Strengthening but still lower production intersected with spring-like weather during February bidweek trading. Natural gas prices varied by region as a result, with swaths of the country impacted by lower supply and posting gains, and others reporting declines amid waning heating demand.

Fresh concerns about the durability of the United States’ increasingly prominent LNG export complex added another wrinkle during the trading period that spanned Jan. 25, 26 and 29.

Ultimately, NGI’s February Bidweek National Avg. advanced 14.0 cents month/month to $3.215/MMBtu. That compared with the $5.430 average in the year earlier month.

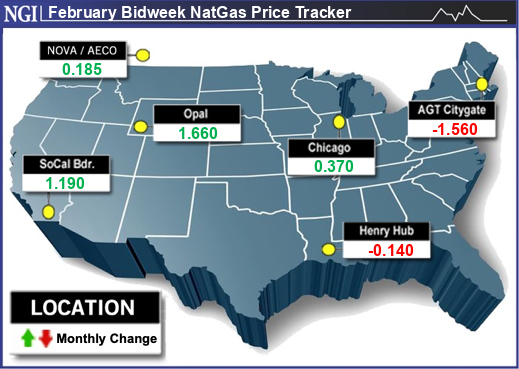

Several hubs in the nation’s midsection as well as the West supported the national average’s month-to-month increase. Following an Arctic blast of frigid air and rounds of snowstorms in mid-January, freeze-offs curtailed natural gas production in the Rockies, Northern Plains and Midcontinent. This slowed the flow of supply in those regions and bolstered prices.

At its January low, total production dropped close to 90 Bcf/d, down from the near-record highs around 106 Bcf/d at which output started 2024, according to Wood Mackenzie data. Production has since recovered and hovered near 105 Bcf/d on Thursday, though it was still a tick lower than the highs of winter.

“The freeze-offs had a big impact” on near-term supply and physical markets, Paragon Global Markets LLC’s Steve Blair, managing director of institution energy sales, told NGI. “If we get another real blast of cold, it’s likely we’d see” another bump in prices, “especially if it’s down into the Midcontinent and Permian Basin.”

In the Midwest, Chicago Citygate advanced 37.0 cents in bidweek trading to average $3.170, while ANR SW in the Midcontinent jumped 47.5 cents to $3.340. Prices also climbed across West Texas, following interruptions to production in the Permian Basin as well.

KRGT Rec Pool in the Rockies, an epicenter for some of the harshest chills, spiked $1.620 to $5.185.

Farther west, where markets depend in part on gas from the Rockies and Permian, prices also climbed. Malin in the Northwest led the charge, rising $1.195 to $4.830.

Elsewhere, however, bidweek prices mostly slipped lower as mild temperatures permeated much of the Lower 48 in late January and forecasts called for more of the same into early February. Highs in the 40s canvassed northern regions this week – rare for this stage of the winter season – and warmer conditions developed in the South.

Algonquin Citygate in the Northeast, for one, dropped $1.560 to $7.270, and Transco Zone 5 in the Southeast fell $2.550 to $4.635.

Futures Rollercoaster

The futures market also proved uneven over recent sessions.

During the bidweek period, the February Nymex natural gas futures contract rolled off the board on Monday with a 22.2-cent decline to a final settlement of $2.490. It had advanced 8% the previous week, however, after buyers swooped in and bounced prices off a technical floor. In that week, a government report also showed a huge storage withdrawal after the burst of frigid air in January. The U.S. Energy Information Administration (EIA) printed a draw of 326 Bcf for the week ended Jan. 19.

The storage pull easily eclipsed the five-year average decrease of 148 Bcf and marked the third-largest on record. It trailed only a 359 Bcf draw in January 2018 and a 338 Bcf pull in February 2021, the week when Winter Storm Uri paralyzed Texas and other parts of the South.

The March futures contract took over as the prompt month Tuesday and proceeded to advance that day and again Wednesday. Forecasts for another round of chilly weather in the second half of February fueled the momentum.

“Immediate-term market fundamentals remain bearish,” EBW Analytics Group’s Eli Rubin, senior analyst, said Thursday. “Nonetheless, an understandable reluctance among speculators to short natural gas near $2.00 ahead of growing signals for a cold back half of February may postpone downside potential into the 30-45 day window.”

On Thursday, the new prompt month shed 5.0 cents to close at $2.050. This followed the latest EIA inventory data, covering the final full week of January. EIA reported a withdrawal of 197 Bcf. It extended to four the string of triple-digit storage decreases to kick off the new year. The five-year average for the period was a 185 Bcf draw.

Still, with production recovering, underground stocks were 5% above the five-year average. The combination of solid output – freeze-offs aside – and stout storage has kept natural gas prices in check this winter, Blair said.

“The market sees we still have a boatload of gas,” he said. Supplies also are healthy in the U.S. export destinations of Europe and Asia. “So we are not seeing global issues driving prices either.”

Mobius Risk Group analysts agreed. “Supply-side gains are adding fuel to the fire, with production having rebounded,” they said. “Consumers have basked in the warm glow of winter weather, except for a bit of cold earlier” in January.

LNG Wildcard

Liquefied natural gas demand averaged about 14 Bcf/d in late January, putting export volumes close to capacity and helping to provide a floor for futures around the $2 level. While Europe and Asia are currently well-stocked, countries on both continents continue to call for U.S. LNG to ensure they can meet heating needs now and are braced for the summer ahead.

Further out, LNG is expected to prove a major catalyst for U.S. prices, given that export facilities under construction or in development could propel a doubling of demand for the super-chilled fuel by the end of the decade.

However, beyond projects already underway, the Biden administration in January curtailed new federal export authorizations for LNG facilities while the Department of Energy (DOE) determines whether more capacity is in the public interest. This could dampen demand growth into the decade ahead.

“The policy change injects more uncertainty in the outlook for natural gas, putting 5-plus Bcf/d of LNG exports in question,” analyst Jack Weixel of East Daley Analytics said, citing his firm’s long-term forecast.

The licensing moratorium “will directly impact the review” of several projects that would further increase export capacity between 2027 and 2031, he said. “The new policy could depress natural gas demand if the pause drags on and delays development of these projects. Producers would have fewer new markets later this decade, lowering prices and stunting growth.”

While it is possible the Biden administration’s suspension may ultimately prove short-lived and have little impact, “in a worst case, DOE could reach an adverse conclusion and permanently pause additional exports,” Weixel said. This puts 5.3 Bcf/d of gas demand at risk through 2030, he estimated.

“We expect the DOE policy to create more volatility in natural gas,” Weixel added. The potentially negative development already played a role in bearish futures trading over recent sessions. “Developers, financers and producers will have less surety of demand, impacting plans to develop new supplies and affecting returns on industry investments.”