Natural gas prices mostly lost ground in August bidweek trading as rising production volumes and stout supplies in storage undercut the impact of forecasts for a sweltering end to the summer.

NGI’s August Bidweek National Avg. fell 51.5 cents month/month to $1.700/MMBtu. That was down from $2.595 a year earlier.

Hubs in the Southeast lost considerable ground in the latest round of bidweek trading, which took place July 25, 26 and 29. Florida Gas Zone 3 tumbled 98.0 cents to $2.410, Transco Zone 4 slid 87.5 cents to $2.165 and Transco Zone 5 fell 87.0 cents to $2.015.

“Looking at some realized prices that we’ve seen in July, everything was super depressed,” Pinebrook Energy Advisors’ Andy Huenefeld, managing partner, told NGI. He noted increased volatility in the Southeast, which could support a price premium in August. However, “Cash pricing was low in July, and there is no real reason for those to turn around looking at the near-term,” Huenefeld said.

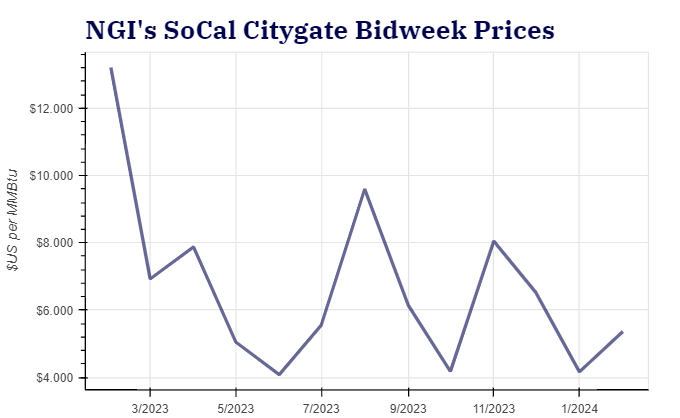

Bucking the trend, most hubs in California posted gains during bidweek trading. PG&E Citygate Avg. jumped 97.5 cents to $4.015, SoCal Border Avg. climbed 32.5 cents to $2.890, and SoCal Citygate added 13.5 cents to an average of $3.190. Scorching temperatures that dominated the region in July are forecast to continue after a brief respite. Huenefeld also noted that solar power would become less available as the summer wanes.

The National Oceanic and Atmospheric Administration’s August outlook showed above-average temperatures across most of the contiguous United States and the northeast half of Alaska. Warmer conditions are forecast from the Gulf Coast states to the West Coast, with higher chances for the inferior West. The Southeast, most of the mid-Atlantic, Northeast and New England are also expected to see triple-digit temperatures.

Huenefeld said while the West seemed to latch onto weather for support elsewhere, the downside was driven by the uncertainty built into the weather outlooks. “I really think after the head fake by the previous month’s forecast in July that didn’t pan out, the market is discounting the monthly outlook.” He noted, “Heat doesn’t look like it is showing up in the six- to 10-day and eight- to-14-day periods in large portions of the Midwest.”

NatGasWeather confirmed the cooldown in its eight- to 15-day outlook Thursday. The forecast showed weather systems could track across the Midwest, Ohio Valley and New England. High temperatures are expected from the 70s to lower 80s, potentially easing national demand from very strong to strong levels, the firm said.

Futures prices also struggled in late July, as gas storage concerns persisted amid a steady but slow contraction, while production averaged 102.1 Bcf/d last month, according to Wood Mackenzie estimates.

EBW Analytics Group senior analyst Eli Rubin said pipeline readings suggest supply climbed to a five-month high on Wednesday. That contributed to “bearish pressure in a market acutely sensitive to production and oversupply risks.”

Supplies in underground storage remained abundant as August began. The U.S. Energy Information Administration (EIA) reported an injection of 18 Bcf for the week ended July 26. The increase lifted inventories to 3,249 Bcf and put stocks 15% above the five-year average of 2,808 Bcf.

Futures Falter

On the final day of the latest bidweek period, the August natural gas futures contract rolled off the board at $1.907, the front-month’s lowest close since April 26.

The September contract moved to the front of the curve and gained 9.0 cents to settle Tuesday at $2.126. Those gains were relinquished the following day as the contract tumbled 9.0 cents to settle at $2.036.

“Cooler temperatures may cause gas prices to drop, although storage surpluses are likely to fall rapidly throughout August,” Rubin said.

Looking ahead to the next EIA print for the week ended Aug. 2, preliminary estimates submitted to Reuters ranged from injections of 11 Bcf to 39 Bcf, with an average increase of 30 Bcf.

Support for higher prices could also emerge amid the potential impact of production declines and stronger LNG demand.

This week, major producer Chesapeake Energy Corp. said it was “totally prepared and willing and ready to do” curtailments in the second half of the year as it did in the spring. This followed similar messaging from EQT Corp. The companies are the two largest U.S. producers of natural gas.

Demand for feed gas for liquefied natural gas facilities is expected to rise into 2025 as Venture Global LNG Inc.’s Plaquemines LNG Phase I, Cheniere Energy Inc.’s Corpus Christi Stage 3 and Golden Pass LNG are placed into service.

In late June, Texas Eastern Transmission LP began feeding gas to the Plaquemines export terminal through Gator Express in Louisiana, indicating the facility was on track “to start exporting in late 2024,” Wood Mackenzie analyst Nadeem Ahmed said.

Wood Mackenzie data showed gas flows to LNG export facilities at 11.7 Bcf on Thursday, down from an average of 12.6 Bcf/d a day earlier and an estimated 12.4 Bcf/d for the week.

Looking from a technical perspective, DeCarley Trading analyst Carley Garner told NGI, “The natural gas market has spent the last two years working off the froth in both speculation and price.” The market is heading into a “seasonally supportive time of year,” with prices at a significant psychologically important level of $2.00 with charts suggesting improvement, according to the analyst.

“Thus far, the most recent selloff has held as expected,” Garner said. While the price of natural gas has been making lower lows, however, the relative strength index – an indicator that measures the speed and change of price movements – has not.

“This is a sign of potential trend exhaustion,” Garner said. “We are proceeding as though the gas market is in the process of bottoming.”