Natural gas prices slipped lower in May bidweek trading as the month’s expected uptick in cooling demand was upstaged by hefty inventory levels and recent bumpy performances by Gulf Coast LNG terminals.

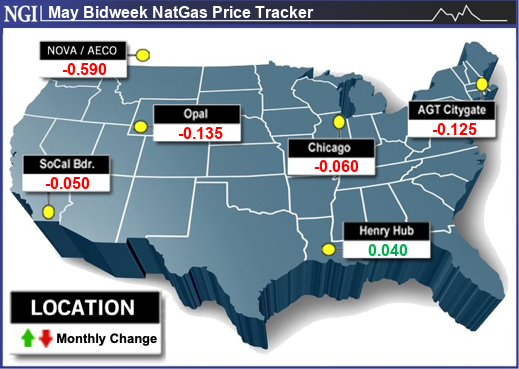

NGI’s May Bidweek National Avg. fell 7.0 cents month/month to $1.240/MMBtu. Trading for the latest bidweek period spanned April 24, 25 and 26 when hiccups at the Freeport liquefied natural gas export terminal and a bearish government storage print kept views biased toward looser fundamentals.

On the final day of the latest bidweek period, the May Nymex natural gas futures contract rolled off the board with a 2.6-cent loss to $1.614. Low-volume trading briefly sent the contract below the $1.500 level that day.

The May 2024 bidweek average is well below the $2.020 average a year earlier. Like last year, Lower 48 markets are flush with natural gas inventories after a mild winter. However, this year storage levels are 22% higher at 2,425 Bcf than a year ago as of April 19, according to the U.S. Energy Information Administration (EIA). That is a surplus of 655 Bcf, or 37%, to the five-year average.

Natural gas prices are lower this year “because the inventory levels are higher,” Snapper Creek Energy analyst Kyle Cooper told NGI. “Overall, there is more concern about potential containment at the end of this injection season.”

EIA has projected the United States would finish this year’s injection season with 4,120 Bcf of natural gas in storage, which would be the most on record. That amount would exceed the critical 4,000 Bcf level above which could begin to test capacity limits of the country’s storage facilities. Markets faced a similar fear in 2023, but a hot summer helped melt those concerns away.

Similarly, the National Weather Service (NWS) has forecast that this year’s summer is likely to be a scorcher. If that outlook plays out, it would help balance an oversupplied market and begin to turn around a price slump that has touched 25-year lows.

But the risk remains that the summer could not come in as expected. Longer-term forecasts for the months ahead still have limited accuracy, forecasters have said.

“It’s certainly within the realm of possibility” that storage levels could be maxed out, “especially if it’s a mild, windy and sunny summer,” Cooper said. In addition, forecasts for an active hurricane season could translate into tropical storms that disrupt LNG exports, according to Cooper. The storms could stall LNG feed gas flows and test the operational limits of South Central storage facilities.

“Hurricanes are almost 100% going to be bearish,” Cooper said.

South Leads Gains

That said, the expected arrival of summer-like heat soon in southern regions modestly supported their respective May bidweek prices.

In the Southeast, Transco Zone 5 that runs from Virginia to the Carolinas added 6.5 cents to $1.765, while Florida Gas Zone 3 that includes western areas of the state’s panhandle climbed 14.0 cents to $1.820.

To the north in Appalachia, prices for all but one hub increased from April. Texas Eastern M-2, 30 Receipt increased 2.0 cents to $1.240.

The other gains for May, modest as they were, were largely confined to portions of the South Central region. In East Texas, the Houston Ship Channel added 1.5 cents to $1.345. In South Texas, NGPL S. TX added 4.0 cents to $1.300.

Meanwhile, in South Louisiana, Henry Hub climbed 4.0 cents to $1.610.

These price increases across portions of the southern United States ran counter to the overall trend lower for May as high inventory levels drowned out any urgency to buy baseload deliveries ahead of incoming warmer temperatures.

West Texas prices fell the hardest for May bidweek. El Paso Permian fell 44.5 cents to an average of negative 46.0 cents. May marks the second bidweek month that the region’s prices averaged in the negative, mirroring cash prices that struggled to break above zero for most of March and April.

The culprit for negative prices has been pipeline and LNG terminal maintenance stranding gas supply in the Permian Basin. Those constraints are expected to continue with more maintenance planned in May. Sputtering start-and-stop operations at Freeport LNG also have held back exports and raised doubts about the facility’s ability to ramp up operations.

Elsewhere, declines were a mix of single and low double digits. In the Midwest, Dawn was one of the most actively traded of all hubs for the month. It declined 16.0 cents to $1.430.

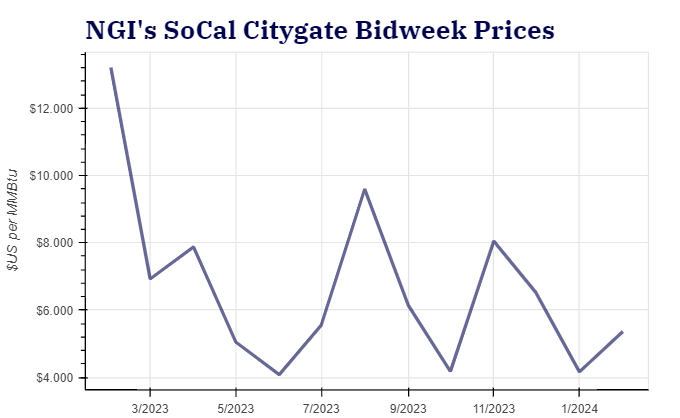

In the Rockies, prices fell by 10.0 cents on average, while average price declines in California and the Northeast were in the single digits.

Output Cuts In Focus

Production cuts put in place since February – when output levels topped out around 107 Bcf/d – have acted as support for natural gas prices by countering the mountain of gas in storage. The 30-day average for production levels rode into early May at 99.2 Bcf/d, down by 2.3 Bcf/d from a year earlier, according to Wood Mackenzie data.

A big question for the market is how long producers plan to keep those cuts in place. The country’s largest gas producer, EQT Corp., said it would keep its 1 Bcf/d of production curtailments in place at least through May. The company indicated it could extend the cuts depending on market conditions. CEO Toby Rice said he expected other operators to remain patient and exercise discipline on production.

Chesapeake Energy Corp. said Wednesday it would continue its curtailments until demand rebounds and gave guidance that its cuts would extend through the end of June – excluding volumes to be gained from forthcoming merger with Southwestern Energy Co. “The market is pretty clearly oversupplied,” CEO Nick Dell’Osso said.

Snapper Creek’s Cooper said one of the things he was watching closely was how long Chesapeake and EQT would keep their production voluntarily curtailed. “That could certainly put a lid on things if we get back to $2.25 on the Nymex,” and that attracts production to come back.

“We’ll see how they do. We’ll see what June production looks like and if there’s any indication EQT is bringing output back.”