Weekly natural gas cash prices jumped across regions as summer heat ramped up ahead of record levels later this month. Futures topped $3/MMBtu before falling back on hints of higher production.

NGI’s Weekly Spot Gas National Avg. for the June 10-14 trading period rose 28.5 cents to $2.000.

Prices in Texas led gains, followed by the Midwest and North Louisiana.

West Texas prices, which had struggled to reach positive levels as recently as May, traded above $1 for the first time since February. El Paso Permian jumped 76.5 cents week/week to average $1.235.

Elsewhere in Texas, Tres Palacios rose 46.0 cents to $2.420.

In the Southeast, Transco Zone 5 North jumped 83.0 cents to $3.250 as maintenance work cut southbound flows through Maryland north of the hub. Transcontinental Gas Pipe Line Co. LLC (Transco) started maintenance scheduled to run until June 21 that cut southbound flows by about 400 MMcf/d.

Among top decliners, NOVA/AECO C in Canada fell C34.0 cents to C68.0 cents/GJ.

In futures markets, the July Nymex contract on Friday settled at $2.881, down 7.8 cents on the day and down 3.7 cents from the previous week’s close.

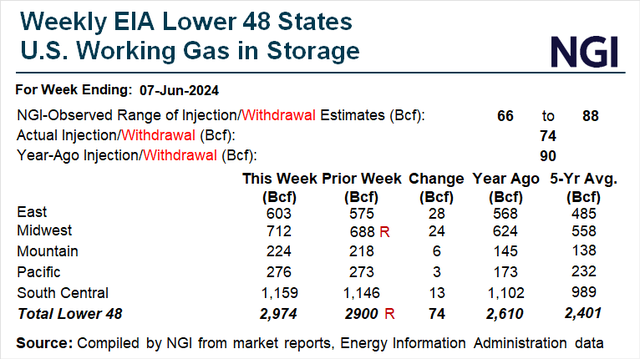

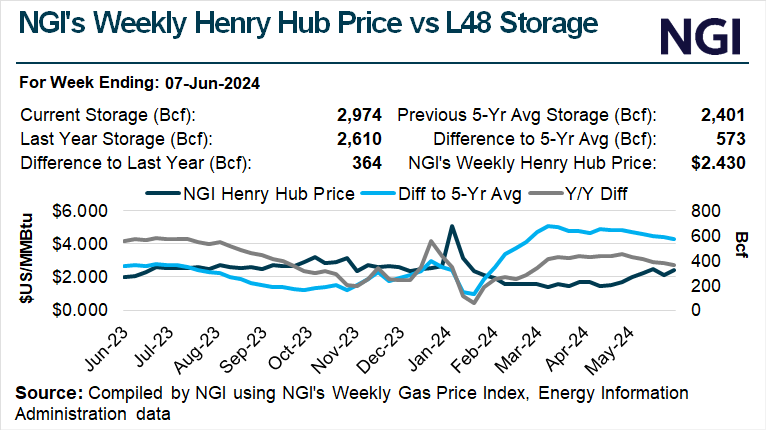

During the week, the path for futures was down in all but one session. That day was Tuesday, when futures soared 22.3 cents after trading as high as $3.159. But bulls could not maintain the upward momentum as a new pipeline shifted attention to supply. That pendulum swung further on Thursday when bears seized on upward revisions to May government gas inventory tallies, overshadowing an in-line storage print for the first week of June.

Friday’s announcement by Equitrans Midstream Corp. that it was starting up service for the 2 Bcf/d Mountain Valley Pipeline LLC (MVP) signaled that more supply was on the way. The 303-mile, 42-inch pipeline will move supply from Appalachia to the Southeast.

Summer Heat

Prompt month Nymex futures retook the $3 level this week for the first time since January on the back of record-hot weather forecasts for the second half of June and continued supply restraint by producers.

Forecasts are advertising record heat for the second half of June. High temperatures were forecast for next week with highs in the 90s and 100s in the southern and eastern portions of the country. Into the following week, temperatures were forecast from the mid-80s to lower 90s across the northern reaches and from the upper 80s to 100s to the southern part of the country.

However, forecasters have cautioned that the weather models could trend cooler, and the actual heat could turn out to be less than expected, NatGasWeather meteorologist Rhett Milne said on the online energy platform Enelyst.

All of last summer, both the European and American weather models over-forecast the heat, Milne said. “In reality, cooling degree days (CDD) didn’t prove to be quite that hot,” he said. Looking at last summer’s forecasts, both models overshot for CDDs every day compared with the conditions that played out, he said.

“The point being” the two models “are likely too hot,” Milne said. “But even then, they are both plenty hot enough to where stronger-than-normal national demand is expected and with further reductions in surpluses coming.”

Another factor for summer gas demand – analysts have highlighted how rising renewable energy capacity was already eating into natural gas’ share of the power stack.

London Stock Exchange Group analyst Saheed Olayiwola said for the latest storage report period, CDDs rose 20% year/year, but residential demand for gas fell because of increased generation from wind and solar, he said. Gas power burns in the week were 2% lower than a year earlier, he said.

The pullback came as wind and solar generation were lighter week/week in the period, Milne said.

That downward trend would follow analyst forecasts calling for summer gas power burns to decline year/year. Wood Mackenzie estimated natural gas power generation would drop 1% this summer, while solar generation would jump 22% and wind would rise 10%.

Physical Trade

Cash prices for natural gas on Friday fell for a second day as output increased ahead of stronger cooling demand this weekend.

Southeast prices fell as the region gained a new link to Appalachian Basin gas with the startup of MVP. The 303-mile, 42-inch pipeline would supply gas from the Marcellus and Utica shale formations to the Mid-Atlantic and Southeast regions via an interconnect with Transco.

Transco Zone 5 slid 18.5 cents day/day to average $3.455. In contrast, upstream in Appalachia, Texas Eastern M-2, 30 Receipt added 3.5 cents to $1.630. That put the spread between the two regions at $1.825, down from $2.035 a week earlier.

One possible pull for MVP gas flows south along Transco: Transco Zone 5 North, at $2.995, widened its discount Friday to about 50 cents relative to Transco Zone 5 South at $3.465.

In South Louisiana, Henry Hub fell 5.5 cents to $2.735. TC Energy Corp.’s ANR Pipeline Co. on Thursday lifted a force majeure at its Evangeline southbound location in Louisiana that had cut capacity to below 1 Bcf/d since June 4. Southbound nominations rose to around 1.1 Bcf/d for Friday, nearing the operational capacity of about 1.3 Bcf/d, Wood Mackenzie analyst Alex Sealy said.

Prices in East and South Texas were also among the top decliners. Katy fell 27.0 cents to $2.280.

Regional gains were seen in the Northeast and Canada. Algonquin Citygate near Boston rose 8.5 cents to $1.895.