Natural gas prices gained upside momentum in June bidweek trading as rising temperatures ignited cooling demand, pipeline maintenance eased and modest storage injections clashed with hints of increasing production.

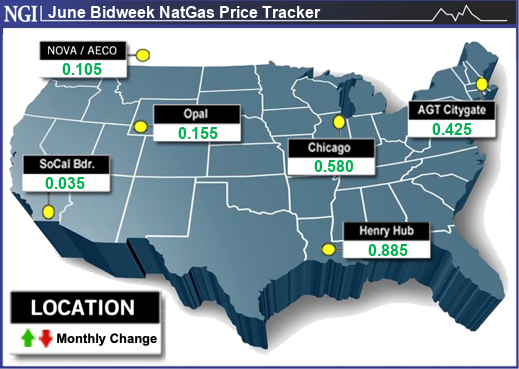

NGI’s June Bidweek National Avg. climbed 57.5 cents month/month to $1.815/MMBtu. Trading for the latest bidweek period spanned May 24, 28 and 29 when temperatures soared, particularly in Texas and the Southeast, and lighter-than-average storage injections signaled a tighter balance between supply and demand.

The June 2024 bidweek average is below the $2.020 average a year earlier, even as fundamentals turned in favor of market bulls.

On the final day of the latest bidweek period, the June Nymex futures contract rolled off the board with a 9.7-cent loss to $2.493/MMBtu. However, the contract catapulted as much as 51% higher in May before shedding some of the gains to end its run up 29% since May 1.

July futures, meanwhile, settled Monday at $2.756, up 16.9 cents from Friday.

The natural gas storage inventory surplus relative to the five-year average narrowed with five consecutive comparatively small weekly injections. Lower 48 storage at 2,795 Bcf on May 24 was 586 Bcf – or 26.5% – above the five-year average of 2,209 Bcf, according to the U.S. Energy Information Administration (EIA). However, that surplus shrunk substantially from highs above 40% in March, which developed following a mild winter and production that reached record levels around 107 Bcf/d.

Weather forecasts calling for a mild start to June before a return of extreme heat, including impressive highs in the mid-90s to 100s in Texas, contributed to the bullish leanings. Heat is forecast to become widespread by the second half of the month.

“Much of the weather data favors a hotter pattern gaining ground over most regions July 15-20 and where highs would be in the 80s across the northern United States and upper 80s and 90s over the southern portions, with 100s stretching from California to Texas for strong national demand,” NatGasWeather said.

Additionally, the market responded to the conclusion of some pipeline maintenance and changes in LNG demand.

The optimistic outlook was tempered, however, by evidence that gas production was creeping up in anticipation of the summer season. Production averaged 99.4 Bcf/d in the week ended May 31, according to Wood Mackenzie’s estimate. That was up more than 2 Bcf/d from spring lows amid rumblings that major producer EQT Corp. had begun to ramp up output for summer.

EBW Analytics Group LLC’s senior analyst, Eli Rubin, noted that “while immediate-term softness is possible and higher gas production is a bearish risk,” rebounding heat could offer physical support. “We remain constructive on the 30- to 45-day window – particularly if forecasts calling for stifling heat materialize in early July.”

South Leads Widespread Gains

The expected arrival of summer heat across the country supported June bidweek prices at regional delivery hubs.

In the Southeast, Florida Gas Zone 3 that includes western areas of the state’s panhandle climbed $2.185 to $4.005, while Transco Zone 5 that runs from Virginia to the Carolinas added $2.120 to $3.885.

Along with the heat, the increased difficulty getting natural gas into the region also supported the large price increases in the region. Maintenance reduced north-to-south flows through Station 190 on Transcontinental Gas Pipe Line Co. (Transco). South-to-north flows through Transco’s Station 60 in Louisiana also remained at a reduced capacity. Flows through the station have been down since early May, according to Wood Mackenzie. Transco operator Williams Co. said it was working to assess the situation and develop an expected timeline for service to return.

The constraints were tempered by the expected June start of natural gas flow through the Mountain Valley Pipeline LLC.

Meanwhile, in South Louisiana, Transco Zone 3 St. 65 increased $1.805 to $3.425 and Southern Natural gained $1.575 to $3.175. Henry Hub climbed 88.5 cents to $2.495.

In West Texas, prices were sharply up from May and back in the black after mainly wallowing in the negative since March. Transwestern gained 88.5 cents to 35.0 cents, while El Paso Permian gained 80.5 cents to 34.5 cents.

The culprit for negative prices had been pipeline and liquefied natural gas terminal maintenance stranding gas supply in the Permian Basin. Feed gas flows to LNG facilities have drifted on either side of 13 Bcf with the return of all three trains at Freeport LNG, but still some hiccups at the facility. At the same time, the Sabine Pass Corpus Christi and Cameron LNG terminals were operating below capacity, according to NGI’s LNG Export Tracker.

Elsewhere, bidweek price gains were less substantial in the Northeast. Iroquois Zone 2 added 44.0 cents to $1.920, Algonquin Citygate increased 42.5 cents to $1.850 and Transco Zone 6 non-NY gained 26.0 cents to $1.555.

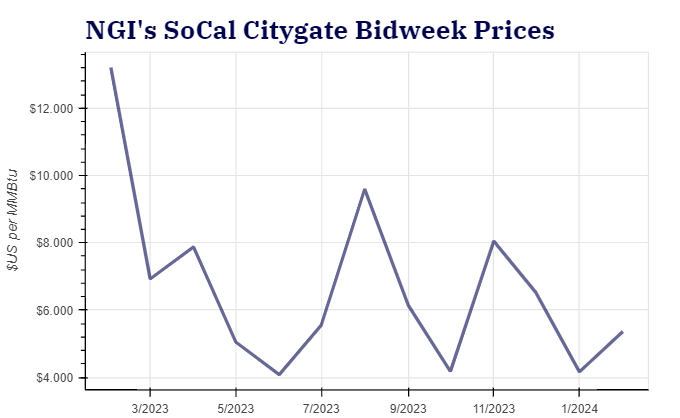

On the opposite coast, California saw the only negative changes, with SoCal Citygate shedding 23.5 cents to $1.720 and PG&E Citygate down 22.0 cents to $2.140.

Hurricane Season Begins

On the radar, forecasters are predicting a historically active hurricane season from June to November.

The National Oceanic and Atmospheric Administration (NOAA) said in its May outlook that it predicted eight to 13 hurricanes and 17 to 25 named storms. An average season has 14 named storms, seven hurricanes and three major hurricanes.

“The forecast for named storms, hurricanes and major hurricanes is the highest NOAA has ever issued for the May outlook,” NOAA administrator Rick Spinrad said during a press conference. “This season is looking to be an extraordinary one.”

A big question for the market is what, if any, impact hurricanes would have.

“We must keep in mind that we’re heading into hurricane season, and that could impact natural gas demand either positively or negatively, depending on when and if these storms hit and where they hit,” Price Futures Group senior analyst Phil Flynn told NGI.

There are seven LNG facilities on the Gulf Coast, five of which are in operation and have averaged close to 11.5 Bcf/d of demand this year to date, according to NGI data. Another two export terminals are nearing completion.

There are seven LNG facilities on the Gulf Coast, five of which are in operation and have averaged close to 11.5 Bcf/d of demand this year to date, according to NGI data. Another two export terminals are nearing completion.