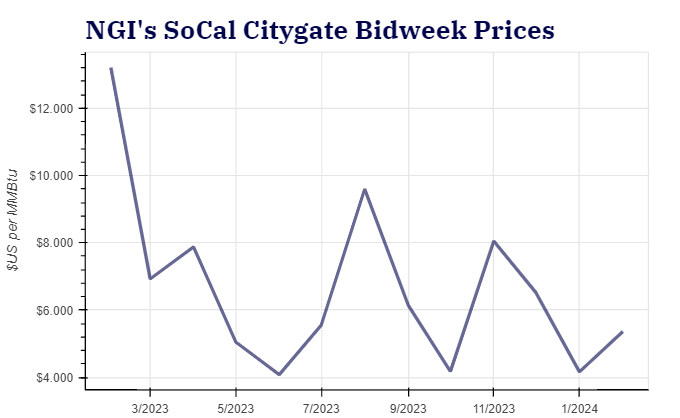

Hamstrung by a growing surplus of natural gas in inventories and with a spring-like February running into a mild March, traders tugged natural gas prices lower for March baseload delivery, according to NGI’s Bidweek Alert (BWA).

Losses were largest in the West, where California’s SoCal Citygate traded about $2.20 lower month/month at around $3.170/MMBtu, BWA data showed. In the northern part of the state, PG&E Citygate slid more than $2.40 on the month to $3.050.

After a modest 5 Bcf withdrawal in the Pacific, inventories in the region slipped to 217 Bcf as of Feb. 16, leaving stocks more than 25% above the five-year average.

Looking ahead at the weather, AccuWeather said two strong storms would advance across the country’s western portion as February ends and March begins, “bringing rounds of rain, damaging winds, and potentially the biggest thump of snow to the Sierra so far this season,” meteorologist Alyssa Glenny said.

After the near-term storms, the National Weather Service (NWS) forecasts for March show above-average temperatures would spread across most of California and the Northwest.

A warmer-than-normal pattern would also extend through the end of February and to the middle of March across most of the country. Freezing daytime temperatures are projected to prove largely elusive for the remainder of winter, Accuweather said.

Mobius Risk Group analysts said the current season – “the winter that wasn’t” – is on track to finish among the three warmest winters on record.

Meanwhile, El Paso Natural Gas has been performing Line 1201 pipeline repairs since Feb. 12, with more maintenance set to begin on March 5, keeping capacity restricted to varying degrees for all of March, according to Wood Mackenzie.

Pressed by pipeline constraints and the lack of fundamental support, upstream in the Permian Basin prices also were trending lower for March bidweek. BWA data showed Waha averaging down about $1.60 month/month at 64.5 cents.

Price weakness spread into the Midwest, where basis prices for March bidweek sank into the negative, BWA data showed. Chicago Citygate averaged about minus 10 cents, down from an average of plus 70.0 cents for February bidweek. Losses came even as inventories fell by a robust 31 Bcf in the week of Feb. 16, as stocks at 631 Bcf were 19.5% above the five-year average.

Basis prices for March also fell into the negative across the Midcontinent. BWA data showed Panhandle Eastern fell as low as minus 25 cents. This compared with an average basis price of plus 57.0 cents a month ago.

Losses extended into the South Central region as Houston Ship Channel sank to about minus 27 cents for bidweek in March, down from an average of minus 3.25 cents for February bidweek. The move lower came after the EIA reported an 8 Bcf injection into regional inventories. Stocks were 1.8% higher than the same time last year after an earlier fall to a deficit and were 24% above the five-year average.

Eastern markets followed the downtrend as Transco Zone 6 non-NY tumbled to about minus 33.0 cents as Maxar’s WeatherDesk meteorologist Bradley Havey said above-normal to much above-normal temperatures are expected across the region through at least the middle of March. Temperature highs are expected in the 60s to low 70s. Last month, February bidweek basis averaged at plus 92.75 cents.

Production Slowdown

While weather would remain an anchor, there is a looming possibility of a fundamental shift as Chesapeake Energy Corp. announced production cuts, and the market is looking for other producers to follow Chesapeake’s lead.

Natural gas prices would find support as supply is throttled back to rebalance the market, Wood Mackenzie analyst Ed Crooks said, noting both the Chesapeake cuts and a Comstock Resources Inc. announcement that it was cutting one frac crew and two rigs from its operations in the Haynesville shale.

“Over time, the actions taken by these companies and others will tighten the market and drive prices higher. But it will take a while for the effects to work through,” Crooks said. “Deferring completions will affect production one to three months ahead, and cutting back on drilling typically has an impact six to nine months out.”

Paragon Global Markets LLC’s Steve Blair, managing director of institutional energy sales, told NGI, “The only hope in this market” is for “other large producers to follow suit or we get early cooling demand…because we are close to the end of the heating season at this point. The fact that production is so much higher than last year exacerbates the bearishness of the market.”

While Wood Mackenzie data showed production fell to 102.9 Bcf on Feb. 26, weather outlooks suggest little cooperation from Mother Nature as data maintains an impressively warm pattern and accumulated heating degree days a “hefty” 85 lighter than normal, according to NatGasWeather.

Working gas in storage totaled 2,270 Bcf on Feb. 16, 265 Bcf higher than last year and 451 Bcf above the five-year average. Additional lighter-than-normal withdrawals are expected for the next several reports due to warmer-than-normal temperatures. NatGasWeather said surpluses could increase over the next three weeks to near 600 Bcf, “a massive amount.”

“Lighter production and more cooperative weather patterns are going to be needed to meaningfully reduce hefty surpluses,” the firm said.