Natural gas prices surged in November bidweek trading as markets absorbed the sudden demand impacts of frosty winter blasts that permeated the Mountain West and the nation’s midsection.

NGI’s November Bidweek National Avg., which traded Oct. 25-27, climbed 85.5 cents month/month to $3.135/MMBtu. However, it still came in below the year-earlier average of $4.950 for November 2022 Bidweek.

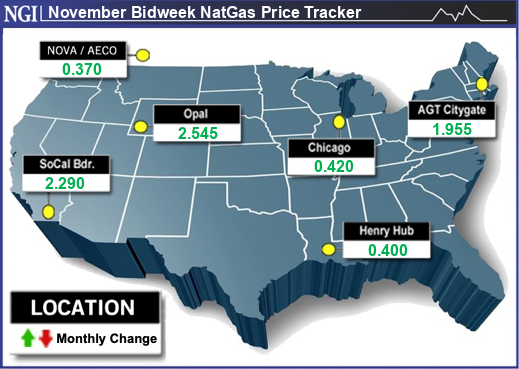

Several natural gas hubs spanning the Northwest, Rockies and the Midwest – where freezing low temperatures were widespread in late October – powered the overall increase during bidweek trading.

Northwest Sumas soared $3.005 to average $6.185, and Malin advanced $2.660 to $5.345.

In the Rockies, Opal jumped $2.545 to $5.140, and KRGT Rec Pool gained $2.545 to $5.135.

Chicago Citygate climbed 42.0 cents to $2.780, while elsewhere in the Midwest, Lebanon rose 41.0 to $2.660.

“That first shot of really cold weather had a big impact,” StoneX Financial Inc.’s Thomas Saal, senior vice president of energy, told NGI.

Indeed, during the covered period, Arctic air descended from Canada and hovered over the Rockies and Northern Plains before spreading across the Midwest. It delivered sub-freezing temperatures and got furnaces cranking across much of the North.

That same wintry system further expanded to the Great Lakes and the Northeast this week, according to National Weather Service (NWS) data. Cash markets and the November Nymex futures contract rallied ahead of that development.

NGI’s Weekly Spot Gas National Avg. for the Oct. 23-27 period advanced 20.0 cents to $2.390.

The November Nymex futures contract, meanwhile, settled at $3.164 last Friday – the final day of bidweek trading – and rolled off the books as the prompt month. It was down 5.0 cents on the day but up 9% from the prior Friday’s finish after posting four gains during the preceding week.

Strengthening LNG demand in the back half of October intersected with the arrival of cold northern weather to bolster futures.

LNG Momentum

Lengthy maintenance events at liquefied natural gas facilities had cut feed gas demand for much of the fall season, bringing export volumes to seasonal lows around 10 Bcf/d. But after the culmination of repair and upgrade projects, LNG demand rebounded by mid-October and has since hovered near the 14 Bcf/d level.

The new momentum and the potential for more gains amid war in the Middle East could help keep LNG at the forefront of bullish traders’ minds, Saal said.

European countries, while well-stocked for an average heating season ahead, have fewer sources of gas to turn to than in past years in the event of a prolonged or harsh winter. Russia, once a stalwart supplier of gas to Europe, dramatically scaled back the fuel it sends to the continent in response to Western sanctions imposed on the Kremlin amid its ongoing invasion of Ukraine.

Now, European buyers are concerned that the Israel-Hamas conflict that erupted in early October could further escalate and result in closed gas platforms in the region. U.S. exporters could potentially fill any void. “LNG is more and more and more important,” Saal said.

American producers have been exceptionally active throughout most of 2023 in large part to meet global demand. The first of several new export plants on the Gulf Coast are slated to begin operations next year, motivating producers to maintain lofty levels. Natural gas output topped 104 Bcf/d in October, setting records, as a result.

Mike Matousek, head trader at U.S. Global Investors, said Permian Basin oil production also has proven steady. This is important because associated gas is produced alongside crude. “Producers, particularly in the Permian, are bullish on fossil fuels,” Matousek told NGI.

Robust supplies, however, continually have snapped bull runs this year. While production slipped below 102 Bcf/d this week because of freeze-offs in the Rockies, it has averaged well above 100 Bcf/d on the year, according to Bloomberg estimates. That has enabled utilities to stockpile stout levels of gas in storage.

Plump Supplies

With output elevated and a return of milder fall weather in the cards for northern markets as soon as this weekend, as NWS forecasts show, continued strong storage injections into November may lie ahead. That could galvanize bears, said Steve Blair, a veteran gas broker and independent analyst.

“Until all the new LNG demand comes online next year, production is going to look really strong, unless it’s a harsh winter here or overseas,” Blair told NGI.

The U.S. Energy Information Administration’s (EIA) latest inventory print, an injection of 74 Bcf for the week ended Oct. 20, eclipsed the five-year average increase of 66 Bcf. It boosted inventories to 3,700 Bcf, putting underground stocks well above the five-year average of 3,517 Bcf.

For the next EIA storage report, due Thursday and covering the week ended Oct. 27, polls showed median injection estimates hovering in the low 80s Bcf. NGI modeled a build of 82 Bcf. That compares with a five-year average of 57 Bcf.

Looking further ahead, Blair said bears have an El Niño weather pattern in 2023 on their side. When such patterns develop, they often pave a path for relatively mild winter temperatures and lower levels of snow in the Northern Plains, Midwest and Great Lakes – major gas-consuming regions.

Against that mixed fundamental backdrop, December Nymex futures have proven volatile so far this week. The new prompt month opened the week Monday with a 13.1-cent loss, then reversed course Tuesday and notched a 22.3-cent gain. It then slumped anew on Wednesday, shedding 8.1 cents to $3.494.

Blair reminded, however, that long-range weather forecasts are hardly reliable. “Now it depends on whether we get a mild, normal or harsh winter,” he said.