Gas National Avg. for the July 31-Aug. 2 trading period fell 1.5 cents to $1.760/MMBtu.

Declines were focused in the Rockies and South Central region.

El Paso Permian in Texas was down 63.0 cents to negative 57.5 cents. El Paso San Juan in the Rockies fell 24.0 cents to $1.870. Meanwhile, Algonquin Citygate near Boston rose 27.5 cents to $1.945.

Futures trading was volatile in the week that saw the August contract roll off the board. A nearly 22.0-cent jump on Tuesday was followed by three down days. The September Nymex futures contract on Friday settled at $1.967, down 0.1-cent on the day and down 3.9 cents from the previous week’s close.

Production levels climbed further in the week, keeping concerns about storage surpluses at top of mind. The seven-day average for Lower 48 output rose 0.4 Bcf/d to 102.5 Bcf/d from the previous week, according to Wood Mackenzie. Wednesday (July 31) at 103.2 Bcf/d was the highest day since late February.

Chesapeake Energy Corp. and Comstock Resources Inc. helped boost futures on Wednesday by indicating they would keep output curtailments in place.

Chesapeake management said it was prepared to cut more, as it did during the weak shoulder season, and did not anticipate loosening the spigot in the Haynesville Shale this year.

Similarly, Haynesville-heavy Comstock said it had reduced drilling activity and would wait for prices to turn more favorable before it added back completion crews. Comstock management noted that private exploration and production companies also have reduced activity until prices turn higher.

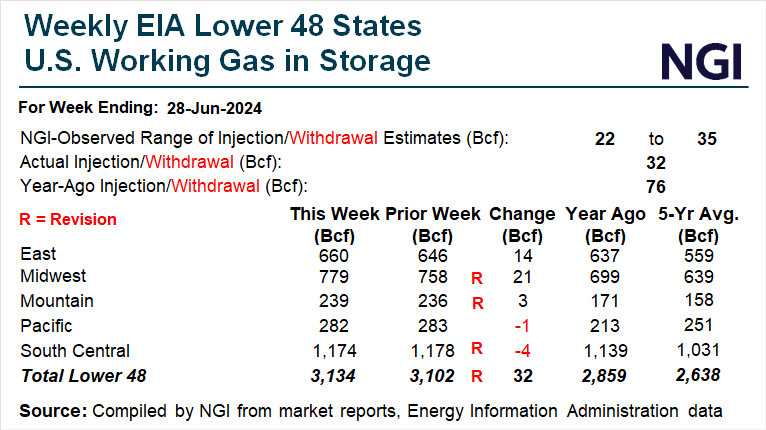

Storage worries returned after Thursday’s weekly government storage report that showed an 18 Bcf injection into storage for the week ending July 26. While the increase was lighter than analyst expectations and the five-year average of 33 Bcf, it was 3 Bcf heavier than a year earlier. Combined with cooler forecasts for August, the still hefty trend for storage left a short-lived rally in futures “as a fleeting glimmer of hope for a market still waiting for production declines,” analysts at Mobius Risk Group said.

On the demand side, feed gas flows to North American liquefied natural gas export terminals hovered around 13 Bcf/d throughout the period, up about 1-2 Bcf/d week/week, according to NGI’s U.S. LNG Export Tracker. Notably, all three of Freeport LNG’s trains have been brought online, keeping feed gas pace at or above 2.1 Bcf/d more than two weeks since its outage.

Extra Summer Innings?

Weather forecasters predicted a scorching summer that would support gas power burns. Now, they are saying to expect a longer hot season that could keep power burns elevated deep into the injection season.

AccuWeather’s long-range forecasters said summer-like heat was expected to last well into autumn across most of the Lower 48.

“Fall is going to feel more like an extended summer for millions of Americans this year,” said AccuWeather meteorologist Paul Pastelok. “Much of the country will experience a delayed transition to cooler temperatures this year, following a summer with intense heat.

“We’ve seen record-high temperatures shattered in several cities across California, Nevada, Oregon, Utah and North Carolina this summer. We could see more record temperatures this fall,” Pastelok said.

The AccuWeather fall forecast predicted temperatures would hover one to three degrees above the historical average for most of September through November. The firm said even higher temperature departures were expected across parts of the Great Lakes region, the Midwest and the Rockies.

Forecasters said the only areas where above-historical-average temperatures were not expected this fall were along coastal areas in the Southeast and West.

Spot Prices Stumble

Physical cash prices sank Friday for deliveries over the weekend and Monday.

The Southeast Regional Avg. dropped 15.0 cents day/day to average $1.955 ahead of the looming tropical storm that is expected to dampen the region’s cooling demand.

Among the leading decliners, Waha slumped $1.065 to average at a negative $1.145. West Texas prices have traded in the negative amid a glut of supply caused by pipeline constraints.

Relief is on the way in the form of the 2.5 Bcf/d Matterhorn Express Pipeline expected to come online later this year. On Thursday, a consortium of operators that own the Whistler system added another pipeline to the mix. The 2.5 Bcf/d, 365-mile Blackcomb Pipeline would move forward, with its first flows to the Agua Dulce hub in South Texas expected by the second half of 2026.

Elsewhere, price moves were more modest. Chicago Citygate in the Midwest shed 8.5 cents to $1.740.

However, moves were more pronounced in some regions. Northwest Sumas in the Rockies fell 32.0 cents to $1.650. PG&E Citygate in California was down 24.0 cents to $3.395.

NatGasWeather said both the American and European models on Friday advertised “very strong national demand through” the weekend and into the week ahead “as hot high pressure rules most of the U.S. with highs of upper 80s to 100s.”