Natural gas cash prices rode a searing heat wave to strong gains for the trading week – led higher hubs in the South and the West.

NGI’s Weekly Spot Gas National Avg. for the July 11-15 period cruised ahead 88.5 cents to $6.730.

Extreme heat and dry conditions across most of the Lower 48 bolstered demand and prices. At the same time, U.S. production hovered between about 94 Bcf and 96 Bcf – below the 97 Bcf that many analysts had expected to see by July.

Producers have wrestled with unplanned maintenance events just as the peak of summer nears, raising concerns about supply/demand imbalance.

Florida Gas Zone 3 finished the week up $1.100 to $11.090, while Southern Pines gained $1.490 to $10.940 and Southern Border, PG&E jumped $1.555 to $7.245.

The August Nymex natural gas contract took a winding path but it, too, ultimately advanced for the week. The prompt month settled at $7.016/MMBtu to close trading on Friday, up 16% from the prior week’s finish.

A June fire and protracted outage at the Freeport LNG facility scaled back U.S. export capacity by about 2.0 Bcf/d through at least early fall. That gas is now available for domestic consumption, including storage. The sudden addition of supplies boosted the market’s capacity to meet U.S. demand, despite recent lackluster production, and continued to give bears room to roam at times over the past week.

On other days, however, record-setting high temperatures and nearly insatiable cooling demand propelled futures higher.

Forecasters called for equally strong demand in the week ahead.

The pattern “remains exceptionally hot and bullish as unseasonably strong upper high pressure rules most of the U.S. with highs of 90s and 100s,” NatGasWeather said.

Volatile Nymex Futures

Natural gas futures flew at times and stumbled at others, but the August contract ultimately gained ground for the week as questions festered about utilities’ collective ability to meet robust summer demand at a time when production seemingly cannot sustain momentum.

“The summer months have barely just started and higher temperatures are all but certain in late July and early August,” Rystad Energy analyst Ryan Kronk said.

In addition to domestic consumption, Kronk noted, European demand for U.S. liquefied natural gas remains elevated amid Russia’s war in Ukraine. Europe is cutting ties with Russia to oppose the war and establish long-term energy security. The continent needs U.S. LNG to fill the gap. Temperatures also are soaring in the UK and Europe.

With LNG feed gas volumes averaging more than 11 Bcf/d this month, U.S. export facilities in operation are essentially working at full capacity to meet global demand, including the steady calls from Europe. This provides a bullish undercurrent for U.S. prices.

The combination of strong demand and modest production leaves markets guessing about the adequacy of supplies in storage for next winter.

