Weekly natural gas cash prices advanced amid sizzling summer temperatures and robust cooling demand across wide swaths of the Midwest and East.

NGI’s Weekly Spot Gas National Avg. for the June 17-21 period climbed 11.0 cents to $2.110/MMBtu.

Conditions during the week were defined by daytime highs from the upper 80s to the low triple-digits. The scorching heat got air conditioners cranking and physical prices climbing.

“The major heat wave” baked heavily populated markets from the central United States across to the East Coast, including New York City, fueling robust demand, Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI.

At the culmination of the week, Chicago Citygate was up 11.5 cents to $2.125, while Niagara in New York was ahead 50.0 cents to $2.110, and PNGTS in New England was up $1.490 to $3.685.

Futures, however, failed to find momentum during the week as traders focused on rising production levels, Blair noted. Following a spring pullback to as low as the mid-90s Bcf/d, producers ramped back up in June to align with mounting summer demand. Production averaged more than 101 Bcf/d throughout the past week, according to Wood Mackenzie estimates on Friday.

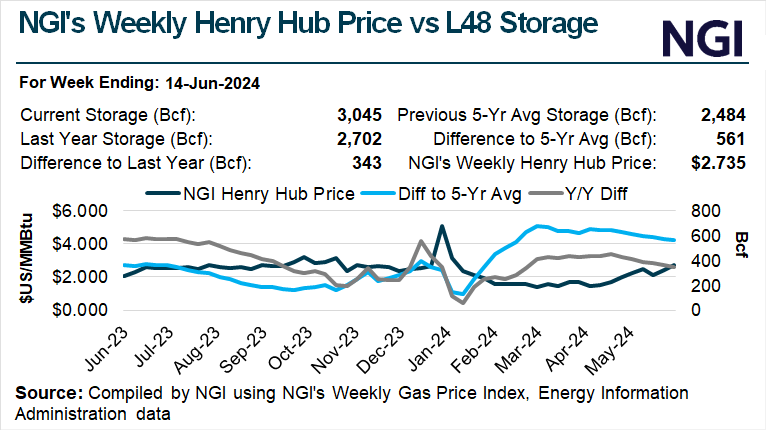

The July Nymex contract settled at $2.705 to close trading on Friday, down 3.6 cents on the day and down 6% from the prior week’s finish.

“I don’t think there is any denying the heat is here,” StoneX Financial Inc.’s Thomas Saal, senior vice president of energy, told NGI. “But with production coming back, I think the market is a little cautious and wants to see cooling demand remain strong as forecasted before getting too bullish.”

Looking to the trading week ahead, National Weather Service forecasts called for continued lofty temperatures. While pockets of the East Coast were expected to see reprieves from the most intense heat, peak summer-like conditions were projected to cover much of the Lower 48, including the West Coast.

“Blistering heat…may settle in for the better part of the next month,” said EBW Analytics Group’s Eli Rubin, senior analyst. “Record heat to end June may extend with the July forecast to smash the hottest July of the past 10 years.

“Focus on demand – and a likelihood of sharply lower weekly storage injections – may fuel” an “overshoot of long-term fundamentals,” Rubin added. “Upside remains a weather-dependent bet on the extent of incoming heat, however.”

