In the workweek ahead of the Fourth of July, natural gas cash prices dropped amid strong production and easing demand because of a cooldown in the country’s midsection and business closures for the holiday.

NGI’s Weekly Spot Gas National Avg. for the July 2-8 period fell 54.0 cents to $1.500/MMBtu.

Production reached a fresh three-month high at 102.1 Bcf/d on Monday and had hovered above 100 Bcf/d over the recent seven-day period as the majority of volumes shut in by producers earlier this year returned, analysts said.

Additionally, weather outlooks erased six to seven cooling degree days (CDD) as heat was expected to die down in the Midwest and Plains. A cooldown was also forecast for Texas. Lower holiday demand, combined with that, added to the downside pressure.

In the Midwest, Dawn averaged $1.545 off 56.0 cents in heavy volume trade. Chicago Citygate slid 53.5 cents to $1.615

In West Texas, Waha fell $1.350, entrenched in the red at an average of negative $2.565.

Even as extreme heat was expected to maintain a grip on the West Coast, with temperatures surging into the 100s in California, the SoCal Border Avg. was off 33.5 cents to $1.965, while PG&E Citgate notched a 1.0 cent gain to $3.030.

Nymex futures, meanwhile, extended a losing streak into a seventh day. The August contract tumbled 1.7 cents Wednesday to close the shortened week at $2.418. July futures expired a week earlier, down 12.8 cents at $2.628.

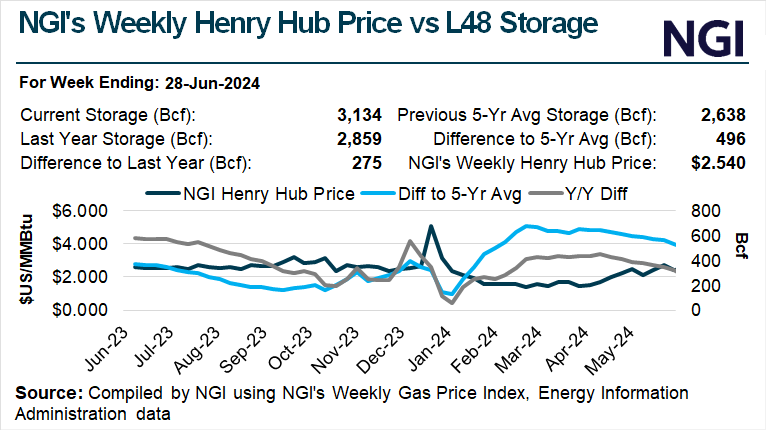

With the solid Lower 48 production, the natural gas storage surplus relative to the five-year average, while narrowing, remained substantially deep into July. This kept supply/demand balance concerns festering and provided fodder for the bears.

During this period, news on the LNG front supported both market bears and bulls.

Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI that feed gas volumes to domestic liquefied natural gas facilities are likely to climb this summer to meet rising overseas demand. This includes heavily populated Asian countries that are wrestling with heat waves.

A ruling by the U.S. District Court for the Western District of Louisiana may help the U.S. meet the rising export demand. It ordered the Biden administration to end its “pause” on new permits for LNG export facilities.

In bearish news, Freeport LNG staff told Texas officials that the facility’s Train 2 suffered a trip that reduced feed gas flows over the June 29-30 weekend. Though service regained its earlier June pace with nominations at around 1.9 Bcf/d, the recent series of trips at the facility remained a worry for the market, which is counting on increases in exports to help eat away at domestic gas supply.

Weather Front

Hurricane Beryl further bolstered demand-side woes during the period. The Category 4 storm formed at a historically rapid pace and was the earliest a storm of that magnitude had developed in the history of Atlantic hurricane seasons, the National Hurricane Center (NHC) said.

Beryl’s eyewall was expected to pass south of Jamaica on its way to striking Mexico’s Yucatan Peninsula on Friday, NHC said.

After that, NHC said “there remains uncertainty in the track and intensity forecast of Beryl over the western Gulf of Mexico this weekend. Interests in the western Gulf of Mexico, including southern Texas, should monitor the progress of Beryl.”

NHC said Beryl would weaken more over the Yucatan, “then slowly re-intensify over the Gulf of Mexico in a somewhat more favorable environment. The intensity forecast again calls for the cyclone to regain hurricane strength before it reaches the western Gulf coast.”

On Storage

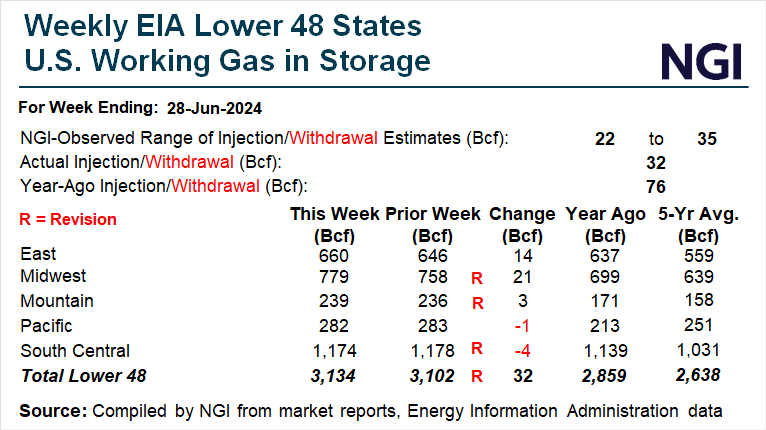

The U.S. Energy Information Administration (EIA) reported a 32 Bcf build of natural gas in storage for the week ended June 28. The result was within the expected range and included a bearish revision for the prior week.

The increase lifted inventories to 3,134 Bcf. Stocks remained above the year-earlier level of 2,859 Bcf and the five-year average of 2,638 Bcf. The 32 Bcf build came as EIA revised storage data up 5 Bcf for the previous week.

NatGasWeather meteorologist Rhett Milne attributed the light storage build to hot conditions over much of the southern two-thirds of the U.S., including highs in the mid-90s and 100s for Texas during the review week.

“After the Fourth of July weekend passes, rebounding heat and post-holiday demand, the subsequent four EIA storage weeks may average 99 CDDs/week, which may lead to rising power burns and stem the bleeding for natural gas,” EBW Analytics Group analyst Eli Rubin said.

Rubin noted that the scorching heat is forecast to endure into August.

“If forecasts verify, Nymex futures could trend higher,” he said. Still, the weather bust of the past three weeks has led the market to refocus on the “bloated storage levels.” That was “mitigating upside,” Rubin said.

Friday Cash Prices

Trading volumes were generally thin, and prices were mostly lower for gas deliveries through the long July Fourth holiday weekend.

West Texas prices mostly tumbled. Oneok Wes Tex bucked a wider downtrend, adding $1.455 to a still negative 6.0 cents. Waha, meanwhile, shed $1.915 and moved deeper into the red to negative $3.795.

“Texas will cool a few degrees this weekend due to a weather system tracking across the Plains, as well as from likely showers from approaching Beryl, but still very warm overall,” NatGasWeather said.

Meanwhile, impressive heat was expected for California, with highs reaching 100-117 degrees over much of the state, as well as highs of 90s-100s over the Pacific Northwest.

Even with the heatwave, California’s SoCal Citygate lost 23.0 cents to $2.015. Malin fell 15.5 cents to $1.540.