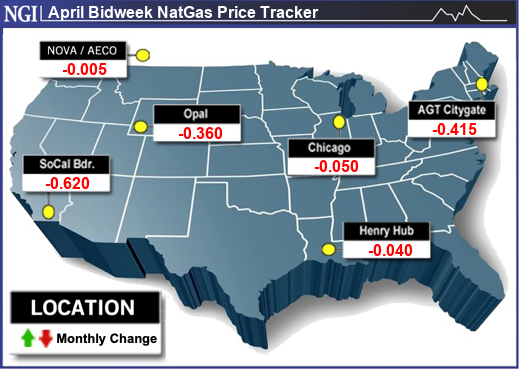

Natural gas prices were modestly lower in April bidweek trading as the transition from winter to spring signaled milder weather, weakening demand and an end-of-season natural gas supply swelling to the brim.

NGI’s April Bidweek National Avg. fell 19.5 cents month/month to $1.310/MMBtu. That was down from $2.180 a year earlier.

Trading for the latest bidweek period spanned March 22, 25 and 26. The weather offered little support, as mostly mild conditions stretched across large swaths of the country. The National Weather Service forecasts called for more of the same for April as above-normal temperatures are expected to span the upper tier, and mostly normal temperatures are seen elsewhere.

Against a more dominant downtrend, some modest gains were recorded in Appalachia in bidweek trading as weather forecasts pointed to light to moderate gas demand into the first few days of April. At Texas Eastern M2, 30 Receipt, a gain of 4.5 cents brought the average to $1.220, while Eastern Gas South gained 7.0 cents to $1.265.

Appalachian gas production kicked off April at a seasonal low of 33 Bcf/d, with no indication of the return of 1 Bcf/d of supply from EQT Corp., said Criterion Research Vice President of Research James Bevan.

Elsewhere, modest losses were widespread as mild weather is expected to take hold, and the natural gas withdrawal season is ending with bloated storage facilities.

Gelber & Associates analysts said end-of-season inventory forecasts still point to a 2.23 Tcf carryout for the beginning of the injection season. Worries persist that natural gas inventories could soar beyond storage capacity limits by October.

Producers, including EQT, have been trimming natural gas output to rein in production, but the Gelber analysts said the bullish response to cuts “has so far been relatively weak.”

Additionally, the pullbacks could be short-lived, according to The Desk’s John Sodergreen, editor-in-chief. Sodergreen recently spoke with investors and officers from U.S. funds and exploration and production (E&P) companies.

“What we see now, in terms of slowing volumes, is a very temporary condition,” Sodergreen said. E&Ps expected volumes to be up fairly quickly – by the end of the second quarter as E&Ps focus on the summer.

At the same time, Freeport LNG took Trains 2 and 3 offline for inspections expected to last into May. Demand for liquefied natural gas was averaging below 13 Bcf.

“Natural gas traders are hoping for a resumption of the Freeport LNG terminal quickly so LNG exports can start to surge,” Price Futures Group senior analyst Phil Flynn told NGI.

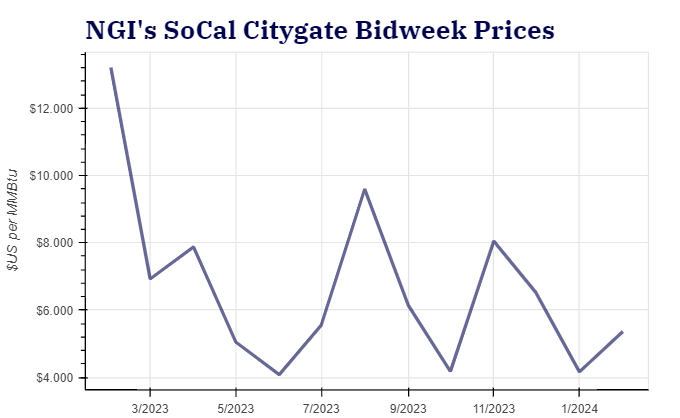

Some of the biggest decreases in April bidweek trading were seen in the West, where a $1.200 loss was recorded at SoCal Citygate to an average of $1.895. It was the sole hub to see a more than $1.00 month/month retreat. The SoCal Border Avg. fell 62.0 cents to $1.345.

Futures Seesaw

April Nymex natural gas futures rolled off the board on March 26 at $1.575/MMBtu, 4.0 cents down on the day, after a brief run to a high at $1.647. May futures slipped into the lead position at $1.788, shaving less than a penny off their prior-day settle.

May futures settled 4.5 cents higher on March 28, rallying as traders considered the implications of a larger-than-anticipated 36 Bcf storage withdrawal. The front-month contract closed the session at $1.763, slipping from a $1.786 high.

The contract reached a high of $1.853 early Monday. The Gelber analysts attributed the gains to production changes, which showed a 2.6 Bcf/d drop from 102.0 Bcf/d the prior day.

“If late-cycle data does not bring any meaningful revision to this data, this drop significantly widens the gap from earlier highs and also brings output below the 102 Bcf/d level of 2023,” Gelber said. “Price’s reaction (or lack thereof) to this latest move down in output should be a useful gauge of the strength of otherwise bearish sentiment.”

EBW Analytics Group senior analyst Eli Rubin said a push of cold weather to start the month might provide “a degree” of support for natural gas prices. However, shoulder season conditions may prolong recent price weakness.

“The coming sharp decline in weather-driven demand poses concerns that any strength may quickly prove fleeting into mid-month,” Rubin said.

Possible Draw?

Following the 36 Bcf storage withdrawal reported by the U.S. Energy Information Administration for the week ended March 22, another strong draw for the week ended March 29 could combine with a late-season uptick in heating demand and lower production pipeline scrapes to offer near-term price support, Rubin said.

Early estimates from Reuters called for a range of withdrawals from 20 Bcf to 53 Bcf, with an average decrease of 31 Bcf. That would compare with a drawdown of 29 Bcf during the same week last year and a five-year average decrease of 1 Bcf.

Weather remains a wildcard. While support comes from the weather system tracking across the Great Lakes and East during the first week of April, the pattern for April 7-15 is expected to be “exceptionally comfortable over much of the country for very light national demand,” according to NatGasWeather.

“Next week, demand falls sharply and will be limited in mid/late April,” Bevan said.