Storage Situation

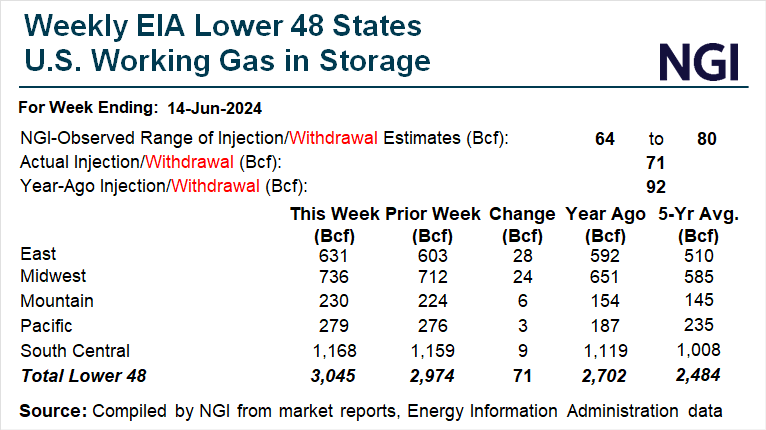

Futures finished the week on a sour note after the U.S. Energy Information Administration (EIA) reported an injection of 71 Bcf natural gas into storage for the week ended June 14. EIA issued the report a day later than usual because of the Juneteenth holiday on Wednesday.

From a price perspective, the result compared bullishly with the five-year average increase of 83 Bcf. However, it was slightly above the 69 Bcf median expectation found by polls, leaving traders to focus on the stronger production volumes and still lofty levels of gas underground. NGI also modeled a 69 Bcf increase.

Gelber & Associates analyst Ryan Parsons said on the online energy platform Enelyst that rising production could offset the strong summer demand so far and the forecasts for more.

He also noted the June 14 startup of the long-delayed Mountain Valley Pipeline LLC (MVP). While expected to build gradually toward shipment of its full 2 Bcf/d capacity, the MVP addition in the East will “push us even higher by early next year,” Parsons said of production.

The latest storage injection boosted stocks to 3,045 Bcf. That was 23% above the five-year average, though the surplus was down about a percentage point from the prior report.

By region, the East and Midwest led with builds of 28 Bcf and 24 Bcf, respectively, according to EIA. The South Central injection of 9 Bcf followed. Mountain region stocks increased by 6 Bcf, while Pacific inventories rose by 3 Bcf.

For the June 21 EIA storage period, analysts looked for a seasonally soft build, given the searing heat of mid-June. Early estimates submitted to Reuters ranged from additions of 30 Bcf to 66 Bcf. The estimates compared with a five-year average increase of 85 Bcf.

Friday Cash Prices

Spot gas prices were mixed on Friday, with strong gains in the West but pullbacks in the Midwest and Northeast after rallies earlier in the week. NGI’s Spot Gas National Avg. ticked down 4.0 cents to $2.075.

Algonquin Citygate near Boston fell 16.0 cents day/day to average $2.240, for example, while Joliet in Illinois shed 4.0 cents to $2.135.

Out West, however, gains were widespread.

SoCal Citygate climbed 22.0 cents to $1.995, while Malin in the Northwest advanced 16.0 cents to $1.955. El Paso S. Mainline/N. Baja in the Southwest gained 23.0 cents to $1.900.

For the week ahead, NatGasWeather said forecasts as of Friday called for upper high pressure to “rule vast stretches” of the Lower 48. This could deliver highs of 80s to lower 90s across the northern third of the country and upper 80s to 100s elsewhere. Extreme heat is in the cards for portions of the heavily populated West Coast and across the South “for strong to very strong demand.”

The “long-range data maintains a hotter-than-normal U.S. pattern for the first half of July,” the firm added, “to keep weather patterns to the bullish side.”

An active start to the 2024 hurricane season presents an ongoing wildcard, however, said Wood Mackenzie analyst Kara Ozgen.

Alberto, the first named storm of the season, dissipated by Friday, but not before it crossed over Mexico and delivered chilling rains and power outages to South Texas, dampening demand there. The system peaked at tropical storm strength.

Another disturbance had emerged in the same area as Alberto, Ozgen noted Friday. The National Hurricane Center said Friday it had a 60% chance of forming into a storm during the week ahead, presenting the possibility for another bout of heavy rains impacting portions of the Lone Star State.

Additionally, a disturbance west of Florida held the potential to form over the weekend as it approached the Southeast. “While this might bring some marginally cooler temps to portions of the Southeast,” Ozgen said, forecasts showed the region “warming back up to above-normal temps starting late Saturday” and extending into the coming trading week.