Weekly natural gas cash prices retreated with demand easing as extreme heat and volatile weather gave way to milder conditions. Futures pared earlier steep losses into the week’s end as supply and demand fundamentals shifted.

In the Memorial Day-shortened workweek, NGI’s Weekly Spot Gas National Avg. for May 28-30 sank 23.0 cents to $1.550/MMBtu. As the trading week closed, the largest losers included Columbia Gas, down 50.0 cents to $1.450 and Texas Eastern M-3, Delivery, off 46.5 cents to $1.330.

Adding downside pressure, East Texas prices were a principal source of weakness. NGPL TexOK fell 34.0 cents to $1.570, while Katy slipped 29.5 cents to $1.830. Meanwhile, in the Southeast, Transco Zone 5 slid 32.5 cents to $3.185, and though Transco Zone 4 shed a less robust 26.0 cents, the average at $3.220, was near the highest priced in the land.

In physical trade, lower prices in Texas and the Southeast predominantly resulted from extreme weather events. Storm systems moved through Texas resulting in widespread power outages that sapped demand. Later, as weather systems moved across the South, temperatures that reached into the upper 80s to 100s in some local areas gave way to comfortable highs that eased demand for cooling.

Also in the bears’ favor, Transcontinental Gas Pipe Line Co. (Transco) maintenance reduced north-to-south flows through Station 190. “As this event began, Transco Zone 5 demand decreased by 190 MMcf/d, with 137 MMcf/d of this decrease being due to a drop in deliveries to power plants,” Wood Mackenzie analyst Kevin Ong said Tuesday (May 28).

Futures, meanwhile, took a beating as the June contract rolled off the board Wednesday, and July futures took the lead. After routing through Thursday, the July Nymex contract drifted on either-side of unchanged before settling at $2.587, up 1.5 cents on the day. The prompt-month price series finished 6.7 cents up on the week.

On the futures front, there were a number of factors with the potential to induce near-term price weakness including soft cash prices and changes in cooling demand, as well as LNG terminal maintenance, EBW Analytics Group analyst Eli Rubin said.

However, incrementally higher production triggered the pronounced retreat this week. “I think a primary factor for losses is the production level bouncing in revised prints,” Snapper Creek Energy analyst Kyle Cooper told NGI this week.

According to Tudor, Pickering, Holt & Co. Inc. (TPH), recent production estimates suggest a partial return of volumes shut in by Appalachian Basin natural gas heavyweight EQT Corp. earlier this year. EQT, the largest U.S. natural gas producer, announced a 1.0 Bcf/d curtailment that began in late February and was extended through May.

Prices that rallied sharply in May potentially changed the thinking among producers around bringing supply back to market. TPH modeled domestic production was poised to increase by 1 Bcf/d in June, which would result in an average output of 101.3 Bcf/d.

Storage Woes Persist

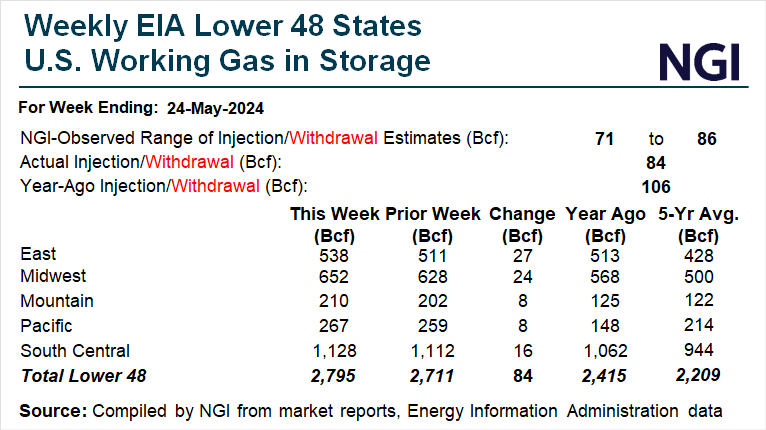

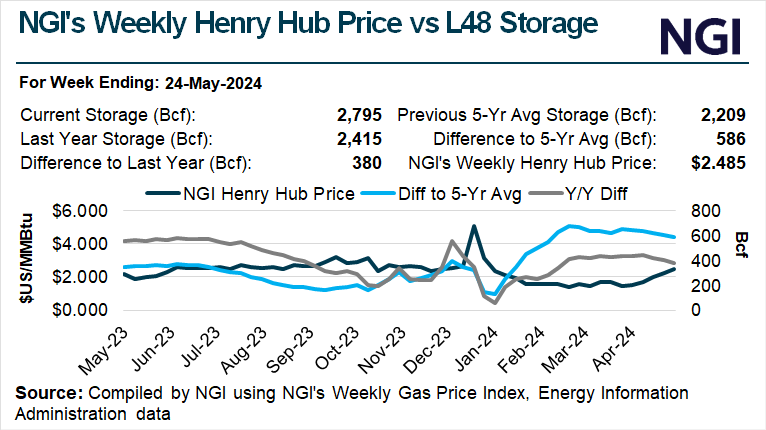

More supply and lackluster shoulder season demand are keeping end-of-season storage concerns alive. Worries persist, even after the U.S. Energy Information Administration (EIA) reported the fifth straight lighter-than-average weekly injection into Lower 48 storage facilities for the week ended May 24.

EIA on Thursday reported an 84 Bcf injection that was below the five-year average hike of 104 Bcf and the 106 Bcf increase recorded for the year-earlier period. It brought inventories to 2,795 Bcf. That is 380 Bcf higher than the same week last year and 586 Bcf above the five-year average of 2,209 Bcf.

The print missed most expectations coming into the day. A Reuters survey of 12 analysts produced a 78 Bcf median injection. Bloomberg’s survey generated a 77 Bcf median. NGI modeled a spot-on 84 Bcf injection.

Wood Mackenzie analyst Eric McGuire said, “Even though power burns are starting to increase as we move into summer, we expect to see larger injections in the coming three weeks.” He attributed the outlook to the ramp-up of production, “which has recovered significantly with the recent rally in gas prices.” McGuire said that U.S. production currently sits at around 100 Bcf/d after reaching a low of 97 Bcf at the beginning of May.

Early estimates from Reuters for the week ending May 31 ranged from additions of 73 Bcf to 95 Bcf, with an average increase of 86 Bcf. That compares with an increase of 105 Bcf during the same week last year and a five-year average increase of 103 Bcf.

Friday’s Cash

Prices were mostly lower for a three-day, Saturday through Monday package traded Friday as the weekend days and milder weather outlooks combined to weaken values.

West Texas prices crumbled, sinking back into the negative, as the National Weather Service (NWS) showed temperatures easing into the upper 80s to low 90s through the weekend, from highs into the 100s locally early in the week.

Oneok WesTeX tumbled 61.0 cents to negative 13.0 cents, while Waha sank 45.5 cents to average negative 19.0 cents.

Meanwhile, losses at California’s Malin hub, down 27.5 cents day/day to 82.5 cents, and Canada’s Westcoast Station 2, at C27.0 cents/GJ, down 51.5 cents, were exacerbated by pipeline maintenance.

Westcoast Energy said it would begin performing integrity piping modifications and dig maintenance affecting Station 4B South and restricting southbound flow to the U.S.-Canada border. The Westcoast maintenance on Station 4B South is expected to cut southbound flow by up to 529 MMcf/d starting Monday and lasting until June 16, according to Wood Mackenzie analyst Magnus Gilje.