Natural gas prices were mostly lower in January bidweek trading as blasts of cold buoyed demand in a few regions, but with most of the country flush with supply after a slow start to winter.

NGI’s January Bidweek National Avg., based on trades Dec. 22, 26 and 27, fell 25.0 cents month/month to $3.075/MMBtu, which was also well below the year-earlier average of $13.720 for January 2023 Bidweek.

Several natural gas hubs in the East and Central regions – where freezing low temperatures spread in late December – limited a more pronounced decrease in the bidweek price average.

Gains were concentrated in the Northeast, Appalachia and Southeast, which had turned colder in late December and are forecast to see more cold in the first weeks of 2024.

Transco Zone 6 non-NY soared 55.5 cents in the Northeast to average $3.590. In the Southeast, Transco Zone 5 gained $3.135 to $7.185. In the Midcontinent, OGT gained 22.5 cents to $2.845.

Snapper Creek Energy analyst Kyle Cooper wasn’t surprised by the upticks. “You do have, even at above-normal temperatures, still pretty solid demand overall…

“It’s just to get it going, you’re gonna need to have more sustained cold, and that doesn’t seem to be in the works,” Cooper told NGI.

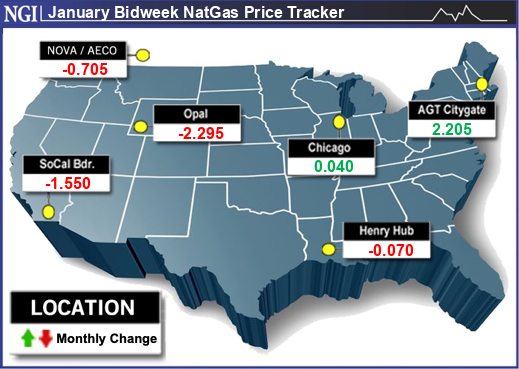

More widespread were losses, most notably in the Rocky Mountain region, where Northwest Sumas tumbled $2.610 to an average of $3.750, and El Paso San Juan fell 31.5 cents to an average of $3.175.

Prices fell in West Texas as mild weather capped regional demand, sending El Paso Permian down 44.0 cents to $1.870. Texas natural gas was free to flow west to east on the Permian Highway Pipeline (PHP).

Downstream of the supply in California, bidweek prices sank as PHP added 0.55 Bcf/d capacity from Dec. 1, bringing less constrained West Texas natural gas into the region to meet more robust demand from late-December storms.

PG&E Citygate tumbled $2.065 to an average of $4.290, while the SoCal Border Avg. slumped $1.550 to $3.750.

Cold weather could not grip enough of the country and stay around long enough to drive demand to support prices.

Indeed, during the bidweek trading period, a slow-moving weather system brought rain and snow to the East, although there was little coverage of subfreezing highs, and demand remained weak, NatGasWeather said. Weather systems also swept across the Midwest and East for a modest increase in national demand.

NGI’s Weekly Spot Gas National Avg. for the Dec. 26-28 trading period for December delivery reflected the mild weather and fell 19.0 cents to $2.145.

Meanwhile, the January Nymex futures contract settled at $2.619/MMBtu last Wednesday – the third day of bidweek trading – and rolled off the books up 6.9 cents on the day.

Price Futures Group senior analyst Phil Flynn quipped, “Natural gas looks like it’s trying to come back but will need Old Man Winter’s help.”

Cooper told NGI that winter will be halfway over in two weeks, “so the scare factors are really diminishing, because even if the back half of January-February-March turns cold, you know, the first two and a half months of winter have really been a disappointment for the bulls.”

Cooper said, “While we might have come down enough, for the time being, the upside is more and more limited every day that passes.”

Storage Surpluses Widen

The lack of weather-related demand has widened natural gas surpluses to historical averages. Surpluses could broaden further as the mild weather continues.

The U.S. Energy Information Administration (EIA) reported an 87 Bcf drawdown from Lower 48 natural gas stores for the week ending Dec. 22 that was deeper than most industry estimates.

However, the pull was well below the hefty year-earlier draw of 195 Bcf — when winter storms led to freeze-offs amid huge demand spikes — and the five-year average 123 Bcf withdrawal for the week.

The total working gas supply stood at 3,490 Bcf, a healthy 348 Bcf above the year-ago level and 316 Bcf above the five-year average.

Early storage estimates from Reuters for the week ending Dec. 29 ranged from withdrawals of 76 Bcf to 12 Bcf, with an average decrease of 56 Bcf.

NGI modeled a 40 Bcf drawdown.

That compares with a withdrawal of 219 Bcf during the same week last year and a five-year average decrease of 97 Bcf.

EBW Analytics Group analyst Eli Rubin said, weather-driven demand may add 42 heating degree days (HDD) week-over-week to start 2024 and another 44 HDDs in the first three weeks of January, “creating fundamental support for natural gas prices to start off the new year.”

The consensus, however, is notably bearish, said analysts with Gelber & Associates.

LNG Exports Delayed

That is because producers who held production at near-record high levels through December “so far appear willing to maintain high output levels even in low-priced environments,” Gelber analysts said.

Producers increased production on the anticipated ramp-up in LNG exports from the Golden Pass liquefied natural gas terminal.

“After ExxonMobil’s delay of the Golden Pass LNG timeline, analysts are now less confident in the ramp-up of LNG in 2024, which had previously been the main bullish catalyst for the year,” Gelber said.

The firm said, “As a mild winter means the normal reduction to working gas stocks will be smaller than normal, the final point of note is simply that ample storage appears to be here to stay well into the year.”