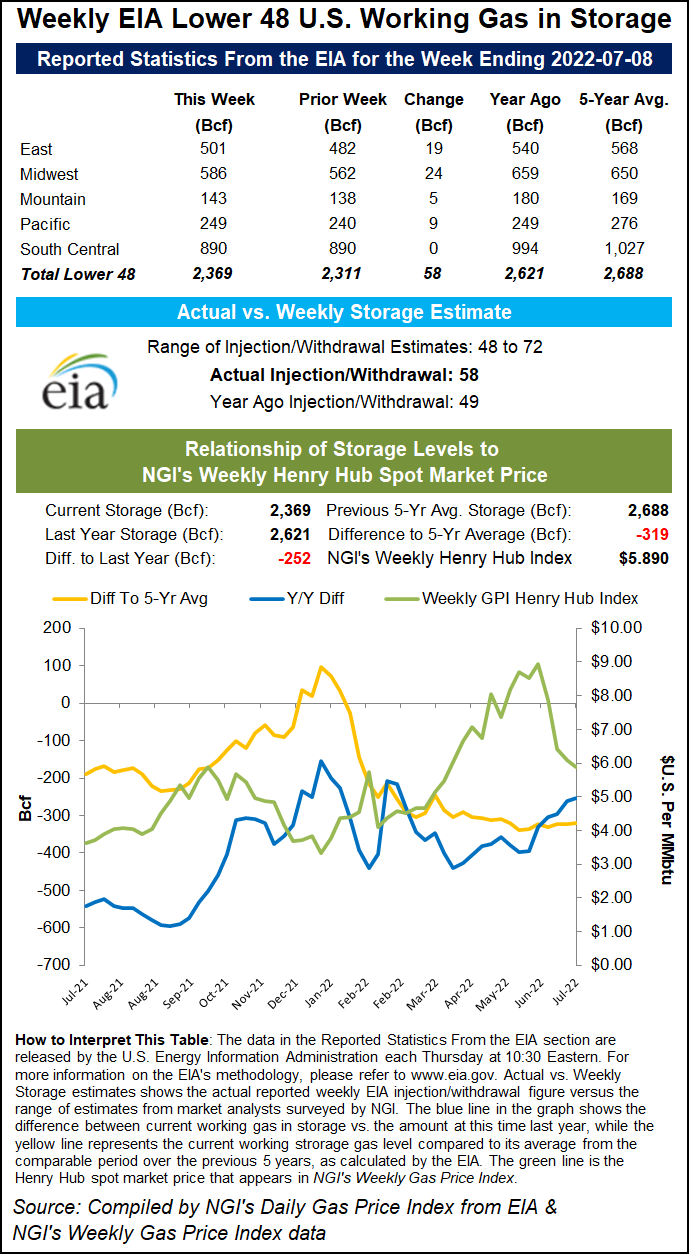

The U.S. Energy Information Administration’s (EIA) latest inventory report on Thursday showed an injection of 58 Bcf natural gas into storage for the week ended July 8.

The result was essentially in line with expectations but appeared bearish when compared to a 49 Bcf build during the comparable week last year and a five-year average injection of 55 Bcf.

The injection boosted working gas in storage to 2,369 Bcf.

However, stocks were 252 Bcf lower than a year earlier and 319 Bcf below the five-year average ahead of the dog days of summer.

Analysts on The Desk’s online energy platform Enelyst noted that the build would have been much smaller – and the storage deficit notably wider -- if not for the ongoing Freeport LNG export outage. Even with the Freeport boost to domestic supplies, South Central region stocks were flat for the July 8 period, a sign that vexing heat in Texas and neighboring states may take a toll on storage.

Some analysts on Enelyst predicted an injection in the 30s Bcf with the next EIA report, covering the week ended July 15. That would compare with an injection of 50 Bcf during the comparable week in 2021 and a five-year average injection of 41 Bcf.

“If supply fades ahead of peak summer heat, it could reinforce upward pressure for the August contract into late July,” said EBW Analytics Group’s Eli Rubin, senior analyst.

Following a rollercoaster ride of gains and losses during the week, the prompt month rallied Friday on the imbalance concerns and finished the final session of the week up 41.6 cents day/day.

Friday Spot Prices

Natural gas cash prices fell Friday – after rising most of the week – ahead of the weekend respite from the intense heat. NGI’s Spot Gas National Avg. pulled back 22.0 cents for Saturday through Monday delivery to $6.600

NatGasWeather said national demand would likely ease over the weekend as rainy conditions and “comfortable” highs of 70s and 80s were expected to track from the Great Lakes into the Northeast.

High temperatures in Southern California eased, too, falling into the low 80s Friday and projected to stay in the 80s over the weekend, aside from the deserts.

In the East on Friday, Columbia Gas shed 10.5 cents day/day to $6.015, while Tenn Zone 1 100L fell 27.5 cents to $6.195.

Out West, SoCal Citygate dropped 62.5 cents to $7.380 and SoCal Border Avg. lost 76.0 cents to $7.025.

Prices also retreated in Texas – after run-ups earlier in July amid the relentless heat. Waha fell 35.0 cents to $6.025.

Still, elevated natural gas consumption was expected throughout the western, central and southern United States to start the week ahead, NatGasWeather said. Hot high pressure was forecast to deliver highs of upper 80s to 110s.

“Hot conditions continue from California to Texas with highs of mid-90s to 100s” as well as highs in the 90s “across the Plains and Southeast,” the forecaster said.

Those conditions were forecast to expand “to rule most of the U.S.” late into July as well, NatGasWeather added.