Natural gas prices gained ground in August bidweek trading as markets in the West spiked amid sizzling high temperatures and ubiquitous cooling demand.

NGI’s August Bidweek National Avg., covering July 25-27, climbed 3.5 cents month/month to average $2.595/MMBtu. However, the average was still down notably from August 2022, when it clocked in at $8.765 due to the intersection of heat waves and global supply shortages in the wake of Russia’s invasion of Ukraine.

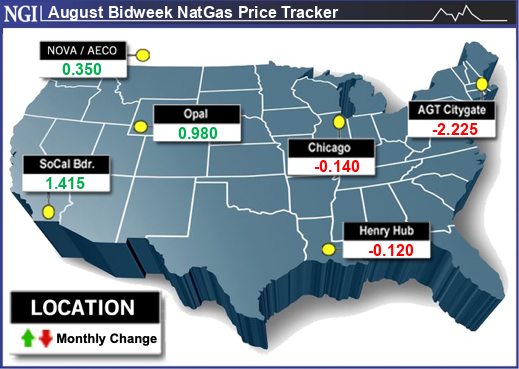

Several hubs in California and the Southwest posted gains of more than a dollar in the latest round of bidweek trading. SoCal Border Avg. jumped $1.415 to $5.440, and Malin gained $1.005 to $4.130. In the Southwest, KRGT Del Pool soared $1.580 to $5.605.

National Weather Service (NWS) data showed hot high pressure over a large swath from California through Arizona and the South during the covered period. Peak daily temperatures during bidweek and into the start of this month ranged from the upper 90s to well above 110, galvanizing air conditioner use.

This extended a summer-long trend.

“No question that part of the country, especially, is driving the demand,” StoneX Financial Inc.’s Thomas Saal, senior vice president of energy, told NGI.

Also bullish during bidweek trading, production at one point declined about 2 Bcf/d to 99 Bcf/d amid maintenance events.

However, production proved choppy since bidweek trading ended – as it has at times for the past couple months -- with output climbing back above 100 Bcf/d by the end of July and remaining above the century mark to start August. Production is within earshot of record levels above 102 Bcf/d. What’s more, the Energy Information Administration (EIA) forecast that output would average more than 102 Bcf/d in the second half of 2023.

Additionally, while heat permeated the Midwest and East during bidweek, forecasts at the time called for easing temperatures by the start of August. The intensity of heat has indeed moderated, and NWS outlooks continue to call for highs in the mid- to upper-80s in parts of the central United States and Northeast this week – down from highs in the 90s.

Against that backdrop, bidweek prices pulled back in the Midwest and Northeast.

Chicago Citygate declined 14.0 cents to $2.220, and Lebanon lost 23.0 cents to $2.060.

In the Northeast, Algonquin Citygate dropped $2.225 to $1.890.

Faltering Futures

On the futures front, meanwhile, prices proved volatile during and since bidweek.

The August Nymex contract settled at $2.492/MMBtu before rolling off the books last Thursday, the day bidweek trading culminated. It was down 17.3 cents on its final day and down 8% from the prior week’s close.

The September futures contract moved to the front of the curve last Friday and gained 4.3 cents to $2.638. But it lost ground Monday and fell further on Tuesday, losing 7.4 cents to close at $2.560.

Futures have been held in check by relatively light LNG demand, resilient production and robust supplies in storage, Marex North America LLC’s Steve Blair, senior account executive, told NGI.

EIA most recently reported total Lower 48 working gas in storage of 2,987 Bcf as of July 21, 13% higher than the five-year average. The agency posted a 16 Bcf storage increase for the period. That was well below the five-year average injection of 31 Bcf, and recent storage reports have been shrinking.

NGI modeled a 17 Bcf draw for the week ended July 28. EIA’s next storage print is slated for Thursday. Early injection estimates submitted to Reuters averaged 24 Bcf. The projections compare bullishly with the five-year average of 37 Bcf.

But further small prints may be needed in concert with strong liquefied natural gas export activity “to eat away” at storage surpluses and bolster prices, Blair said. That, he added, is hardly a sure thing amid elevated production and volatile export readings.

Lighter LNG

LNG volumes have recently hovered between 12-13 Bcf/d, up from seasonal lows closer to 10 Bcf/d but still far from the 2023 peak of 15 Bcf/d. This is in part because of maintenance events and lighter overseas demand this summer.

“With feed gas volumes remaining lower than expected, we’ll be watchful” to see if export demand starts to pick up in “price-sensitive countries” in Asia and Europe, Tudor, Pickering, Holt & Co. analyst Matt Portillo said. He added that “European storage levels sit comfortably at an estimated 84% capacity, 24% higher versus the five-year average.”

Meanwhile, Portillo noted, near-term weather remains a wildcard in spite of the extreme heat in western and southern stretches of the country. With forecasts pointing to high temperatures and national cooling demand exceeding historical averages during the first third of August, but only by a narrow margin, weather alone may not power prices forward.

NatGasWeather echoed that sentiment. It said rainy and cooler weather systems were expected to canvas the Upper Midwest and Northeast this week and next, curbing demand in key regions and dampening national demand modestly – potentially enough to prevent price rallies.

“It’s still impressively hot from California to Texas and up the Southern Plains, with highs of 90s to 110s, while also hot with 90s over the South and Southeast” through early August, the forecaster said. “But with the Great Lakes and Northeast cooling several degrees versus last week, national demand isn’t as strong.”